What Is OPEC? A Simple Definition

The Organization of the Petroleum Exporting Countries, commonly known as OPEC, is an intergovernmental body established to coordinate and harmonize the petroleum policies of its member nations. Formed as a collective response to external control over oil resources, OPEC functions as a powerful coalition of major global oil exporters. By aligning production strategies, the organization seeks to influence crude oil supply on the international stage, helping stabilize prices and secure consistent revenue for its members.

At its core, OPEC aims to balance the interests of oil-producing nations, global consumers, and industry investors. It strives to maintain equitable oil prices, ensure reliable supply chains, and provide a fair return on energy investments. Because oil remains a cornerstone of the global economy, OPEC’s decisions ripple across financial markets, energy sectors, and national economies worldwide.

The History and Founding of OPEC

The creation of OPEC marked a turning point in global energy dynamics, shifting influence from Western-dominated oil conglomerates to resource-rich producing countries. In the decades following World War II, a small group of multinational companies—dubbed the “Seven Sisters”—held near-total control over oil production, pricing, and distribution. These corporations operated with minimal oversight from host nations, often setting prices that disadvantaged oil-producing economies.

This imbalance sparked a movement among key oil-exporting states to reclaim sovereignty over their natural resources and assert greater control over their economic futures.

The Baghdad Conference (1960)

In September 1960, representatives from five nations convened in Baghdad for a historic meeting that would reshape the energy landscape. Triggered by unilateral price cuts in crude oil by major oil firms, the gathering brought together Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. United by a shared goal of protecting their national interests, these countries formalized their cooperation and laid the foundation for OPEC.

Their vision was clear: to create a unified platform where oil-producing nations could collectively negotiate terms, resist exploitative pricing, and safeguard long-term economic stability. The Baghdad Conference thus became the birthplace of a new era in energy geopolitics.

