Mastering Market Volatility: A Practical Guide to Using Bollinger Bands

Welcome, fellow explorers of the financial markets! Technical analysis offers us incredible tools to understand the complex dance of price movements. Among these, the **Bollinger Bands** stand out as a remarkably dynamic indicator, capable of revealing not just the direction of a trend, but also the very pulse of market volatility. If you’re new to technical indicators or looking to deepen your understanding of how professional traders gauge market conditions and identify potential opportunities, you’ve come to the right place.

Developed by the esteemed technical analyst **John Bollinger** in the 1980s, Bollinger Bands provide a visual representation of price volatility relative to a moving average. Unlike indicators that merely smooth price data, Bollinger Bands adapt to changing market conditions, widening during periods of high volatility and contracting during quieter times. Think of them as a flexible envelope around the price, showing you the expected range of movement based on recent price action.

Our journey together will unravel the mystery behind this powerful tool. We’ll break down its components, learn how to interpret its signals, explore practical trading strategies, and understand its limitations. By the end, you should feel confident in applying Bollinger Bands to your own analysis, enhancing your ability to make informed trading decisions. Ready to dive in?

Decoding the Structure of Bollinger Bands: The Core Components

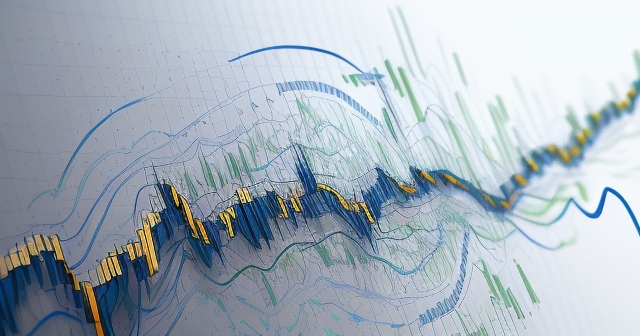

At its heart, a set of Bollinger Bands is comprised of three distinct lines plotted directly onto a price chart. Understanding what each line represents and how they are calculated is fundamental to using the indicator effectively. This isn’t just theoretical knowledge; it’s the foundation upon which all interpretations and strategies are built. So, let’s dissect these components one by one.

The central element is typically a **Simple Moving Average (SMA)**. This middle line acts as a baseline or a measure of the intermediate-term trend. The most commonly used setting is a 20-period SMA, meaning it plots the average closing price over the last 20 price bars (which could be minutes, hours, days, or weeks, depending on the chart timeframe you’re using). The SMA provides a smoothed representation of price, helping filter out random noise.

Flanking the middle band are the two outer bands: the **Upper Bollinger Band** and the **Lower Bollinger Band**. These bands are dynamic, meaning their distance from the middle band is not fixed. Instead, they are calculated using a measure of volatility called **standard deviation**. Specifically, the Upper Band is typically placed two standard deviations *above* the SMA, and the Lower Band is placed two standard deviations *below* the SMA.

- (1) Bollinger Bands adapt to market volatility by widening during high volatility and narrowing during calm conditions.

- (2) The Upper and Lower Bands are calculated based on the standard deviation of prices from their moving average.

- (3) Changes in volatility are visually evident as the bands expand or contract, providing important insights for traders.

Why standard deviation? This is where the genius of Bollinger Bands lies. Standard deviation quantifies the dispersion or variability of data points around their average. In the context of financial prices, a higher standard deviation means prices are spread out further from the moving average – indicative of high volatility. A lower standard deviation means prices are clustered closer to the average – indicative of low volatility.

By using standard deviation, the outer bands automatically widen when the market is choppy or trending strongly with large price swings, and they narrow when the market is calm and consolidating. This dynamic nature is what makes Bollinger Bands such a powerful tool for assessing market conditions in real-time. It’s like having a market volatility meter built right into your price chart.

Understanding the Three Lines: Middle, Upper, and Lower

Let’s look more closely at the role each of the three lines plays in market analysis. While they work together as a system, each band provides unique information that contributes to the overall picture. Mastering their individual interpretations is key to unlocking the full potential of Bollinger Bands.

-

The Middle Band (SMA): As mentioned, this line represents the average price over a specific period. Its primary role is to show the intermediate-term trend. When the price is consistently above the middle band and the band is sloping upwards, it suggests an **uptrend**. Conversely, when the price is consistently below the middle band and it’s sloping downwards, it indicates a **downtrend**. During periods of consolidation or sideways movement, the price will often oscillate around the middle band, and the band itself will tend to flatten out.

