Unmasking Round-Trip Trading: A Deep Dive into Deception

In the dynamic and often complex world of financial markets, understanding the myriad of trading practices is paramount for any investor, whether you are just beginning your journey or seeking to deepen your technical analysis expertise. You may encounter terms that sound straightforward but conceal layers of intricacy. One such term, often associated with historical financial scandals, is round-trip trading. On the surface, it simply describes the act of buying and then selling a financial asset – a complete cycle. However, when we delve deeper, we uncover a darker, more deceptive maneuver that can fundamentally undermine market integrity and pose significant risks to unsuspecting participants.

So, what exactly does round-trip trading entail in its illicit form? At its core, it is a deceptive financial maneuver involving the repetitive buying and selling of the same or very similar financial assets. These transactions often occur between related entities or even within a single controlled group, and crucially, they are executed without any genuine business purpose. Imagine a magician performing a trick: what you see is not always what is real. Similarly, in deceptive round-trip trading, the intent is to create a misleading impression, a facade of market activity or financial health that simply does not exist.

- Round-trip trading creates an illusion of active trading.

- It often involves coordinated transactions between related parties.

- The tactic lacks genuine market purpose or risk exposure.

You might hear this practice referred to by other aliases within the financial community, such as “churning” or “wash trades.” These terms also describe transactions designed to generate artificial volume or give a false appearance of active trading, often to manipulate prices or create an illusion of liquidity. Regardless of the specific alias, the underlying mechanism remains consistent: a coordinated series of buy and sell orders, often between parties with pre-arranged agreements, designed to circulate assets back and forth without transferring real economic value or risk. It’s akin to a closed loop where money or assets are exchanged repeatedly, creating the illusion of bustling commerce while, in reality, nothing substantive has changed hands for a legitimate market reason.

This manipulative technique can be executed in various ways. Sometimes, it involves a single trader executing both buy and sell orders for the same security. In more complex scenarios, it can unfold between two companies, perhaps subsidiaries of the same parent corporation, or even through a sophisticated network of intermediaries and shell companies. The common thread in all these arrangements is the absence of a genuine, arms-length market purpose. There is no intention to profit from market fluctuations or to acquire an asset for operational needs; rather, the goal is to fabricate data, inflate figures, and deceive observers.

| Method of Execution | Description |

|---|---|

| Single Trader | One trader executes both buy and sell orders for the same security. |

| Related Companies | Two companies, possibly siblings of the same parent entity, perform transactions. |

| Shell Companies | An elaborate network of intermediaries that hide the true nature of transactions. |

Understanding this distinction is crucial for you as an investor. While buying and selling a security is a standard part of trading, deceptive round-trip trading transforms this routine act into an unethical and largely illegal scheme due to its inherent intent to defraud and manipulate. It’s not just about the transaction itself, but the malicious purpose behind it. As we continue our exploration, we will unpack the profound implications of these deceptive practices and equip you with the knowledge to navigate the market more safely.

The Deceptive Web: How Round-Tripping Misleads Markets and Investors

Having grasped the fundamental definition of deceptive round-trip trading, let’s now unravel the intricate web of deceit it weaves across financial markets. Why is such a seemingly simple act of buying and selling considered so detrimental, and ultimately, illegal? The answer lies in its core purpose: to create a false impression and distort reality, impacting various facets of the financial ecosystem and severely eroding investor confidence.

One of the primary goals of illicit round-trip trading is to inflate financial figures. Imagine a company repeatedly “selling” products or services to a related entity and then “buying” them back, often at pre-arranged prices. This circular transaction generates fabricated revenue and inflates balance sheet values, giving the impression of robust business activity or rapid growth. These misleading financial statements can significantly distort a company’s true financial health, making it appear far more profitable or stable than it actually is. For you, the investor, this means making decisions based on fraudulent data, potentially leading to substantial financial losses when the truth inevitably surfaces. Are you truly seeing a healthy company, or merely a mirage?

| Impact of Round-Trip Trading | Description |

|---|---|

| Inflated Revenue | Creates a misleading perception of financial strength. |

| False Market Liquidity | Artificially inflates trading volume, misleading investors. |

| Erosion of Investor Trust | Undermines confidence in the integrity of financial markets. |

