Navigating the Depths of Forex and CFD Broker Models: A-Book vs. B-Book Unveiled

Welcome to a crucial discussion that lies at the heart of your trading journey: understanding how your broker handles your trades. It might seem like a technical detail, but knowing whether your broker operates on an A-Book or B-Book model can profoundly impact your trading experience, from execution speed and costs to potential conflicts of interest. As we delve into the intricate world of Forex and CFD broker operations, we aim to equip you with the knowledge to see beyond the trading platform and understand the mechanics that govern your interactions with the market.

Imagine your broker not just as a platform provider, but as a complex engine connecting you to the vast financial markets. The choice of engine – A-Book or B-Book – determines the path your trading orders take, the nature of your counterparty, and fundamentally, how the broker generates its revenue. This understanding is vital for both novice traders seeking transparency and experienced participants looking to optimize their trading environment. So, let’s embark on this exploration together, demystifying these critical broker models with clarity and insight.

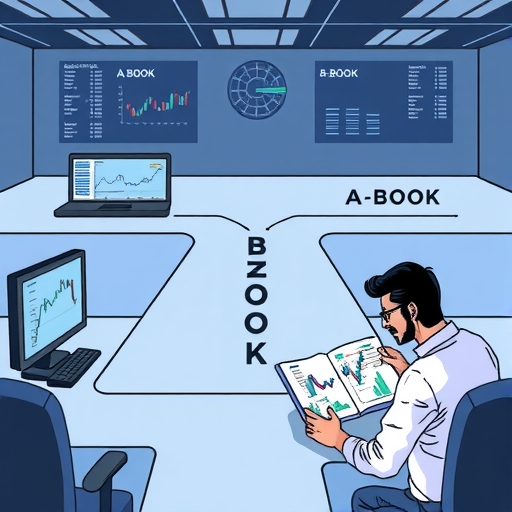

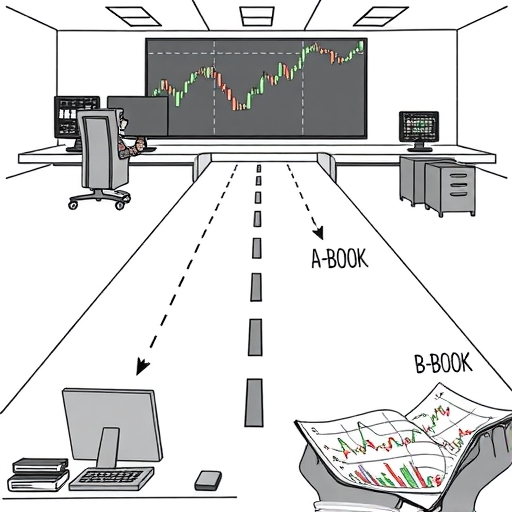

The A-Book model, often referred to as a Straight-Through Processing (STP) or No Dealing Desk (NDD) model, positions the broker as a pure intermediary. Think of the broker here as a sophisticated travel agent. When you want to book a flight, the travel agent doesn’t fly you themselves; they connect you with airlines (the liquidity providers) that offer the route you want at the best available price. Your ticket is with the airline, not the agent.

In the financial world, when you place a trade with an A-Book broker, your order is electronically passed directly to external Liquidity Providers (LPs). These LPs are typically large financial institutions such as banks, other brokers, or hedge funds that are willing to buy or sell a particular asset at a specific price. The broker acts as a bridge, sending your order out and receiving the best available bid and ask prices from its pool of LPs. Your trade is executed against one or more of these external counterparties, not against the broker itself.

How does an A-Book broker make money if they aren’t trading against you? Their revenue primarily comes from two sources: a small commission per trade executed, or by adding a small markup to the raw spread they receive from their LPs. For example, if an LP offers a raw spread of 0.1 pips on EUR/USD, the A-Book broker might add 0.5 pips, presenting a spread of 0.6 pips to you. The 0.5 pips is the broker’s profit margin on that specific trade. Their profitability is directly tied to your trading volume – the more you trade, regardless of whether you win or lose, the more commission or spread markup they earn.

This revenue model inherently aligns the broker’s interests with yours in terms of needing a healthy, active trading environment. Since the broker doesn’t take the other side of your trade, they don’t profit from your losses. Their focus is on providing reliable execution and competitive pricing to encourage high trading volumes, which benefits them through commissions or markups. This absence of direct counterparty risk between you and the broker is a key characteristic and a significant advantage of the A-Book model.