Key Milestones

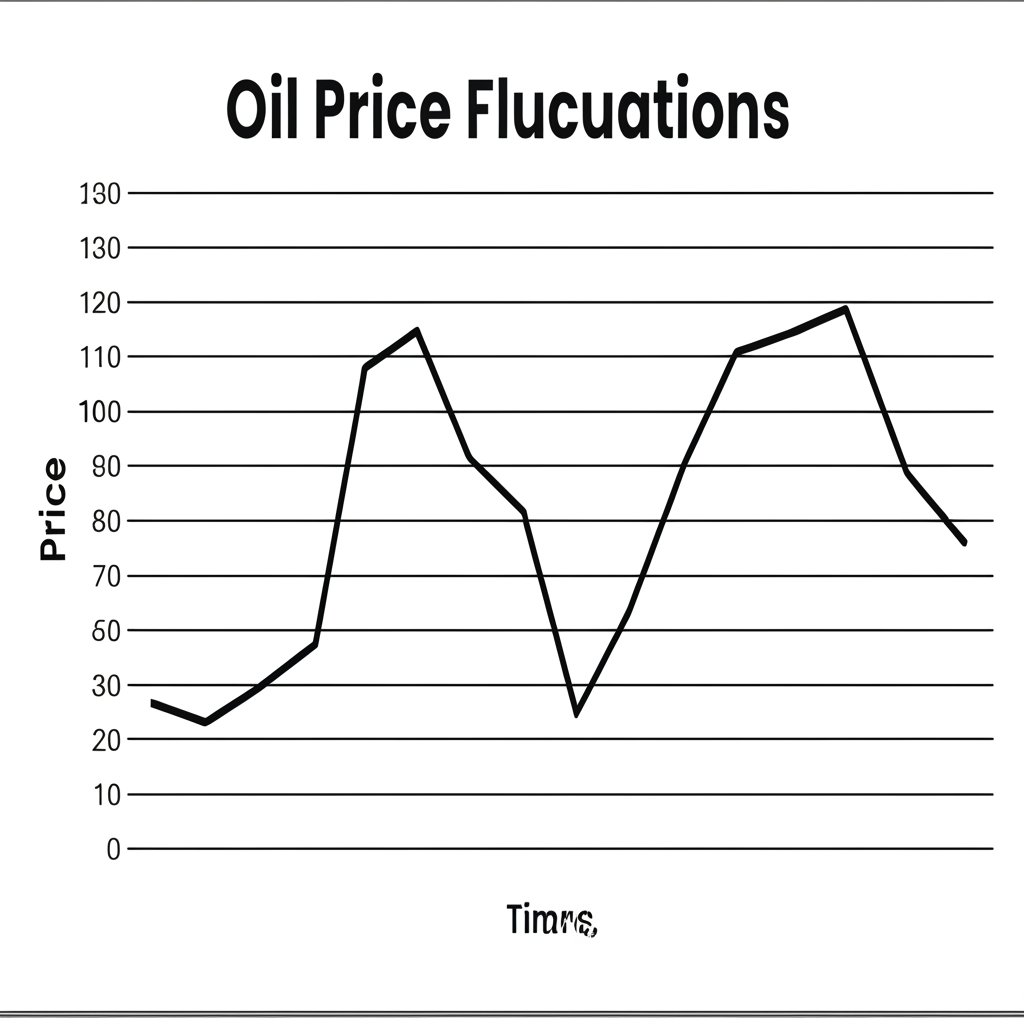

OPEC has played a central role in some of the most transformative moments in modern economic history. The 1973 Oil Crisis stands out as a defining event, when Arab OPEC members initiated an oil embargo against nations supporting Israel during the Yom Kippur War. The move caused oil prices to surge nearly fourfold within months, triggering widespread recessions and reshaping energy policies across the West.

The 1980s introduced a different challenge—the oil glut. After years of high prices and conservation efforts, global demand slowed while non-OPEC production rose. To counter plummeting prices, OPEC introduced formal production quotas in 1982, marking a shift toward managed supply strategies.

Fast forward to the 2010s, the surge of U.S. shale oil disrupted traditional market dynamics. Faced with another supply oversupply between 2014 and 2016, OPEC recognized the need for broader coordination. This led to the formation of OPEC+, a strategic alliance that expanded its reach and influence in a rapidly evolving energy landscape.

What Is the Main Purpose of OPEC?

The official mandate of the Organization of the Petroleum Exporting Countries is outlined in the OPEC Statute, which establishes its role as a stabilizing force in global oil markets. The organization’s mission is not solely about protecting producer revenues but also about ensuring market equilibrium for the benefit of all stakeholders—producers, consumers, and investors alike.

- Stabilize Oil Prices: Prevent extreme price volatility that can destabilize economies and disrupt energy planning.

- Ensure a Regular Supply: Maintain a dependable flow of petroleum to importing nations to support industrial and transportation needs.

- Provide a Steady Income: Guarantee member countries a predictable revenue stream to fund national development and public services.

- Secure a Fair Return on Capital: Encourage continued investment in exploration, infrastructure, and innovation by offering stable market conditions.

To fulfill these objectives, OPEC’s member ministers convene regularly—often in Vienna—to evaluate global supply and demand trends. Their most impactful decisions involve adjusting collective production levels, a tool that directly shapes market sentiment and price movements.

