Understanding Market Quotes: The Foundation of Trading

Welcome to a deep dive into the fundamental language of the financial markets: quotes. When you look at a trading screen, you see numbers flashing constantly. These aren’t just random figures; they represent the consensus price at which buyers and sellers are willing to transact. Understanding these quotes is absolutely critical, whether you’re looking at stocks, bonds, options, or even currencies. It’s the first step towards understanding how prices are formed and how your orders will actually be executed.

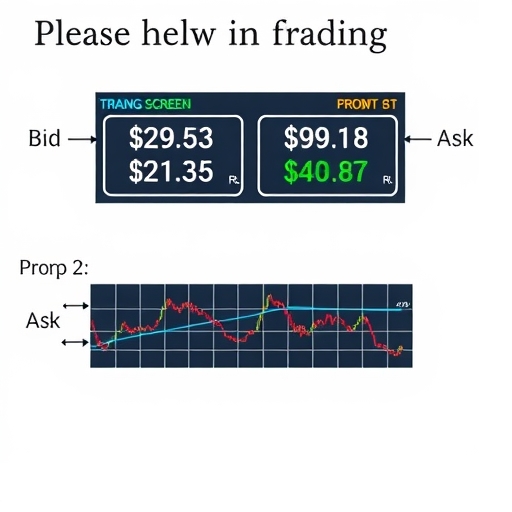

Think of a market quote as a snapshot of supply and demand at a specific moment. It tells us what the highest price a buyer is currently willing to pay is, and what the lowest price a seller is currently willing to accept is. These two prices, the bid and the ask (or offer), form the core of any market quote.

For new traders, it’s easy to just look at the “last traded price.” But solely focusing on the last price is like only looking at the finish line without understanding the race itself. The bid and ask, and the relationship between them, tell you much more about the current market conditions and the potential cost of entering or exiting a trade. As we explore market microstructure, you’ll see why paying close attention to these details is paramount for effective trading.

Understanding the bid-ask spread is essential for traders. Below are some key points regarding this concept:

- The bid-ask spread represents the transaction cost incurred when trading.

- A narrow spread indicates a more liquid market, while a wide spread suggests less liquidity.

- Market makers profit from the spread between the bid and ask prices.

| Spread Type | Description | Market Indicator |

|---|---|---|

| Narrow Spread | Indicates high liquidity and tight pricing. | High Trading Volume |

| Wide Spread | Indicates low liquidity or increased volatility. | Low Trading Volume |

The Bid-Ask Spread: Market’s Transaction Cost

At the heart of every market quote is the bid-ask spread. The bid price is the maximum price a buyer is ready to pay for an asset at a given time. The ask price is the minimum price a seller is willing to accept for the same asset at that same time. Naturally, the bid price is always lower than the ask price.

The difference between the ask price and the bid price is the bid-ask spread. This spread is essentially the transaction cost incurred when you trade immediately. If you want to buy right now, you’ll pay the ask price. If you want to sell right now, you’ll receive the bid price. The market maker, or the entity quoting these prices, profits from this spread.

Consider this analogy: Imagine you’re at a currency exchange counter. The counter has a price to buy USD from you (the bid) and a higher price to sell USD to you (the ask). The difference is their profit margin. In financial markets, market makers perform a similar function, providing liquidity by being ready to buy or sell at their quoted prices.

The size of the bid-ask spread is a crucial indicator of a market’s liquidity and efficiency. A narrow spread suggests high trading volume and many buyers and sellers, making it cheaper to trade. A wide spread can indicate low liquidity, higher volatility, or potentially a less efficient market, making it more expensive to execute trades immediately.

Why does the spread exist? It compensates market makers for the risk they take holding assets and for the service they provide in facilitating trades. Without market makers quoting both bids and asks, finding a counterparty for your trade would be much slower and more difficult. They are, in a sense, the lubricant of the financial engine.

Understanding the spread allows you to calculate the immediate cost of market orders and helps you decide whether to use market orders or limit orders. A market order executes immediately at the best available price (either the current bid or ask), incurring the spread. A limit order allows you to specify a price, potentially saving the spread but risking non-execution.

Introducing “Firm Quotes”: Beyond the Indication

Now, let’s refine our understanding of quotes by introducing a critical concept: the firm quote. In many markets, especially those involving professional traders and market makers, quotes are not just indicative; they represent a commitment to trade at the stated price for a specified size.

A quote typically consists of three pieces of information: the bid price, the ask price, and the size associated with each price. For example, a quote might appear as “10.50 – 10.60 (10×20)”. This means:

- The bid price is 10.50. This is the price at which a market maker is willing to buy.

- The ask price is 10.60. This is the price at which the market maker is willing to sell.

- The bid size is 10 (often representing 10 “round lots,” e.g., 1000 shares). The market maker is willing to buy up to 1000 shares at 10.50.