The advantages for you, the trader, are substantial. Firstly, there is high transparency. The prices you see should be reflective of the prices offered by external LPs, aggregated and presented to you. Secondly, there is a significant reduction, if not complete elimination, of the conflict of interest that can exist when the broker is your counterparty. Your broker isn’t incentivized for you to lose. Thirdly, execution speed can be very fast, especially with modern STP technology and robust connections to multiple LPs. Finally, depending on the broker and their LP relationships, you might gain access to tighter, market-variable spreads, which can be particularly beneficial for high-frequency traders or those employing strategies sensitive to costs.

However, operating a pure A-Book model requires significant capital and infrastructure on the broker’s part. They need to establish and maintain relationships with multiple tier-one and tier-two liquidity providers, which often involves substantial margin requirements and complex technological setups for order aggregation and routing. This higher barrier to entry is one reason why not all brokers operate solely on this model.

In stark contrast to the A-Book, the B-Book model operates on a Market Maker principle. Here, the broker doesn’t pass your order to an external LP for every single trade. Instead, the broker takes the opposite side of your trade internally. When you buy EUR/USD, the B-Book broker sells it to you from their own “inventory” or essentially creates the position within their system. When you sell, they buy from you. They are your direct counterparty for that trade.

Imagine the travel agent analogy again, but this time the agent owns their own fleet of planes. When you want to fly a popular route, they might offer you a seat on one of their planes directly, perhaps at a slightly different price or with different rules than the major airlines. They decide whether to fly you themselves or book you on another airline based on their own capacity and risk assessment.

How does a B-Book broker generate revenue? Their primary source of income comes from your client losses. Since they are the counterparty, when your trade loses money, that money doesn’t go to an external LP; it stays within the broker’s system and contributes directly to their profit. Conversely, if your trade is profitable, the broker incurs a loss on that specific position. They also earn from the spread you pay on each trade. B-Book brokers often offer wider, fixed spreads compared to the variable, raw spreads found in A-Book models. This fixed spread provides a predictable income stream for the broker, regardless of whether you win or lose on the underlying market direction (though the amount of profit/loss is dictated by your trade outcome).

Consider a simple example: You buy 1 standard lot of EUR/USD at 1.1000. The B-Book broker sells it to you at 1.1000. If the price moves down and you close the position at 1.0950, you lose 50 pips (e.g., $500). This $500 represents a direct profit for the broker, minus any small costs like the spread. If, however, the price moves up and you close at 1.1050, you gain 50 pips ($500), which is a direct loss for the broker on that position.

The most significant characteristic and potential drawback of the B-Book model is the inherent conflict of interest. Since the broker’s profit is directly linked to client losses (on internalized trades), there is a potential temptation, albeit regulated against, to engage in practices that might lead to client losses. While reputable brokers are strictly forbidden from manipulating prices or unfairly triggering stop-loss orders, the underlying incentive structure exists and is a point of concern for many traders. It’s estimated that a large percentage, perhaps up to 95%, of retail FX/CFD brokers utilize a B-Book model to some extent, highlighting its prevalence, especially for smaller account sizes.

Despite the conflict of interest concern, B-Book brokers can offer certain advantages. They can often provide extremely fast execution because the trades are processed internally without waiting for confirmation from external LPs. They can also offer fixed spreads, which some traders prefer for predictability in their trading costs, although these fixed spreads are typically wider than the variable spreads available through A-Book channels. For brokers, the B-Book model generally requires less starting capital than establishing robust A-Book relationships with multiple top-tier LPs, making it a more accessible model for new brokerages.

Let’s consolidate the fundamental distinctions between these two prevalent broker models to clearly highlight their contrasting approaches:

| Aspect | A-Book Model | B-Book Model |

|---|---|---|

| Business Model & Role | Intermediary (NDD/STP) | Market Maker |

| Revenue Source | Commissions and Markup | Client Losses and Spread |

| Execution Speed | Fast with Technology | Fast for Small Trades |

Understanding these differences is crucial because they directly impact the environment in which you trade. While both models can be legitimate when properly regulated and managed, the underlying mechanics create fundamentally different incentives and operational risks.