The middle band can also act as a potential support or resistance level, particularly after the price has moved significantly towards one of the outer bands and then reverses back towards the center. A break of the middle band can sometimes signal a potential shift in the short-term trend.

-

The Upper Band: This band is typically positioned two standard deviations above the middle band. Think of it as a dynamic **resistance** level or an indicator of a potentially **overbought** condition. When the price reaches or pushes against the upper band, it suggests that the price is reaching an extreme level relative to its recent average and volatility. It doesn’t necessarily mean the price *will* reverse immediately, but it’s a signal to pay close attention, as the upward move might be losing steam or due for a pullback.

In a strong uptrend, price may “walk” along the upper band, indicating sustained momentum. However, a failure to stay above the upper band or a decisive move back inside the bands after touching it can be a significant bearish signal.

-

The Lower Band: Positioned two standard deviations below the middle band, the lower band serves as a dynamic **support** level or an indicator of a potentially **oversold** condition. When the price drops to or below the lower band, it suggests that the price has fallen to an extreme level relative to its recent average and volatility. This can signal that the selling pressure might be exhausting and a potential upward correction or bounce is likely.

In a strong downtrend, price may “walk” along the lower band, showing persistent selling pressure. However, a failure to stay below the lower band or a move back inside the bands after touching it can be a significant bullish signal.

| Bollinger Band | Description |

|---|---|

| Middle Band | The Simple Moving Average, typically set to 20 periods. |

| Upper Band | Two standard deviations above the middle band, indicating potential resistance. |

| Lower Band | Two standard deviations below the middle band, indicating potential support. |

Understanding the typical behavior of price relative to these three lines – bouncing between them, walking along them, or breaking out of them – is the key to interpreting Bollinger Bands for trading.

Bollinger Bands as a Dynamic Volatility Gauge

One of the most powerful aspects of Bollinger Bands is their ability to visually represent market volatility. As we discussed, this is thanks to the use of standard deviation in calculating the outer bands. The distance between the upper and lower bands directly correlates with the current level of market volatility.

When the market is experiencing high volatility, characterized by large price swings and uncertain direction, the standard deviation increases. This causes the Upper and Lower Bands to **widen** significantly, moving further away from the middle band. Think of it like a market taking a deep breath – expanding with energy and potential for big moves.

Conversely, during periods of low volatility, such as sideways consolidation ranges or calm trending phases with small price movements, the standard deviation decreases. This results in the Upper and Lower Bands **contracting** and moving closer together, squeezing towards the middle band. This is the market holding its breath, gathering energy for a potential future move.

Observing this expansion and contraction of the bands provides traders with invaluable context about the current market environment. Are we in a quiet period likely preceding a large move? Or are we in a volatile chop where quick reversals are common? The bands tell you. Trading strategies that work well in high volatility (like range trading between wide bands) may perform poorly in low volatility, and vice versa (breakout strategies thrive after low volatility). Bollinger Bands help you identify which environment you’re in.

This dynamic volatility measurement is a key differentiator from static envelopes that might use a fixed percentage away from a moving average. Bollinger Bands are constantly adjusting, giving you a more accurate real-time reading of the market’s “temperature.”

Identifying Trading Signals: Overbought, Oversold, and Mean Reversion

Now that we understand the components and how they reflect volatility, let’s explore how Bollinger Bands can generate potential trading signals. The most common interpretation revolves around the idea of **mean reversion**, which suggests that prices tend to return to their average (the middle band) after moving to an extreme (touching or crossing an outer band).

-

Touching or Crossing the Upper Band: When the price reaches or moves above the Upper Bollinger Band, it’s often interpreted as a signal that the asset may be **overbought** in the short term. This doesn’t guarantee a price drop, especially in a strong uptrend where prices can ride the band. However, in sideways or less volatile markets, it frequently precedes a pullback back towards the middle band. A common strategy is to consider selling or taking profits when price touches the upper band in a range-bound market.

-

Touching or Crossing the Lower Band: Conversely, when the price reaches or moves below the Lower Bollinger Band, it’s often interpreted as a signal that the asset may be **oversold**. Similar to the upper band, this isn’t a guaranteed buy signal, particularly in a strong downtrend. But in ranging or less volatile conditions, it often signals a potential bounce back towards the middle band. Buying or initiating a long position when price touches the lower band is a common strategy in range-bound markets.

