“`html

Unlocking Market Secrets: A Comprehensive Guide to Technical Analysis for Traders

Embarking on the journey of trading can feel like navigating a vast, unpredictable ocean. You see prices fluctuating, news headlines flashing, and it’s easy to feel overwhelmed. How do you make sense of it all? How do you decide when to buy or sell? For many, the answer lies in understanding the language of the market itself – a language spoken through charts and data points known as technical analysis.

Technical analysis isn’t a crystal ball, but rather a framework for studying historical price action and volume to forecast future price movements. It’s based on the fundamental premise that market prices reflect all available information. By examining charts, you can identify patterns, trends, and signals that suggest potential future direction. Think of it like studying weather patterns; past conditions and trends can give you insights into what might happen next, though they don’t guarantee it.

As you delve deeper, you’ll discover that technical analysis provides a structured way to approach trading decisions. It helps you define entry points, exit points, and manage risk. It empowers you to make decisions based on objective criteria derived from market data, rather than emotion or speculation.

In this guide, we’ll walk together through the core principles and tools of technical analysis. We’ll explore different chart types, essential concepts like support and resistance, and introduce you to powerful indicators that can help you identify opportunities. Whether you’re just starting out or looking to refine your trading strategy, understanding technical analysis is a crucial step towards navigating the markets with greater confidence.

The philosophical underpinnings of technical analysis are essential to comprehend before diving into specific tools. They represent the worldview of a technical trader.

The first, and perhaps most important, tenet is that market prices discount everything. This means that the current price of an asset already reflects all known information – supply and demand, fundamental factors, political events, market psychology, and more. If a company has groundbreaking news, the price will likely react quickly to incorporate that information. If there’s a shift in global economic sentiment, it will show up in market movements. A technical analyst believes they don’t need to know *why* the price is moving; they only need to observe *how* it is moving.

Consider a stock price. It’s not just determined by the company’s earnings or the industry outlook. It’s also influenced by how people *feel* about those earnings, how much they’re willing to pay, competing investment opportunities, and even rumors. Technical analysis posits that all these complex, often invisible factors are consolidated into the price displayed on your chart. Therefore, studying the price action itself is the most direct route to understanding the market’s collective assessment.

The second tenet is that prices move in trends. Markets don’t typically move randomly in straight lines up or down. Instead, they tend to move in discernible directions for periods of time. These trends can be upward (uptrends), downward (downtrends), or sideways (sideways or ranging markets). Identifying and trading with the prevailing trend is a central goal of many technical strategies.

Think about a ship at sea. While the waves might move erratically in the short term, the ship itself is moving in a specific direction towards its destination. Similarly, market prices might have daily volatility, but over weeks or months, a clear directional bias often emerges. Recognizing whether an asset is trending up, down, or sideways helps you align your trading decisions with the dominant market force. Ignoring the trend is often akin to trying to paddle upstream against a strong current.

The third tenet is that history tends to repeat itself. This doesn’t mean the market follows a perfectly predictable cycle, but rather that crowd psychology and market behavior patterns reappear over time. Human emotions like fear, greed, and hope influence trading decisions, and these emotions tend to manifest in consistent ways on price charts. Patterns that worked in the past often retain their significance because they reflect recurring investor behavior.

For instance, if a stock price repeatedly fails to break above a certain level, traders might start to anticipate resistance at that point, and their collective selling activity there can reinforce the pattern. Conversely, if a price bounces off a specific level multiple times, traders might see it as a buying opportunity, creating support. Recognizing these recurring patterns, whether they are specific chart formations or the behavior of indicators at certain levels, provides potential trading opportunities. It’s not about predicting the future with certainty, but about identifying probabilities based on historical market reactions.

Before you can analyze historical data, you need to understand how that data is presented. Charts are the foundation of technical analysis, and different types offer varying levels of detail and visual clarity.

The most basic chart type is the line chart. This chart simply connects the closing prices of an asset over a given period. It provides a clear, uncluttered view of the general trend, making it easy to see the overall direction of price movement. However, it doesn’t show the price range within each period (high, low, open), which limits its usefulness for detailed analysis.