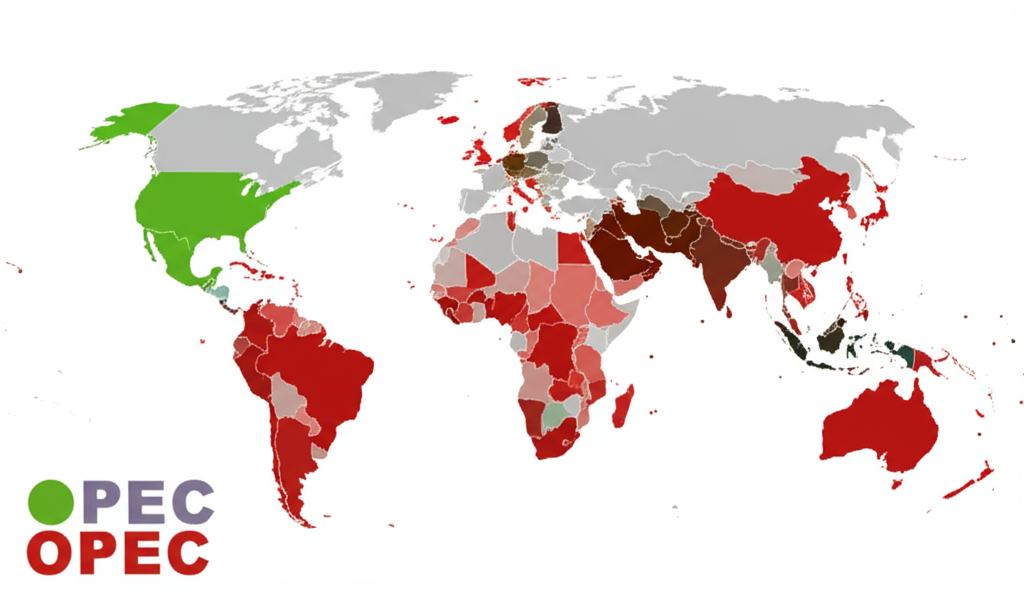

Current OPEC Member Countries

Since its inception with five founding nations, OPEC has gradually expanded its membership to include 12 countries spanning three continents. Headquartered in Vienna, Austria since 1965, the organization continues to serve as a forum for dialogue and policy alignment among major oil exporters. Below is the complete list of current members, their year of accession, and regional classification.

| Country | Year Joined | Continent |

|---|---|---|

| Algeria | 1969 | Africa |

| Congo, Rep. of the | 2018 | Africa |

| Equatorial Guinea | 2017 | Africa |

| Gabon | 1975 (rejoined 2016) | Africa |

| Iran | 1960 (Founding Member) | Asia |

| Iraq | 1960 (Founding Member) | Asia |

| Kuwait | 1960 (Founding Member) | Asia |

| Libya | 1962 | Africa |

| Nigeria | 1971 | Africa |

| Saudi Arabia | 1960 (Founding Member) | Asia |

| United Arab Emirates | 1967 | Asia |

| Venezuela | 1960 (Founding Member) | South America |

How OPEC Influences Global Oil Prices

The primary mechanism through which OPEC shapes global oil prices is the adjustment of production quotas. As a group controlling a significant share of the world’s oil exports, the organization holds substantial sway over supply levels. By collectively increasing or reducing output, OPEC can directly impact the balance between supply and demand—a fundamental driver of commodity pricing.

When demand remains steady or grows, a reduction in OPEC’s production tightens the market, leading to higher prices. Conversely, when the organization increases output, the influx of crude oil can suppress prices by alleviating scarcity concerns. These decisions are typically made during ministerial meetings in Vienna, where market data, economic forecasts, and geopolitical developments are analyzed to determine the optimal production path.

The effectiveness of OPEC’s influence, however, depends on member compliance and global market conditions. For instance, during periods of strong non-OPEC production—such as the U.S. shale boom—OPEC’s ability to dictate prices diminishes, necessitating strategic alliances like OPEC+ to maintain leverage.

OPEC vs. OPEC+: What’s the Difference?

While OPEC remains a central player in global oil markets, the rise of OPEC+ has redefined how supply is managed in the 21st century. OPEC+ is not a formal organization but an informal yet highly coordinated coalition that unites OPEC’s 12 members with 10 major non-OPEC oil producers. Formed in late 2016, the alliance was a direct response to the oil price collapse caused by oversupply, much of it driven by the rapid expansion of U.S. shale production.

Russia stands as the most influential non-OPEC participant, bringing significant production capacity and geopolitical weight to the table. Other key contributors include Mexico, Kazakhstan, Azerbaijan, and Oman. Together, OPEC+ accounts for more than half of the world’s total oil output, giving it unmatched influence over global pricing and market stability.

A landmark example of OPEC+ coordination occurred in April 2020, when the group agreed to cut production by nearly 10 million barrels per day in response to the dramatic drop in demand caused by the COVID-19 pandemic. This historic move, documented by the U.S. Energy Information Administration (EIA), underscored the alliance’s role as a stabilizing force during times of crisis.