-

Returning to the Middle Band: After touching or crossing an outer band, a move back towards the middle band is considered a natural price behavior – the “mean reversion.” The middle band often acts as a target level for trades initiated at the outer bands. For example, if you buy at the lower band, you might set your profit target at the middle band. A decisive break *through* the middle band can suggest that the mean reversion is gaining momentum and might continue towards the opposite outer band, or even signal a potential trend change.

| Signal Type | Interpretation | Action |

|---|---|---|

| Upper Band Bounce | Indicates potential overbought condition. | Consider selling or taking profits. |

| Lower Band Bounce | Indicates potential oversold condition. | Consider buying or initiating a long position. |

| Middle Band Break | Potential trend shift signal. | Reassess position or take action. |

It is absolutely crucial to remember that these signals are context-dependent. Touching a band in a strong trend means something different than touching a band in a sideways market. This highlights the need to use Bollinger Bands in conjunction with other forms of analysis, which we’ll discuss later.

The Power of the Bollinger Squeeze: Anticipating Big Moves

One of the most anticipated signals derived from Bollinger Bands is the **Bollinger Squeeze**. This phenomenon occurs when the Upper and Lower Bands contract dramatically, becoming very narrow and hugging the price tightly. It’s a visual representation of significantly reduced market volatility.

Why is a squeeze important? Because periods of low volatility are often followed by periods of high volatility. Think of it like compressing a spring: the more it’s squeezed, the more energy is built up, ready to be released. A Bollinger Squeeze suggests that the market is consolidating, building energy for a potential sharp move.

Identifying a squeeze doesn’t tell you the *direction* of the impending move, but it signals that a significant move is likely on the horizon. Traders who use the squeeze are anticipating a **breakout** – a strong price move that decisively breaks above the upper band or below the lower band after the period of low volatility.

The squeeze is often a precursor to major trend changes or continuations. A long period of consolidation (squeeze) followed by a strong breakout upwards can mark the beginning of a significant uptrend. Conversely, a breakdown below the lower band after a squeeze can signal the start or continuation of a downtrend.

| Market Condition | Implication | Next Steps |

|---|---|---|

| High Volatility | Widening bands indicate potential large moves. | Prepare for potential trades or adjustments. |

| Low Volatility (Squeeze) | Narrow bands indicate consolidation. | Watch for breakout opportunities. |

| Post-Breakout | New trend direction established. | Enter trades in direction of breakout. |

Trading the squeeze involves waiting for the market to decide its direction. Once a clear breakout occurs (often defined as a closing price outside the bands), traders might enter a position in the direction of the breakout, anticipating continued momentum as volatility expands. This requires patience, as the squeeze period can sometimes last longer than anticipated.

Practical Trading Strategies: The Bounce Strategy

Let’s delve into some actionable trading strategies using Bollinger Bands. One of the most straightforward is the **Bounce Strategy**, which is based on the principle of mean reversion we discussed earlier. This strategy works best in markets that are range-bound or moving sideways, rather than those in strong, persistent trends.

The core idea of the Bounce Strategy is to trade the expected move back towards the middle band after the price touches an outer band. It assumes that the outer bands act as dynamic support and resistance levels within a contained range.

Here’s how it typically works:

-

Identify Range-Bound Conditions: Look for markets where the Bollinger Bands are relatively flat and the price is oscillating between the upper and lower bands without sustaining moves outside them. The bands should not be significantly expanding or contracting (avoiding squeeze conditions).

-

Entry Signal (Buy): Wait for the price to touch or dip slightly below the **Lower Bollinger Band**. This is your potential buy signal, indicating an oversold condition within the current range. You might enter a long position here.

-

Entry Signal (Sell): Wait for the price to touch or push slightly above the **Upper Bollinger Band**. This is your potential sell signal, indicating an overbought condition within the current range. You might enter a short position here.

-

Setting Price Targets: The primary target for a bounce trade is typically the **Middle Bollinger Band**. This is where mean reversion suggests the price is likely to head. Some aggressive traders might target the opposite outer band, but the middle band is a more conservative and frequently achieved target.

-

Setting Stop-Losses: Risk management is paramount. For a buy signal at the lower band, a stop-loss should be placed slightly below the recent price low that touched the band, or perhaps a bit below the lower band itself. For a sell signal at the upper band, the stop-loss goes slightly above the recent price high that touched the band or above the upper band.