Beyond inflating a company’s perceived financial strength, round-trip trading is a powerful tool for market manipulation. By engaging in repetitive buying and selling, perpetrators can artificially inflate trading volume for a particular security. High trading volume is often interpreted by investors as a sign of strong market interest, liquidity, and even price momentum. However, when this volume is purely artificial, generated by circular trades that have no genuine economic substance, it creates a deceptive sense of demand. This can entice unsuspecting investors to buy into a stock, driving up its price, only for the manipulators to then sell off their genuinely held shares at an inflated value, leaving others holding the bag. It’s a classic pump-and-dump scheme, but executed with a specific, repetitive trading pattern.

The impact extends to broader market integrity. Financial markets are predicated on the principles of transparency, fairness, and accurate information. When manipulative practices like round-tripping are allowed to proliferate, they fundamentally undermine these pillars. The distortion of economic data, the illusion of genuine market activity, and the resulting misallocation of capital can have far-reaching consequences, affecting not just individual investors but the stability of the entire financial system. It erodes trust, making investors hesitant to participate in markets they perceive as rigged or untrustworthy. This loss of trust can lead to reduced liquidity, higher transaction costs, and ultimately, less efficient capital formation for legitimate businesses.

In essence, the illegality of round-tripping stems from its deliberate intent to deceive, manipulate, and defraud. It stands in stark contrast to legitimate trading, which relies on transparency and accurate market conditions to facilitate genuine price discovery and capital allocation. The distinction is crucial for maintaining a fair and robust financial system where capital can flow efficiently to productive enterprises, rather than being siphoned off by fraudulent schemes.

Beyond Market Manipulation: Round-Tripping’s Role in Tax Evasion and Money Laundering

While the primary focus of understanding deceptive round-trip trading often centers on market manipulation and the inflation of financial figures, its illicit scope stretches even further into the realm of severe financial crimes. Beyond creating misleading financial statements and generating artificial volume, this sophisticated maneuver can also serve as a potent conduit for activities like tax evasion and money laundering, particularly through complex cross-border transactions.

Consider the potential for tax evasion. By engaging in circular transactions between related entities located in different tax jurisdictions, companies can artificially shift profits or losses. For instance, an entity in a high-tax jurisdiction might “sell” an asset at an artificially low price to a related entity in a low-tax jurisdiction, then have it “sold back” at a higher price. This sequence can create artificial losses in the high-tax jurisdiction, reducing taxable income, while consolidating profits in a tax haven. Such schemes often lack economic substance and are designed solely to exploit differences in tax regimes, depriving governments of legitimate revenue and creating an unfair competitive advantage for those willing to engage in illicit activities. The principle of “substance over form” is critically important here, where regulators look beyond the stated transactions to the true economic reality.

The role of round-trip trading in money laundering is equally insidious. Illicit funds, derived from criminal activities, need to be “cleaned” or integrated into the legitimate financial system without detection. Round-trip trading offers a sophisticated mechanism for this. Funds can be used to purchase assets, which are then repeatedly bought and sold through a series of transactions, often involving shell companies or offshore entities. Each “round trip” can obscure the original source of the funds, making them appear to be legitimate proceeds from trading activities. The complexity of these layered transactions can make it incredibly challenging for authorities to trace the money back to its criminal origins, effectively “laundering” it through the financial system. This is especially prevalent in cross-border scenarios, where different legal frameworks and limited information sharing can create loopholes for criminals.

These applications of round-tripping highlight its versatility as a tool for financial malfeasance. It extends its illicit scope far beyond securities markets, impacting broader economic and legal concerns. When transactions lack a genuine commercial purpose and are merely designed to create a paper trail for illicit gains or to minimize tax liabilities, they become a threat to national and international financial stability. The deliberate opacity, the use of multiple intermediaries, and the lack of a true economic rationale are hallmarks of these schemes. As an investor, recognizing that a company engaging in such practices is not just inflating its stock price but potentially facilitating grave criminal enterprises should raise immediate and profound red flags.