Next, we have the bar chart. A bar chart provides more information for each period (e.g., day, hour, minute). Each vertical bar represents one trading period and shows four key price points: the high (top of the bar), the low (bottom of the bar), the opening price (horizontal tick on the left of the bar), and the closing price (horizontal tick on the right of the bar). Bar charts offer a more complete picture of price action within each period, allowing you to see the volatility and the relationship between open and close.

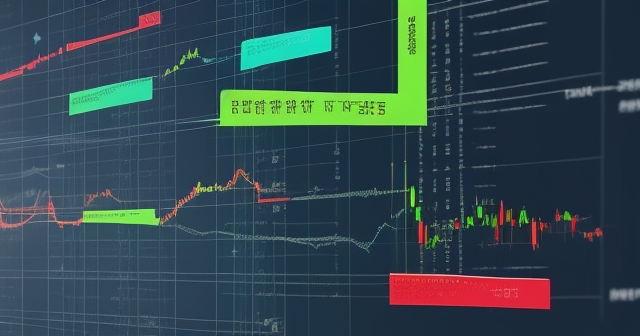

However, the chart type favored by most traders, particularly in currency and commodity markets, is the candlestick chart. Originating in 18th-century Japan, candlestick charts provide the same four price points as bar charts (open, high, low, close) but present the information in a much more intuitive and visually striking way. Each candlestick consists of a “body” and “wicks” or “shadows”.

The body represents the range between the opening and closing prices. If the close is higher than the open, the body is typically colored green or white, indicating a bullish period. If the close is lower than the open, the body is usually colored red or black, indicating a bearish period.

The wicks (or shadows) extend above and below the body. The upper wick shows the highest price reached during the period, and the lower wick shows the lowest price reached. The length and position of the body and wicks can provide quick visual cues about the strength of the buying or selling pressure during that period.

- A long green body with short wicks might suggest strong buying pressure.

- A long red body with short wicks might indicate strong selling pressure.

- Small bodies with long wicks (like Doji or Spinning Tops) often signal indecision or a potential turning point.

Why are candlesticks so popular? They are rich in visual information at a glance and lend themselves to identifying specific patterns, known as candlestick patterns, which can provide insights into market sentiment and potential reversals or continuations. We’ll touch upon some basic candlestick principles as we discuss chart patterns.

One of the most fundamental concepts in technical analysis is identifying support and resistance levels. These are price levels on a chart where the price has historically tended to pause, consolidate, or reverse direction.

Support is a price level where a downtrend is expected to pause due to a concentration of buying interest. Imagine the price falling. As it reaches a support level, buyers who believe the asset is now undervalued step in, overwhelming the sellers and potentially causing the price to stop falling or even bounce back up. Think of it as a “floor” for the price.

Resistance is the opposite – a price level where an uptrend is expected to pause due to a concentration of selling interest. As the price rises and approaches a resistance level, sellers who may have bought at lower prices, or those who believe the asset is now overvalued, become dominant, potentially causing the price to stop rising or even reverse downwards. This is like a “ceiling” for the price.

Why do these levels exist? They often represent areas where significant numbers of buyers or sellers made decisions in the past. For instance, if a price reversed sharply lower from $100 previously, traders who saw that might place sell orders near $100 again, creating resistance. If the price bounced strongly from $80 before, buyers might place buy orders there, creating support.

These levels are not exact lines but rather zones. Price often hesitates around these areas rather than stopping precisely at a single number. The more times a price level has acted as support or resistance, and the more significant the price reversal at that level, the stronger the level is considered to be. A level tested multiple times over a long period is generally more significant than a level tested only once briefly.

What happens when a support or resistance level is broken? A break above resistance is often seen as a bullish signal, suggesting that the buying pressure was strong enough to overcome the previous ceiling. This broken resistance level can then act as new support for future price pullbacks. Conversely, a break below support is often seen as a bearish signal, suggesting that selling pressure was strong enough to push through the floor. This broken support level can then act as new resistance for future price rallies.