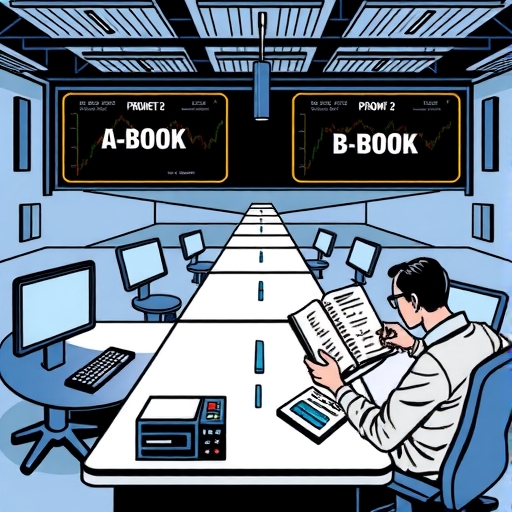

In the dynamic and highly competitive world of online brokerage, a growing number of firms recognize that a rigid adherence to either a pure A-Book or pure B-Book model might not be optimal for all circumstances or all clients. This realization has led to the widespread adoption of the Hybrid model, often referred to as the C-Book.

The Hybrid model is exactly what it sounds like: a combination of both A-Book and B-Book strategies. It allows brokers to dynamically decide how to handle client orders on a trade-by-trade or client-by-client basis. Think of our sophisticated travel agent again. For some clients booking a standard route, they might book directly with an airline (A-Book). For other clients wanting a less common destination, or for a booking at a busy time, the agent might utilize their own charter plane (B-Book) if it makes more sense from a cost or capacity perspective. They make this decision based on various factors to optimize their operation.

Similarly, a Hybrid broker uses advanced technology, often called a Liquidity Bridge or dynamic order routing system, to categorize and route client orders. How do they decide whether to A-Book or B-Book a trade?

| Criteria | Decision |

|---|---|

| Client Profitability/Risk Profile | A-Booked for Profitable Clients |

| Trade Size | A-Booked for Large Trades |

| Market Conditions | A-Booked during High Volatility |

This dynamic approach provides brokers with immense flexibility. It allows them to balance the transparency and risk mitigation benefits of the A-Book with the potential profitability and execution speed advantages of the B-Book. By intelligently routing orders, the broker can optimize both their risk exposure and their revenue streams.

The Hybrid model requires even more sophisticated technology than a pure A-Book or B-Book. The liquidity bridge needs to aggregate feeds from multiple LPs (for A-Booking), manage the internal risk book (for B-Booking), and have the logic to route orders instantaneously based on predefined rules or real-time analysis. Platforms like Brokeree Liquidity Bridge or components within systems like B2TRADER facilitate these complex operations, integrating with trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

The conversation around A-Book and B-Book models is intimately linked to the concept of Liquidity Providers (LPs) and, at a higher level, Prime Brokers and Prime of Prime (PoP) brokers. For an A-Book model to function effectively, a broker needs access to deep, consistent liquidity – meaning there are always parties willing to buy and sell the assets at competitive prices. This liquidity comes from LPs.

Traditionally, only the largest financial institutions (tier-one banks) could access the interbank market directly through relationships with Prime Brokers. Prime Brokers provide credit lines and clearing services, allowing institutions to trade large volumes with multiple counterparties without needing individual credit relationships with each one. This was beyond the reach of most retail Forex brokers due to capital requirements, regulatory hurdles, and complex onboarding processes.

This is where Prime of Prime (PoP) brokers emerged. PoPs are financial institutions that have secured relationships with one or more Prime Brokers and can then offer aggregated liquidity and clearing services to smaller institutions, including retail FX/CFD brokers. Think of a PoP as a wholesaler of liquidity, breaking down the massive liquidity pool accessed via a Prime Broker into smaller, more accessible packages for other brokers.

PoPs themselves operate with variations of the A-Book and B-Book concepts in their relationships with the brokers they serve. An A-Book PoP would provide access to external market liquidity, passing the broker’s flow directly onto their underlying Prime Broker relationships (assuming the flow fits the criteria). The retail broker using an A-Book PoP would pay a commission or markup based on volume, similar to a standard A-Book relationship.

However, a significant number of PoPs operate on a B-Book PoP model. In this setup, the PoP enters into a revenue-sharing agreement with the retail broker. The retail broker sends *all* its client flow to the B-Book PoP. The PoP B-Books this flow internally, becoming the counterparty to the retail broker’s aggregated client book. The PoP then shares a percentage of the net B-Book profit (primarily derived from client losses) back with the retail broker. This allows the retail broker to offload their B-Book risk entirely to the PoP and focus on client acquisition, while the PoP manages the aggregated risk of many retail brokers’ B-Booked flow.