The ongoing vigilance against these multifaceted financial crimes underscores the importance of robust regulatory frameworks and international cooperation. It reinforces why federal regulators view round-tripping with such severity and why understanding its various deceptive applications is paramount for anyone navigating the financial landscape.

The Heavy Hand of the Law: Penalties and Prosecutions for Round-Tripping

The consequences of engaging in illicit round-trip trading are far from theoretical; they are severe, multifaceted, and have led to the downfall of major corporations and prominent individuals. When perpetrators are caught, they face a barrage of legal repercussions that can include hefty fines, significant prison sentences, and irreparable reputational damage. The legal framework is designed to punish those who undermine market integrity and protect investors from fraudulent schemes.

Individuals and entities suspected of illegal round-tripping schemes face a spectrum of federal criminal charges. Among the most common are:

- Wire Fraud (18 U.S.C. § 1343): This charge is applicable when a scheme to defraud involves the use of interstate wires (e.g., telephone, email, internet communications) to execute the fraudulent transactions. Since virtually all financial transactions today involve electronic communication, wire fraud is often a foundational charge in complex financial manipulation cases.

- Securities Fraud (18 U.S.C. § 1348): Directly targeting fraudulent activities in connection with the purchase or sale of any security, this statute is a cornerstone for prosecuting market manipulation schemes, including those involving round-tripping. It addresses the deliberate deception of investors and the broader market.

- Tax Fraud: If round-tripping is used to evade taxes by creating artificial losses or shifting profits, individuals and companies can face charges related to tax evasion, which carry severe penalties.

- RICO Charges (Racketeer Influenced and Corrupt Organizations Act): For highly organized and ongoing fraudulent enterprises, prosecutors may levy RICO charges. This powerful statute allows for the prosecution of individuals involved in a pattern of racketeering activity, offering a broad scope to dismantle criminal organizations involved in systematic fraud.

| Charge Type | Description |

|---|---|

| Wire Fraud | Involves the use of interstate wires in a scheme to defraud. |

| Securities Fraud | Targets fraudulent activities connected with the sale of securities. |

| Tax Fraud | Charges related to the evasion of taxes. |

| RICO Charges | Applicable for organized fraudulent enterprises. |

These charges can lead to substantial fines, often running into millions or even billions of dollars, depending on the scale of the fraud. Imprisonment terms can be lengthy, with sentences for financial fraud often reaching several decades. Beyond criminal charges, perpetrators also face civil lawsuits from defrauded investors, regulatory sanctions from bodies like the SEC, and a complete decimation of their professional and personal reputations.

A prime example of these devastating consequences can be seen in the historical case of Enron. The infamous Enron collapse in 2001 remains one of the most significant corporate scandals in U.S. history, serving as a stark reminder of how pervasive round-tripping and other deceptive accounting practices can artificially inflate market capitalization and revenue figures. Enron, once a darling of the energy trading world, engaged in complex and deceptive transactions, including sophisticated round-tripping of energy trades, often between its Special Purpose Vehicles (SPVs). These transactions created the illusion of robust trading volume and profitability, while in reality, little genuine economic activity occurred. The company’s executives, including CEO Jeffrey Skilling and CFO Andrew Fastow, were deeply implicated.

The exposure of Enron’s deceptive bookkeeping practices led to its rapid downfall, wiping out billions in shareholder value and employee pensions. Fastow, for instance, pleaded guilty to two counts of conspiracy and was sentenced to six years in prison. The cascading effects included the dissolution of Arthur Andersen, one of the “Big Five” accounting firms, due to its complicity in Enron’s audit failures. Similar scandals involving CMS Energy, Reliant Energy, and Dynegy also surfaced in the early 2000s, where energy trading firms were found to have engaged in “wash trades” to inflate trading volume figures. More recently, the Wirecard scandal in Germany showcased similar patterns of fictitious transactions and inflated revenues that ultimately led to the company’s collapse and criminal charges.