Identifying support and resistance is crucial because these levels can provide potential entry and exit points. You might look to buy near support (expecting a bounce) or sell near resistance (expecting a reversal). Alternatively, you might wait for a convincing break of a level and trade in the direction of the breakout. Understanding these boundaries is a cornerstone of building a trading strategy based on technical analysis.

For traders looking to apply these concepts across a wide range of instruments, whether it’s forex pairs, indices, or commodities, finding a platform that provides robust charting tools and access to diverse markets is key.

As we discussed, prices tend to move in trends. Trend lines and channels are graphical tools that help us visually identify and follow these trends.

A trend line is a straight line drawn on a chart connecting a series of price points to illustrate the direction of a trend.

- In an uptrend, you draw a trend line by connecting two or more rising lows. This line acts as dynamic support. The price tends to bounce off this line as it moves higher. A valid uptrend line requires at least two rising lows, but a third touch confirms its significance.

- In a downtrend, you draw a trend line by connecting two or more falling highs. This line acts as dynamic resistance. The price tends to be pushed back down from this line as it moves lower. A valid downtrend line requires at least two falling highs, with a third touch for confirmation.

The steeper the trend line, the stronger or more aggressive the trend. A break of a trend line can signal a potential change in trend direction or a weakening of the current trend. A convincing break below an uptrend line might suggest the uptrend is over, while a break above a downtrend line might indicate a potential reversal to an uptrend.

A channel is formed by drawing a second, parallel line to the trend line. This parallel line is drawn across the highs in an uptrend (forming the upper resistance boundary) or across the lows in a downtrend (forming the lower support boundary). The area between the two parallel lines is the channel, which contains most of the price action during the trend.

- In an ascending channel (uptrend), the price moves upwards between parallel support and resistance lines.

- In a descending channel (downtrend), the price moves downwards between parallel resistance and support lines.

- In a horizontal channel (sideways market), the price moves back and forth between roughly horizontal support and resistance lines.

Trading within a channel involves buying near the lower boundary (support) and selling near the upper boundary (resistance), assuming the channel will hold. A break of a channel boundary, particularly the side opposite to the trend, is a stronger signal of a potential trend change than just a break of a trend line. For example, a break above the upper resistance line of an ascending channel is a very bullish signal, suggesting the uptrend might be accelerating. Conversely, a break below the lower support line of an ascending channel is a bearish signal, potentially indicating a trend reversal.

Trend lines and channels are simple yet powerful tools for visualizing market direction and identifying potential trading opportunities at the boundaries. They help you stay aligned with the dominant market force and provide reference points for entries and exits.

Beyond single candlesticks or simple lines, prices often form more complex geometric shapes on charts. These chart patterns are believed to reflect recurring market psychology and can provide clues about potential future price movements. They are broadly categorized into two types: reversal patterns, which suggest a trend is about to change direction, and continuation patterns, which suggest the current trend is likely to continue after a brief pause.

| Reversal Patterns | Description |

|---|---|

| Head and Shoulders: | This well-known reversal pattern forms three peaks: one central peak (the “head”) and two lower peaks (the “shoulders”). A break below the neckline suggests a bearish reversal. |

| Double Top: | Formed after two price peaks at roughly the same level, signaling a potential bearish reversal when the price breaks below the support level formed by the trough between the peaks. |

| Double Bottom: | Consists of two troughs at similar levels, indicating a potential bullish reversal when the price breaks above the resistance level formed by the peak between the troughs. |

Identifying and interpreting these patterns requires practice, but they offer valuable insights into market sentiment and potential future price action. The “measured move” concept is often applied to these patterns, where the potential price target after a breakout is estimated based on the height of the pattern itself (e.g., the distance from the head to the neckline in a Head and Shoulders pattern projected from the breakout point).

While chart patterns and support/resistance are based directly on price action, technical indicators are mathematical calculations based on price, volume, or both. They are typically displayed below or overlaid on the price chart and are used to generate trading signals, confirm trends, or identify overbought/oversold conditions.