Practical Trading Strategies: The Breakout Strategy

In contrast to the Bounce Strategy, the **Breakout Strategy** utilizing Bollinger Bands thrives on periods of expanding volatility, typically following a **Bollinger Squeeze**. While the Bounce Strategy works in ranges, the Breakout Strategy targets the beginning of potential new trends or significant directional moves.

The core idea here is to identify the compression phase (the squeeze) and then trade in the direction of the eventual forceful move out of the narrow bands.

Here’s how the Breakout Strategy is often implemented:

-

Identify a Bollinger Squeeze: Look for periods where the Upper and Lower Bollinger Bands are visibly close together, indicating low volatility and consolidation. The longer and tighter the squeeze, the more significant the potential move might be.

-

Wait for the Breakout: Be patient. Do not trade during the squeeze itself. Wait for the price to make a decisive move and ideally **close** above the Upper Band (for a bullish breakout) or below the Lower Band (for a bearish breakout). Some traders require a certain number of consecutive closes outside the band or a certain percentage move to confirm the breakout and filter out false signals.

-

Entry Signal (Buy): Enter a long position on confirmation of a bullish breakout (price closing above the upper band after a squeeze).

-

Entry Signal (Sell): Enter a short position on confirmation of a bearish breakdown (price closing below the lower band after a squeeze).

-

Setting Price Targets: Unlike the bounce strategy, targets for a breakout can be more ambitious. They might involve using other technical analysis methods (like Fibonacci extensions, previous highs/lows, or chart patterns) or simply trailing your stop-loss as the trend develops. The expanding bands themselves often contain the price during the initial phase of the trend, with price riding along the outer band.

-

Setting Stop-Losses: For a bullish breakout, the stop-loss is typically placed just below the Upper Band or below the Middle Band at the time of the breakout. For a bearish breakdown, the stop-loss is placed just above the Lower Band or above the Middle Band. This helps limit losses if the breakout is false and the price reverses back into the range.

The Breakout Strategy is exciting because it targets potentially large, fast moves. However, it also carries the risk of **false breakouts**, where the price briefly moves outside the bands only to reverse quickly back inside. This is why confirmation and proper stop-loss placement are absolutely critical.

Using Bollinger Bands for Trend Following and Setting Targets

While Bollinger Bands are well-known for identifying potential overbought/oversold conditions and breakouts, they are also valuable tools for **trend following** and managing trades within an existing trend, including setting **price targets**.

In a strong trend, prices tend to behave in a specific way relative to the Bollinger Bands:

-

Strong Uptrend: Price will often hug or “walk” along the **Upper Bollinger Band**. Pullbacks, when they occur, often find support at the **Middle Bollinger Band**. The Lower Band acts as a dynamic, far-off support level.

-

Strong Downtrend: Price will often hug or “walk” along the **Lower Bollinger Band**. Rallies, when they occur, often find resistance at the **Middle Bollinger Band**. The Upper Band acts as a dynamic, far-off resistance level.

Knowing this, traders can use the bands to confirm trend strength. If price is consistently closing above the middle band and testing the upper band in an uptrend, the trend is likely healthy. If it starts struggling to reach the upper band or spends more time near or below the middle band, the uptrend might be weakening.

| Trend Type | Price Behavior |

|---|---|

| Uptrend | Price hugs the upper band and finds support at the middle band. |

| Downtrend | Price hugs the lower band and encounters resistance at the middle band. |

Furthermore, the bands can assist in setting price targets:

-

Targeting the Middle Band: As mentioned in the Bounce Strategy, the middle band is a common target after a move to an outer band. If you bought at the lower band, selling at the middle band captures the initial mean reversion move.

-

Targeting the Opposite Band: In stronger moves or trends, price might revert past the middle band towards the opposite band. For example, a strong bounce from the lower band might target the upper band, or a strong pullback from the upper band might target the lower band.

-

Using Outer Bands in Trends: In a strong trend where price is walking the outer band, a touch of the middle band can sometimes serve as a target for a pullback trade (e.g., selling a brief rally to the middle band in a downtrend) or as a re-entry point in the direction of the main trend.

The middle band also serves as a potential warning signal for trend reversal. If price in an established uptrend breaks decisively below the middle band, it could signal that the trend is reversing or entering a period of consolidation. Similarly, a break above the middle band in a downtrend could signal a shift.