These high-profile cases vividly illustrate that engaging in fraudulent activities like round-tripping carries immense personal and corporate risks. The legal system, through diligent investigations by the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC), is relentless in pursuing those who compromise the integrity of our financial markets. As an investor, understanding these historical precedents provides invaluable context and reinforces the need for extreme caution and due diligence when evaluating companies and their reported financials.

Not All Round Trips Are Equal: Differentiating Legitimate Trading from Fraudulent Schemes

The term “round trip” itself, in a general financial context, simply refers to the act of both buying and selling a security. This is, in fact, the fundamental cycle of nearly every profitable trade. So, how do we distinguish between legitimate, transparent market practices that involve repetitive buying and selling, and the illicit, deceptive practice of round-trip trading we’ve been discussing? The key differentiator, as we’ve hinted, lies in the crucial elements of intent and disclosure. Legitimate trading aims to capitalize on market movements or fulfill genuine investment objectives, while fraudulent round-tripping aims to deceive, manipulate, and defraud.

Consider the everyday activities of active traders. You, as an investor interested in technical analysis, might engage in frequent, short-term buy and sell actions to capitalize on small price fluctuations. This is perfectly legitimate. For example, a day trader might buy a stock in the morning and sell it hours later, completing a “round trip” to profit from an intraday price swing. There is genuine market risk involved, and the intent is to achieve actual gains or losses based on market dynamics. These transactions are transparently recorded, and their purpose is to achieve market-based returns, not to create a false impression of volume or financial health.

| Trading Type | Details |

|---|---|

| Legitimate Trading | Engaging in trades to capitalize on market fluctuations with genuine intent. |

| Round-Trip Trading | Orchestrated to deceive, lacking economic purpose. |

Another area where the concept of a “round trip” might appear is in institutional settings, such as swap trades. These are typically agreements between large financial institutions to sell and then repurchase securities at the same price, often with an agreement to adjust for interest payments or other specific financial terms. These are sophisticated, institutional agreements designed for specific hedging, financing, or portfolio management purposes. They are complex derivatives products but are executed with explicit agreements, are regulated, and have genuine business or financial objectives. Their purpose is not to manipulate trading volume or inflate balance sheet values, but to manage risk or optimize capital deployment within a defined legal and regulatory framework. The critical difference is the explicit agreement and the legitimate financial rationale behind the transaction, which is fully disclosed to relevant parties and regulators.

The distinction is subtle yet profound. In legitimate trading, you are exposed to genuine market risk, and the economic substance of the transaction is clear. The goal is real profit or loss. In fraudulent round-tripping, the economic substance is often absent, and the primary goal is to create an artificial impression for deceptive purposes. The participants in an illicit round-trip trading scheme often face no actual market risk because the buy and sell orders are coordinated, ensuring that the asset simply circulates within a closed, predetermined loop. There is no genuine change in ownership for a market-driven reason.

Understanding these distinctions is vital for your due diligence. It requires looking beyond the superficial act of buying and selling and instead focusing on the underlying intent, the genuine economic purpose, and the transparency of the transactions involved. If you encounter transactions that seem to lack a logical business rationale or appear to be excessively repetitive between closely related parties, it should immediately prompt a deeper investigation.