While B-Book PoPs offer convenience and risk offloading for retail brokers, these relationships can become strained, especially during periods of significant, widespread client profitability or extreme volatility that causes large losses for the PoP. Disputes over payouts or trading conditions can arise, as seen in past market events impacting various asset classes like Bitcoin during sharp moves or individual stocks like Nvidia experiencing rapid parabolic surges and corrections.

Access to diversified liquidity sources, whether directly via multiple LPs in a pure A-Book setup or aggregated through a reputable PoP, is paramount for any broker aiming to provide consistent, competitive pricing and reliable execution, particularly when market volatility spikes. For you, the trader, understanding that your broker’s pricing and execution quality depend heavily on *their* liquidity arrangements is crucial.

Market volatility is an ever-present factor in Forex and CFD trading. Whether it’s driven by economic data releases, geopolitical events, or unexpected news impacting assets like the Canadian dollar (CAD), Australian dollar (AUD), or specific equities, volatility can significantly impact broker operations, regardless of the underlying model.

| Broker Type | Impact of High Volatility |

|---|---|

| A-Book Broker |

|

| B-Book Broker |

|

The key takeaway here is the absolute necessity of sophisticated and robust risk management systems for any broker. For A-Book brokers, risk management focuses on managing LP relationships, technology stability, and operational risk. For B-Book and Hybrid brokers, it’s a complex combination of internal exposure management, hedging strategies in the external market, and utilizing technology to dynamically route trades and monitor aggregate risk in real-time. Events like the Swiss Franc crisis or flash crashes in various markets underscore how quickly poor risk management can lead to catastrophic losses for a broker, potentially impacting client funds.

A well-managed broker, regardless of their model, will prioritize risk control. For B-Book brokers, this might involve setting exposure limits for specific instruments or clients and hedging a portion of their B-Booked trades in the external market when the aggregated risk becomes too high. For Hybrid brokers, it’s about intelligently routing flow based on their assessment of risk and profitability. For you, the trader, understanding that your broker has the capability and expertise to navigate volatile market conditions is a crucial factor in assessing their trustworthiness and long-term viability.

The decision for a brokerage to operate primarily as an A-Book, B-Book, or Hybrid entity is a multifaceted strategic choice, not a simple flick of a switch. Several critical factors weigh into this decision:

| Factor | Influence on Model Selection |

|---|---|

| Regulatory Environment | Impact on model flexibility and oversight. |

| Available Capital | Higher requirements for A-Book establishability. |

| Target Market | Different models attract different trader profiles. |

Ultimately, the choice of model reflects a broker’s strategic positioning, risk appetite, and operational capabilities. There is no single “best” model universally; the optimal choice depends on the specific circumstances and goals of the brokerage. However, from a trader’s perspective, the model significantly influences the trading environment they will encounter.

As a trader, understanding the broker’s model isn’t just academic; it has direct implications for your daily trading activities and long-term success. Here’s how the model can affect you:

- Spreads and Costs: An A-Book broker typically offers tighter, variable spreads plus a commission or markup. A B-Book broker often offers wider, fixed spreads. Your trading strategy dictates which cost structure is preferable. High-frequency traders or scalpers usually benefit from tighter, variable spreads. Traders using longer timeframes might prefer the predictability of fixed spreads, even if wider.

- Execution Quality: While B-Book brokers *can* offer very fast internal execution, the risk of requotes or intentional slippage (though regulated against) due to the conflict of interest is a concern for some. A-Book brokers offer execution speed dependent on their LP connections and technology; while external routing adds a theoretical step, it removes the broker’s incentive to manipulate execution.

- Potential Conflict of Interest: Trading with a B-Book broker means your success is their loss on internalized trades. While regulators aim to prevent abuse, the inherent conflict exists. With an A-Book broker, this conflict is largely removed, potentially fostering greater trust.

- Depth of Market/Liquidity: A-Book brokers connecting to multiple tier-one LPs can often provide better depth of market visibility and handle larger trade sizes more smoothly. B-Book brokers’ capacity is limited by their internal risk management capabilities before they need to hedge.

- Stop Loss and Take Profit Execution: With a B-Book broker, your stop loss/take profit orders are triggered and filled by the broker internally. With an A-Book broker, they are executed in the external market at the best available price offered by LPs once your trigger price is hit. This can affect slippage outcomes, especially in volatile markets.