There are hundreds, if not thousands, of technical indicators available. However, most fall into a few core categories:

- Trend-Following Indicators: These indicators help identify and follow the direction of the prevailing trend. Examples include Moving Averages and Bollinger Bands.

- Momentum Indicators: Measure speed and strength of price movement, helping identify potential reversals or confirm trends. Examples include RSI, MACD, and Stochastics.

- Volume Indicators: Provide insights into conviction behind price movements. Examples include On-Balance Volume (OBV) and Volume bars.

- Volatility Indicators: Measure the degree of price fluctuation. Examples include Average True Range (ATR) and Bollinger Bands.

Effective risk management should be a critical part of your trading plan, and technical analysis plays a crucial role in identifying where to set stop-loss orders, understanding potential reversal points, and calculating the risk/reward ratio for each trade.

Protecting Your Capital: Risk Management with Technical Analysis

In trading, protecting your capital is paramount. No matter how skilled you become at analyzing charts, losing trades are inevitable. Effective risk management isn’t about avoiding losses entirely, but about minimizing them so that your winning trades can outweigh your losing ones over time. Technical analysis plays a crucial role in implementing sound risk management.

Here are important concepts and strategies for incorporating risk management into your trading:

| Risk Management Strategy | Description |

|---|---|

| Position Sizing: | Determine the appropriate amount of capital to risk on each trade based on your total trading capital and the distance between your entry price and stop-loss price. |

| Stop-Loss Orders: | Automatically exit a position if the price reaches a specified level, minimizing potential losses. Set based on technical levels such as support and resistance. |

| Risk/Reward Ratio: | Assess the potential profit vs. potential loss before entering a trade. Aim for a favorable risk/reward ratio (e.g., 1:2 or higher) to ensure profitability over time. |

Technical analysis provides the framework for placing your risk management tools (stop-losses, targets) logically on the chart, ensuring your trading is disciplined and protects your precious capital.

The Human Element: Psychological Aspects of Trading

Even with the best technical analysis skills and a meticulously crafted trading plan, success can be elusive if you don’t manage your own psychology. Trading involves dealing with real money and potential losses, which naturally triggers powerful emotions like fear, greed, frustration, and hope. Mastering your mindset is just as important as mastering chart patterns.

How do emotions impact your trading?

- Fear: Can cause hesitations and impulsive actions leading to missed opportunities or premature exits.

- Greed: May lead to holding onto trades too long, risking profits or taking excessive risks.

- Frustration: Could result in revenge trading, deviating from your plan.

- Hope: Can prevent you from cutting losses, waiting for trades to recover beyond reasonable limits.

Technical analysis helps combat these emotional pitfalls by providing objective criteria for decision-making. Your trading plan, grounded in technical analysis, serves as a rulebook to follow, helping you remove subjective emotions from the equation.

Assembling Your Trading Toolkit: Resources for Technical Analysis

To further enhance your technical analysis skills, consider the following resources and practices:

- Books on Trading and Technical Analysis: Explore literature that delves into both theory and practical application of technical analysis.

- Online Courses and Tutorials: Many platforms offer comprehensive courses tailored to different skill levels, from beginner to advanced.

- Trading Simulators and Demo Accounts: Practice trading with virtual money to test your strategies without financial risks.

- Engage with Trading Communities: Participate in forums and social media groups to exchange insights and experiences with other traders.

- Regularly Review and Adapt: Continuously analyze your trades and adapt your strategies based on experiences and market changes.

Your journey in trading involves constant learning and adjustment. With patience, commitment, and effective use of technical analysis, you can navigate the financial markets more confidently and successfully.

samoan tālāFAQ

Q:What is technical analysis?

A:Technical analysis is a method for forecasting price movements by analyzing historical price data and volume, typically through the use of charts.

Q:How can I identify support and resistance levels?

A:Support and resistance levels can be identified by looking for price levels where prices have historically reacted, including previous highs and lows on charts.

Q:What are candlestick patterns?

A:Candlestick patterns are formations created by individual candlesticks on a chart, which can provide information about market sentiment and potential price reversals or continuations.

“`