Pattern Day Trading vs. Deception: Understanding the Regulatory Safeguards

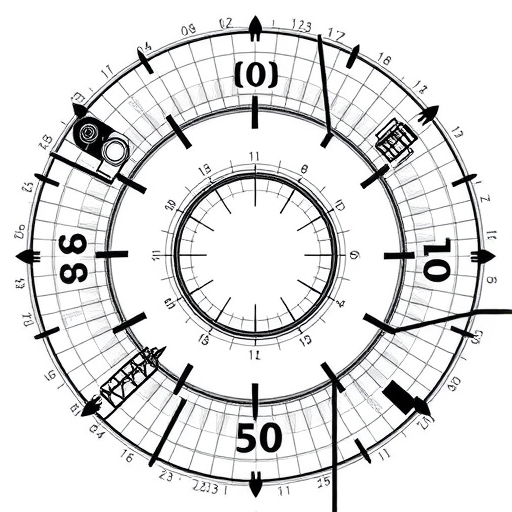

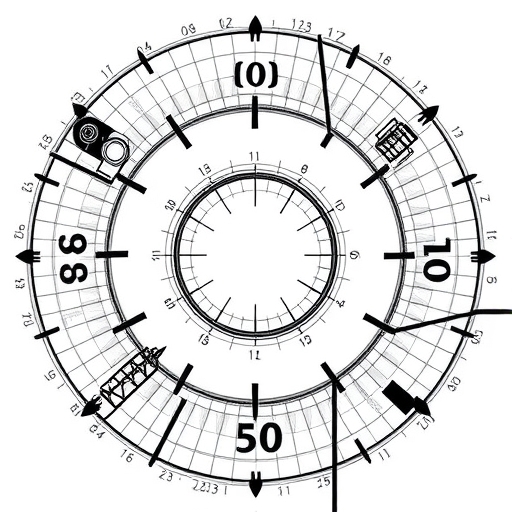

As we continue to differentiate between legitimate and illicit “round trips” in the market, it’s essential to zoom in on a specific and frequently discussed form of active trading: pattern day trading. While pattern day traders engage in frequent buy and sell actions, performing many “round trips” within a single trading day, their activities are fundamentally distinct from fraudulent round-trip trading and are, in fact, subject to strict regulatory oversight designed to maintain transparency and prevent manipulation.

A pattern day trader is defined by regulators as someone who executes four or more “day trades” within five business days, provided those day trades constitute more than 6% of the customer’s total trades in the margin account for that five-day period. A “day trade” itself is simply a “round trip”—the opening and closing of a position in the same security on the same trading day. So, while the mechanics of a single day trade resemble a “round trip,” the intent and regulatory context are vastly different from the deceptive practices we’ve explored.

For one, pattern day traders are required to maintain a minimum of $25,000 account equity in their brokerage accounts. This significant capital requirement serves as a safeguard, ensuring that traders engaged in such high-frequency, short-term strategies have sufficient financial backing to absorb potential losses. It discourages undercapitalized individuals from taking on excessive risk and helps ensure that their trading activity is genuinely aimed at profiting from market movements, rather than fabricating volume or manipulating prices. The rule enforces a level of financial responsibility and seriousness to the activity.

Furthermore, legitimate day trading, whether by an individual or an institution, involves genuine exposure to market risk. When a day trader buys a stock, they face the risk that its price might fall, resulting in a loss. When they sell, they risk missing out on further gains. Their net gains or losses are transparently reported as income, subject to taxation, and reflected accurately in their brokerage statements. There is no attempt to create a false impression of a company’s financial health or to inflate its revenue; the focus is purely on capitalizing on price volatility within the market.

Contrast this with deceptive round-tripping, where the transactions are often orchestrated between related parties, effectively eliminating genuine market risk for the manipulators. The goal is not to achieve legitimate trading profits through market exposure but to artificially inflate figures, deceive investors, and facilitate illicit activities like tax evasion or money laundering. The intent is to defraud, not to trade. The pattern day trading rules, implemented by regulatory bodies like FINRA (Financial Industry Regulatory Authority), are precisely designed to ensure that active trading remains within the bounds of legitimate market activity, fostering a competitive and fair environment.

For you, the aspiring trader, understanding these regulatory distinctions is paramount. It empowers you to discern between genuine, active market participation and illicit schemes. While navigating the complexities of high-frequency trading or day trading, always remember that transparency, adherence to regulatory standards, and a genuine intent to engage with the market (rather than manipulate it) are the hallmarks of legitimate financial activity.

If you’re seeking to engage in legitimate trading, perhaps exploring a variety of financial products and leveraging advanced tools for technical analysis, choosing a robust and regulated platform is key. If you’re considering starting your journey in forex trading or wish to explore a wide range of CFD instruments, Moneta Markets is a platform worth considering. Hailing from Australia, it offers over 1000 financial instruments, catering to both novice and professional traders looking for suitable choices.