Knowing the model helps you evaluate a broker beyond just their promotional offers. It encourages you to ask questions about where their liquidity comes from, their execution policy, and how they manage risk. Reputable brokers, regardless of model, should be transparent about their operations, even if they use a Hybrid approach.

If you’re navigating the choices for your trading platform and considering options for Forex and CFDs, exploring platforms like MT4, MT5, and Pro Trader is a key step. Brokers supporting these platforms, often combined with advanced risk management and liquidity solutions, can offer robust trading environments. In this space, the flexibility and technological integration offered by platforms like Moneta Markets, which supports MT4, MT5, and Pro Trader, are certainly worth considering. Their approach aims for a balance, offering competitive conditions often associated with well-managed liquidity and execution capabilities.

Understanding broker models also highlights the vital role of regulatory bodies. Strong regulatory frameworks are designed to protect traders by ensuring brokers operate fairly, maintain sufficient capital, and handle client funds securely (often through segregated accounts). Regulators impose rules aimed at mitigating the risks inherent in the B-Book model, such as prohibiting price manipulation, requiring robust risk management systems, and mandating transparency about execution policies.

Choosing a broker regulated by a reputable authority (like ASIC in Australia, the FCA in the UK, CySEC in Cyprus, FSCA in South Africa, etc.) provides an essential layer of trust and security, regardless of the specific model they employ. Regulatory oversight helps ensure that brokers, even those B-Booking trades, adhere to strict standards of conduct and have mechanisms in place to handle client funds and manage their business responsibly, even in challenging market conditions.

For traders prioritizing security and global market access, selecting a Forex broker with strong multi-jurisdictional regulation is paramount. If you are looking for a broker with robust regulatory backing, Moneta Markets holds multiple regulations including FSCA, ASIC, and FSA. Their commitment to client fund segregation and providing services like free VPS and 24/7 multilingual customer support reflects a comprehensive approach to client support and security, which are critical considerations alongside the operational model.

While regulation cannot eliminate all risks, it establishes a baseline of expected conduct and provides avenues for recourse if disputes arise. Always verify a broker’s regulatory status and understand what protections are afforded to you under that specific jurisdiction’s framework. This due diligence is just as important as understanding their operational model.

The journey through the A-Book, B-Book, and Hybrid broker models reveals a complex but fascinating aspect of the financial markets. We’ve seen how these models fundamentally shape a broker’s operations, revenue streams, and relationship with you, the trader. The A-Book model offers transparency and avoids conflict of interest by connecting you directly to external liquidity. The B-Book model, while potentially offering faster execution and fixed spreads, introduces a conflict of interest as the broker becomes your counterparty, profiting from your losses.

The Hybrid model represents an evolutionary step, providing brokers with the flexibility to dynamically manage risk and optimize profitability by strategically routing trades. This approach, while sophisticated, relies heavily on robust technology and skilled risk management to be implemented effectively. Furthermore, the world of Prime of Prime brokers adds another layer, illustrating how liquidity access and risk offloading play a crucial role in the broker ecosystem.

For you, the trader, this knowledge is power. It enables you to look beyond marketing pitches and understand the underlying mechanics of your broker. It helps you evaluate their potential strengths and weaknesses, assess the likelihood of encountering conflicts of interest, and understand why spreads or execution might behave in a certain way. While the specific model a broker uses is not the *only* factor to consider – regulation, platform stability, customer service, and trading costs are equally vital – it is a foundational piece of the puzzle.

Making an informed decision about your broker requires careful consideration of their operational model in conjunction with these other factors. Ask questions, read reviews, and ideally, choose a broker that is transparent about their practices and regulated by a reputable authority. By understanding how your broker operates, you take a significant step towards navigating the trading landscape with greater confidence and clarity, better positioning yourself for a sustainable and potentially profitable trading journey.

b book brokerFAQ

Q:What is the primary revenue source for B-Book brokers?

A:B-Book brokers primarily generate revenue from client losses on internalized trades and by earning from the spreads paid by clients.

Q:How do A-Book brokers ensure transparency in pricing?

A:A-Book brokers ensure transparency by sourcing prices directly from external liquidity providers, reflecting true market conditions.

Q:What is a potential drawback of the B-Book model?

A:A significant drawback of the B-Book model is the inherent conflict of interest, as the broker directly profits from client losses.