Enhancing Bollinger Bands with Other Indicators

While Bollinger Bands are powerful, they are rarely used in isolation by experienced traders. No single indicator is perfect, and relying solely on one tool can lead to false signals and poor decisions. The true strength of technical analysis often lies in combining non-correlated indicators to confirm signals and build a more robust trading thesis.

Bollinger Bands are excellent at showing **volatility** and identifying **relative highs and lows** (overbought/oversold) within that volatility context. They are less effective at measuring momentum or providing definitive trend direction signals on their own, especially in choppy markets.

Therefore, combining Bollinger Bands with **momentum oscillators** or **trend-following indicators** can significantly improve signal reliability. Here are some common combinations:

-

Bollinger Bands + RSI (Relative Strength Index): RSI measures the speed and change of price movements to identify overbought (typically > 70) and oversold (typically < 30) conditions. Combining BB and RSI offers powerful confirmation. For example, a buy signal is stronger if price touches the Lower Bollinger Band AND RSI is below 30 (or showing bullish divergence). A sell signal is stronger if price touches the Upper Bollinger Band AND RSI is above 70 (or showing bearish divergence). This combination helps validate the overbought/oversold readings from the bands.

-

Bollinger Bands + MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator. It can be used to confirm the directional bias indicated by Bollinger Bands or provide entry/exit timing. For instance, a bullish breakout from a Bollinger Squeeze is more convincing if the MACD histogram is turning positive or a bullish MACD crossover has just occurred. A bearish signal from the Upper Band is stronger if the MACD is showing bearish divergence or a bearish crossover.

-

Bollinger Bands + Volume: Volume analysis is crucial for confirming the strength of price moves, especially breakouts. A breakout from a Bollinger Squeeze is much more reliable if it occurs on significantly higher volume. A false breakout often happens on low volume, indicating lack of conviction behind the move.

By requiring multiple indicators to align, you filter out weaker signals and increase the probability of successful trades. Think of each additional confirming indicator as adding another piece to the puzzle, increasing your confidence in the picture you’re seeing.

When choosing a platform to practice combining indicators, look for one that offers a wide range of technical tools and allows for detailed chart customization. The right platform empowers you to test different indicator combinations and see how they interact on real charts across various assets, like stocks, commodities, or currency pairs. For those interested in exploring platform capabilities for diverse instruments, considering a platform like Moneta Markets could be beneficial, given their support for multiple trading platforms like MT4, MT5, and Pro Trader, known for their analytical features and trading flexibility.

Limitations, False Signals, and Responsible Trading

As with any technical indicator, Bollinger Bands are not a crystal ball, and they have their limitations. Ignoring these can lead to costly mistakes. Acknowledging and understanding these drawbacks is part of becoming a responsible and skilled trader.

One of the primary limitations is the potential for **false signals**. Price can briefly poke outside the bands only to snap back quickly, trapping traders who acted too impulsively. This is particularly common during sudden news events or periods of very high volatility. The bands themselves use an SMA, which gives equal weight to all data points within its period and can be prone to lag, meaning signals might appear slightly after the optimal entry or exit point.

Furthermore, Bollinger Bands are most effective in certain market conditions (ranging or post-squeeze breakouts) and less so in others (strong, persistent trends where price just “walks” the band). Relying solely on band touches for reversals in a strong trend can lead to repeatedly trading against the dominant market force – a recipe for losses.

This underscores the absolute necessity of **risk management**. No signal, no matter how compelling, is guaranteed. Always use stop-losses to define your maximum acceptable loss on any single trade. Determine your position size based on your account equity and risk tolerance, ensuring that a single losing trade doesn’t significantly impact your overall capital. Never risk more than a small percentage of your account on any one position.

It’s also crucial to **backtest** any strategy involving Bollinger Bands on historical data before risking real capital. See how the strategy performed in various market conditions over time. Does the Bounce Strategy work reliably on your chosen asset in ranging markets? Does the Breakout Strategy yield positive results after squeezes? Backtesting helps you understand the potential profitability and risks based on past performance.

Finally, start with **practice accounts** (demo trading). This allows you to apply your knowledge of Bollinger Bands and test strategies in a risk-free environment using virtual money. Get comfortable with interpreting the bands, identifying signals, setting stops and targets, and managing trades before transitioning to live trading with real funds.