Institutional Nuances: The Legitimate Use of Swap Trades and Their Distinctions

Beyond individual pattern day traders, large financial institutions also engage in complex “round trip” like transactions that are entirely legitimate and serve crucial purposes within the global financial system. One prominent example of this is the use of swap trades. These are not typically the simple buy-and-sell cycles of a retail trader, but sophisticated agreements that highlight the profound difference between legitimate financial engineering and manipulative deception. Understanding these institutional nuances further solidifies your ability to distinguish valid market practices from fraudulent ones.

What exactly are swap trades in this context? At their core, a security swap involves two parties agreeing to exchange securities or cash flows over a specified period. A common form that might resemble a “round trip” is a repurchase agreement, or “repo” agreement. In a repo, one party sells a security to another party with the agreement to repurchase it at a later date at a specified price. While this involves a “buy” and a “sell” action, making it a “round trip,” its purpose is entirely legitimate: it serves as a short-term borrowing mechanism, effectively using the security as collateral. It’s a key tool for managing liquidity, funding, and interest rate risk in financial markets. The intent is to secure short-term financing or to lend out capital, with explicit terms and transparent accounting, rather than to create fictitious trading volume or inflate a balance sheet.

These institutional arrangements are distinct from fraudulent round-trip trading in several critical ways. Firstly, they have a clear economic substance and genuine business purpose. They are executed to fulfill specific financial needs, such as managing cash flow, hedging against interest rate fluctuations, or providing collateral for short-term loans. There is no intention to mislead or deceive regulators, investors, or the public about a company’s financial health or market activity. Secondly, swap trades and similar agreements are typically subject to robust contractual agreements and regulatory oversight. Financial institutions involved in these transactions operate under strict capital requirements and reporting obligations, ensuring a high degree of transparency. Regulatory bodies like the SEC and various central banks closely monitor these activities to ensure market stability and prevent systemic risk.

Furthermore, the pricing mechanisms and accounting treatment for legitimate swaps and repo agreements are transparent and adhere to established financial standards. They reflect the true economic value being exchanged and the risks being transferred. Unlike illicit round-tripping, where prices might be artificially manipulated between related parties to achieve a desired deceptive outcome (e.g., creating artificial revenue), legitimate institutional trades are driven by prevailing market rates and genuine financial considerations. They are audited and reported in a manner that provides a true and fair view of a firm’s financial position.

For you, as an investor or a keen observer of financial markets, recognizing these legitimate institutional practices is important. It highlights that not every circular transaction or repeated buying and selling signals fraud. The critical lens through which to view these activities is always: “What is the true economic purpose? Is there genuine risk transfer? Is it transparently accounted for and disclosed?” By asking these questions, you can sharpen your analytical skills and become more adept at identifying the subtle, yet crucial, differences between complex but valid financial maneuvers and outright deceptive schemes. This advanced understanding moves you beyond surface-level observations to a deeper appreciation of market mechanics and potential vulnerabilities.

Guardians of the Market: How Regulators Combat Round-Tripping

The integrity of financial markets is a cornerstone of economic stability and investor confidence. Given the sophisticated and often concealed nature of deceptive round-trip trading, a robust system of regulatory oversight is absolutely essential. Federal regulators play a pivotal and proactive role in identifying, investigating, and prosecuting these fraudulent schemes, acting as guardians to protect you, the investor, and to maintain the fairness and transparency of capital markets.

In the United States, two of the most prominent regulatory bodies leading the charge against financial fraud, including round-tripping, are the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ).

- The SEC, as the primary regulator of U.S. securities markets, has a mandate to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. Its enforcement division tirelessly investigates instances of market manipulation, accounting fraud, and insider trading. When it comes to round-tripping, the SEC employs sophisticated data analytics to detect unusual trading patterns, inflated trading volume, or suspicious related-party transactions. They scrutinize financial statements, conduct detailed audits, and compel companies to provide full and accurate disclosures. If violations are found, the SEC can bring civil enforcement actions, imposing significant monetary penalties, disgorgement of illicit gains, and barring individuals from serving as officers or directors of public companies.