The Future of OPEC in a Changing World

As the global energy landscape evolves, OPEC faces mounting pressures that challenge its long-term relevance. While it remains a dominant force in oil markets, structural shifts—ranging from climate policy to technological innovation—are reshaping the future of energy consumption.

One of the most pressing issues is the global transition to low-carbon energy sources. With countries committing to net-zero emissions targets, demand for oil is expected to peak and gradually decline in the coming decades. The accelerating adoption of electric vehicles (EVs) poses a particular threat to oil’s dominance in transportation, which accounts for nearly 60% of global crude consumption. According to the International Energy Agency (IEA), oil-dependent economies must diversify their revenue streams and invest in sustainable alternatives to ensure long-term resilience.

Meanwhile, the rise of non-OPEC producers—especially the United States—continues to erode OPEC’s market share. The shale revolution has turned the U.S. into a top oil exporter, reducing OPEC’s ability to unilaterally influence prices. Internal disagreements among member states, often fueled by regional rivalries, can further hinder unified decision-making.

Looking ahead, OPEC and OPEC+ will likely rely on strategic production management, deeper international cooperation, and investments in carbon capture, hydrogen, and renewable energy projects within member nations. Moneta Markets highlights that adaptability and forward-looking fiscal planning will be critical for oil-producing economies navigating this new reality, especially as financial markets increasingly prioritize ESG (Environmental, Social, and Governance) factors in energy investments.

Criticisms and Controversies

Despite its stated aim of market stabilization, OPEC has long been a subject of controversy. Critics frequently label it a cartel, pointing to its coordinated production cuts and price-influencing behavior—actions that would violate antitrust laws in many industrialized nations if carried out by private corporations.

Detractors argue that OPEC’s supply restrictions artificially inflate oil prices, increasing costs for consumers and businesses, fueling inflation, and slowing economic growth—particularly in oil-importing countries. While price increases benefit producers, they can strain household budgets and corporate profitability worldwide.

Additionally, OPEC’s decisions often introduce volatility into financial markets, as traders react swiftly to production announcements. Given that many member nations are located in geopolitically volatile regions, the organization’s policies are frequently entangled with broader political agendas, amplifying its influence beyond the energy sector.

Frequently Asked Questions About OPEC

What does OPEC stand for?

OPEC stands for the Organization of the Petroleum Exporting Countries.

How many countries are members of OPEC in 2024?

As of 2024, there are 12 member countries in OPEC. The members are Algeria, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates, and Venezuela.

Where is the OPEC headquarters located?

The headquarters of OPEC is located in Vienna, the capital city of Austria. It has been based there since 1965.

Who are the 5 founding members of OPEC?

The five founding members of OPEC, who established the organization at the Baghdad Conference in September 1960, are:

- Iran

- Iraq

- Kuwait

- Saudi Arabia

- Venezuela

What is the primary purpose of OPEC?

The primary purpose of OPEC is to coordinate and unify the petroleum policies of its member countries. This is done to stabilize oil markets, ensure a regular supply of petroleum to consumers, provide a steady income to producers, and secure a fair return on capital for those investing in the oil industry.

Is Russia a member of OPEC?

No, Russia is not a member of OPEC. However, Russia is the most influential leader of the non-OPEC countries that cooperate with OPEC as part of a larger alliance known as OPEC+.

What is the difference between OPEC and OPEC+?

OPEC is the formal organization consisting of 12 member countries. OPEC+ is a larger, informal alliance that includes the 12 OPEC members plus 10 major non-OPEC oil-producing countries, led by Russia. OPEC+ was formed to have a greater influence over the global oil market than OPEC could achieve on its own.

How does OPEC control oil prices?

OPEC controls oil prices primarily by setting production quotas for its member countries. By collectively agreeing to increase or decrease their oil output, they can influence the global supply of crude oil. According to the laws of supply and demand, reducing supply tends to raise prices, while increasing supply tends to lower them.