Responsible trading means understanding your tools, acknowledging their limitations, and always prioritizing the preservation of your capital through disciplined risk management.

Real-World Applications and Practice

Bollinger Bands are versatile and can be applied across a wide range of financial instruments and timeframes. Whether you trade stocks, commodities, cryptocurrencies, or forex, Bollinger Bands can provide valuable insights. They are particularly popular in **momentum trading** for identifying points where momentum might be peaking (near outer bands) or poised for expansion (after a squeeze).

Think about analyzing a chart like American Express (AXP) or Microsoft (MSFT). You could plot Bollinger Bands on a daily chart to understand recent volatility and potential reversal points or breakout opportunities. On an S&P 500 (SPX) index chart, the bands can show whether the broader market is reaching extremes or consolidating. In forex pairs like EUR/USD or GBP/JPY, the dynamic nature of the bands is invaluable for navigating their often volatile price action.

The key is practice. Open your charting software and add Bollinger Bands to your favorite assets and timeframes. Observe how price interacts with the bands in different market conditions. Look for examples of bounces, breakouts, squeezes, and trend-following behavior. Compare what the bands are telling you with other indicators you use, like RSI or MACD. Does the combination make sense?

Experiment with the settings. While 20 periods and 2 standard deviations are standard, different assets or timeframes might benefit from slight adjustments. However, always test any changes to ensure they add value. Remember, the goal is to enhance your understanding of price behavior, not to find a magical setting that guarantees profits.

By actively applying what you’ve learned, observing real-time price action, and reviewing past charts, you’ll develop the intuition needed to effectively incorporate Bollinger Bands into your trading toolkit. They are a powerful lens through which to view the market, but like any lens, they require skill and practice to use effectively.

If you’re ready to start applying these concepts or exploring various markets like forex with technical tools, finding a platform that supports comprehensive charting and analysis is essential. If you are currently evaluating brokerage options, Moneta Markets is known for providing a robust trading environment. They offer diverse trading instruments and platform choices suitable for implementing technical analysis strategies on different asset classes globally, backed by multi-country regulatory oversight, which can be a significant consideration for traders.

Conclusion: Bollinger Bands as a Key Tool in Your Arsenal

We’ve covered significant ground in understanding Bollinger Bands. We’ve seen how this innovative indicator, born from the insights of John Bollinger, goes beyond simple moving averages by incorporating the crucial element of market volatility through standard deviation. We’ve learned how the expansion and contraction of the bands vividly illustrate changing market conditions and how the price’s interaction with the upper and lower bands can signal potential overbought or oversold states.

We explored the fascinating Bollinger Squeeze, recognizing it as a powerful alert for impending large price movements, and discussed practical strategies for trading both bounces within ranges and breakouts following consolidation. Furthermore, we touched upon how the bands can aid in trend identification and the setting of logical price targets.

Crucially, we highlighted that no indicator should stand alone. The true power of Bollinger Bands is unlocked when they are combined with other technical tools, such as RSI or MACD, to gain confirmation and filter out less reliable signals. And perhaps most importantly, we stressed the non-negotiable importance of understanding the limitations of Bollinger Bands, being aware of false signals, and always practicing disciplined risk management.

Bollinger Bands are not a predictive tool that tells you exactly what price will do next. Instead, they are a sophisticated analytical tool that helps you understand the *context* of current price action – how volatile the market is, whether price is at a relative extreme, and whether energy is building for a significant move. By providing this context, they empower you to make more informed trading decisions.

Integrate Bollinger Bands into your charting and analysis process. Practice interpreting their signals on various assets and timeframes. Combine them with other tools you trust. With dedication and practice, Bollinger Bands can become an invaluable component of your technical analysis arsenal, helping you navigate the dynamic landscape of the financial markets with greater confidence and insight.

how to use bollinger bandsFAQ

Q:What are Bollinger Bands used for?

A:Bollinger Bands are used to measure market volatility and identify overbought or oversold conditions, helping traders make informed decisions.

Q:How do I interpret the signals from Bollinger Bands?

A:Signals include price touching the upper band (potential overbought) or lower band (potential oversold), and observing squeezes indicating possible upcoming volatility.

Q:Can I use Bollinger Bands with other indicators?

A:Yes, combining Bollinger Bands with other indicators like RSI or MACD enhances signal reliability and improves trading decisions.