- The DOJ, on the other hand, is responsible for prosecuting federal criminal offenses. When the SEC uncovers evidence of criminal wrongdoing, or when it conducts its own investigations, the DOJ steps in to pursue criminal charges against individuals and corporations involved in round-tripping schemes. As discussed, these can include charges for Wire Fraud, Securities Fraud, Tax Fraud, and even RICO charges. The collaboration between the SEC and DOJ is critical; the SEC provides the financial and regulatory expertise, while the DOJ brings the full force of criminal law to bear.

| Investigation Technique | Purpose |

|---|---|

| Whistleblower Programs | Encourage reporting of fraudulent activities. |

| Technological Surveillance | Monitor trading activity for irregular patterns. |

| Forensic Accounting | Analyze financial activities for signs of fraud. |

These agencies utilize a combination of techniques, including whistleblower programs, advanced technological surveillance of trading activity, and extensive forensic accounting. They look for red flags such as:

- Unexplained spikes in trading volume for a company without corresponding news or market events.

- Significant transactions between seemingly unrelated parties that, upon closer inspection, reveal common ownership or control.

- Consistently high revenue growth without commensurate increases in cash flow or operating expenses.

- Complex and convoluted corporate structures, especially those involving numerous shell companies or entities in offshore jurisdictions known for lax oversight.

The proactive stance of these regulators is vital. Their investigations and prosecutions send a clear message that manipulative practices will not be tolerated, thereby deterring potential fraudsters and reinforcing the integrity of our financial systems. Their efforts are a continuous battle, adapting to new forms of deception as financial markets evolve. As an investor, understanding their role empowers you to recognize the safeguards in place, even as you remain vigilant about potential risks.

When you are choosing a trading platform, especially if you are engaging in various financial markets, it’s wise to consider factors such as regulatory compliance and technological sophistication. Moneta Markets stands out for its flexibility and technological advantages. It supports popular platforms like MT4, MT5, and Pro Trader, offering a smooth trading experience through high-speed execution and competitive low spreads. This combination of robust technology and reputable regulatory oversight contributes to a more secure trading environment.

Empowering Your Investment Journey: Detecting Red Flags and Protecting Yourself

We’ve traversed the intricate landscape of round-trip trading, from its deceptive definition and illicit applications to the severe legal ramifications and the vigilant efforts of regulatory bodies. Now, let’s bring it closer to home: how can you, as an informed investor, empower yourself to detect potential red flags and protect your hard-earned capital from such sophisticated schemes? Your diligence is a powerful defense mechanism in the ongoing battle for market integrity and investor confidence.

Firstly, cultivate a healthy skepticism, particularly when confronted with claims of unusually high or consistent revenue growth that seem out of step with broader industry trends or a company’s operational realities. Ask yourself: “Does this growth make genuine commercial sense?” Look beyond the headline numbers to the underlying cash flow. Companies engaging in round-tripping to inflate revenues often exhibit a significant disconnect between reported earnings and actual cash generated from operations. Why might a company be reporting stellar sales figures but struggling with liquidity or operating cash flow? This discrepancy can be a flashing warning sign.

Secondly, pay close attention to trading volume and unusual price movements. While high volume can signify genuine interest, a sudden, unexplained surge in trading activity, especially for a thinly traded stock, without any corresponding news or fundamental developments, should pique your curiosity. Could this be artificial volume designed to create a false sense of liquidity or demand? Research the parties involved in significant transactions if public information allows. Look for patterns where the same entities appear to be both buyers and sellers in large, repetitive blocks of shares. Tools available to sophisticated traders and analysts can sometimes help reveal these patterns.

Thirdly, scrutinize related-party transactions. These are dealings between a company and entities that are controlled by, or otherwise connected to, the company’s management or major shareholders. While not inherently illicit, related-party transactions are a common vehicle for round-tripping and other forms of accounting fraud. Always ask: “Is this transaction at arm’s length? Does it serve a genuine business purpose, or is it merely designed to shift assets or inflate figures?” Disclosures regarding related-party transactions can often be found in a company’s financial footnotes or proxy statements. If these transactions are unusually complex, numerous, or lack clear commercial justification, they warrant further investigation.

Fourthly, foster a deep understanding of financial statements. Beyond just the income statement, delve into the balance sheet and, crucially, the statement of cash flows. The cash flow statement provides an unvarnished look at how money is actually moving in and out of a company, making it harder to manipulate than accrual-based accounting figures. If revenue is soaring but operating cash flow is stagnant or negative, it’s a critical red flag. Familiarize yourself with accounting principles like economic substance and “substance over form,” which regulators use to look beyond the surface of transactions to their true economic reality.

Finally, leverage external resources and opinions. Don’t rely solely on company-issued reports. Consult reputable financial news outlets, independent analysts’ reports, and regulatory filings (like 10-K and 10-Q reports with the SEC). Are there dissenting opinions or critical analyses of the company’s financials? Sometimes, the collective vigilance of a well-informed market can expose discrepancies that an individual might miss. Your commitment to continuous learning and critical thinking is your strongest asset in the face of financial deception.

If you’re looking for a globally regulated forex broker that prioritizes the security of your funds, Moneta Markets provides robust regulatory assurances, including licenses from FSCA, ASIC, and FSA. Beyond regulation, they offer comprehensive support like segregated client funds, free VPS, and 24/7 Chinese customer service, making them a top choice for many traders seeking a secure and well-supported trading environment.

The Continuous Battle for Market Integrity: A Summary of Vigilance

Our journey through the deceptive world of round-trip trading has illuminated a critical aspect of financial markets: the constant tension between innovation and manipulation, legitimate trading and outright fraud. This comprehensive analysis should leave you with a profound understanding that round-trip trading, in its illicit application, stands as a stark reminder of the sophisticated deceptive practices that can permeate financial markets. Its illicit use to manipulate figures, create misleading financial statements, and mislead stakeholders fundamentally undermines the principles of transparency and fairness upon which robust capital markets depend.

We’ve seen how this deceptive maneuver can inflate financial figures, generate artificial volume, distort true trading volume, and give a false impression of a company’s financial health, often leading to severe detriment for unsuspecting investors. The historical examples, from the infamous Enron collapse to more recent scandals like Wirecard, serve as cautionary tales, vividly demonstrating how such fraudulent activities can lead to corporate ruin, widespread financial loss, and severe criminal prosecutions for those involved.

Crucially, we’ve distinguished between these fraudulent schemes and legitimate market practices, such as pattern day trading and institutional swap trades. The key differentiator is always the intent: whether the transaction is designed for genuine economic purpose and transparent risk transfer, or if it is orchestrated solely to deceive and manipulate. This distinction is vital for you, the investor, as you navigate the complexities of financial data and market narratives.

The ongoing need for robust regulatory enforcement, spearheaded by entities like the SEC and DOJ, cannot be overstated. Their diligent investigations and prosecutions are the frontline defense against these sophisticated frauds, protecting the capital markets and upholding the trust that is essential for investment and economic growth. However, regulatory efforts alone are not enough.

Your role as an informed and diligent investor is equally critical. By understanding the mechanisms of round-tripping, by knowing the red flags—such as unexplained volume spikes, discrepancies between earnings and cash flow, and suspicious related-party transactions—you empower yourself. Your commitment to scrutinizing financial statements, leveraging analytical tools, and maintaining a healthy skepticism is your best defense against becoming a victim of such schemes. Investing in your financial education and fostering critical thinking skills are perhaps the most valuable assets you can acquire.

Upholding the integrity of financial systems requires continuous vigilance, not just from regulators, but from every participant. By collectively pushing for greater transparency, demanding accountability, and staying informed, we contribute to a marketplace that truly serves its purpose: facilitating legitimate capital formation and offering genuine opportunities for wealth creation, rather than being exploited by deceptive maneuvers.

what is a round trip tradeFAQ

Q:What is round-trip trading?

A:Round-trip trading refers to buying and selling the same financial asset in a manner that creates a misleading appearance of market activity.

Q:Is round-trip trading legal?

A:While buying and selling is legal, round-trip trading is illegal if it is done to deceive investors or inflate trading volumes artificially.

Q:What are the risks of round-trip trading?

A:Round-trip trading can lead to severe legal consequences for those engaged in it, including fines, imprisonment, and damage to reputation.