- The ask size is 20 (often representing 20 “round lots,” e.g., 2000 shares). The market maker is willing to sell up to 2000 shares at 10.60.

A firm quote means the market maker is legally obligated to honor the quoted price for the specified size (or better). If you place a market order to sell 500 shares, they must buy them from you at 10.50 (or higher, if a better bid exists elsewhere). If you place a market order to buy 1500 shares, they must sell you the first 2000 shares (since their ask size is 20) at 10.60 (or lower, if a better ask exists).

This “firmness” provides a level of certainty for traders. You know that for a certain quantity, you can execute your trade at the displayed price, removing the risk of the price changing unexpectedly before your order is filled within that size.

| Component | Explanation |

|---|---|

| Bid Price | Price at which a market maker will buy |

| Ask Price | Price at which a market maker will sell |

| Bid Size | Volume market maker is willing to buy at bid |

| Ask Size | Volume market maker is willing to sell at ask |

Why Firmness Matters: Understanding Execution Certainty

Why is the concept of a firm quote so important for traders, particularly those dealing with larger order sizes or operating in fast-moving markets? The answer lies in execution certainty and the mitigation of slippage.

Slippage occurs when your order is executed at a price different from the price you saw when you placed the order. This is especially common with market orders. If you place a market order to buy an asset, you expect it to be filled at the current ask price. However, if the market moves rapidly or if your order size exceeds the available quantity at the best ask price, your order might be partially or fully filled at worse prices.

For example, imagine the ask is 10.60 for a size of 20 (2000 shares). If you place a market order to buy 3000 shares:

- The first 2000 shares will likely be filled at the firm quote of 10.60.

- The remaining 1000 shares will need to find the next best available ask price in the market, which might be 10.61, 10.62, or even higher.

In this scenario, your average execution price for the 3000 shares will be higher than 10.60, representing slippage. The firmer the quote and the larger the quoted size, the less likely you are to experience slippage, at least for the quantity within the quoted size.

For institutional traders or those trading large blocks of shares, accessing markets with robust firm quotes is essential for minimizing transaction costs and executing strategies effectively. It provides predictability in execution price for substantial volumes.

Furthermore, in volatile periods, the difference between a firm quote and a merely indicative quote can be the difference between a profitable trade and a significant loss. Knowing that a market maker is committed to a price for a certain size allows traders to act with confidence, even when prices are fluctuating rapidly. Does this make sense? Consider how much more comfortable you’d be trading if you knew exactly the price you’d get for a significant portion of your trade.

Firm Quotes vs. Nominal Quotes: A Critical Distinction

It’s crucial to differentiate between a firm quote and a nominal quote (sometimes called an indicative quote). While both provide information about potential trading prices, their meaning and commitment are vastly different.

A nominal quote, as the name suggests, is purely an indication. It gives you an idea of where an asset might be trading, but there is no obligation from the party providing the quote to actually trade at that price or size. Think of it like seeing a “for sale” sign on a house with a price, but the owner hasn’t formally listed it or committed to selling it at that price yet. It’s just a rough estimate.

Nominal quotes are often used in illiquid markets, for complex or exotic financial instruments, or simply to provide a general market feel without the commitment of a firm quote. You might see nominal quotes for certain bonds, over-the-counter (OTC) derivatives, or even thinly traded stocks during off-hours.

In contrast, a firm quote is a binding offer. If you, as a qualified counterparty, accept the firm quote within the specified size, the market maker is obligated to trade with you at that price. This is the standard expectation in regulated, exchange-based markets for widely traded securities, like major stocks or liquid futures contracts.

The distinction is paramount for trading strategy and risk management. Basing a trading decision on a nominal quote carries the significant risk that the actual execution price will be nowhere near the quoted price, especially when you try to execute. Relying on firm quotes, however, provides a degree of price certainty up to the quoted size.

How can you tell if a quote is firm or nominal? In many professional trading platforms and market data feeds, quotes are explicitly labeled as “firm” or “indicative.” In regulated exchanges, quotes displayed on the central order book for standard sizes are generally assumed to be firm unless otherwise specified. However, for OTC markets or less standardized instruments, it’s always wise to clarify the nature of the quote. Never assume a quote is firm unless it’s explicitly stated or implied by the market structure.

Factors Influencing Quote Firmness and Spread

The degree of firmness in quotes and the size of the bid-ask spread are not static. They fluctuate constantly based on several key market factors. Understanding these influences helps you anticipate changes in transaction costs and execution quality.

-

Liquidity: This is perhaps the most significant factor. Highly liquid markets, where there are many buyers and sellers actively trading, typically have narrower bid-ask spreads and larger firm quote sizes. It’s easier for market makers to offset their positions quickly, reducing their risk and allowing them to quote tighter prices for greater quantities. Conversely, illiquid markets have wider spreads and smaller firm sizes (or only nominal quotes) because market makers face higher risk in finding a counterparty for their trades.

-

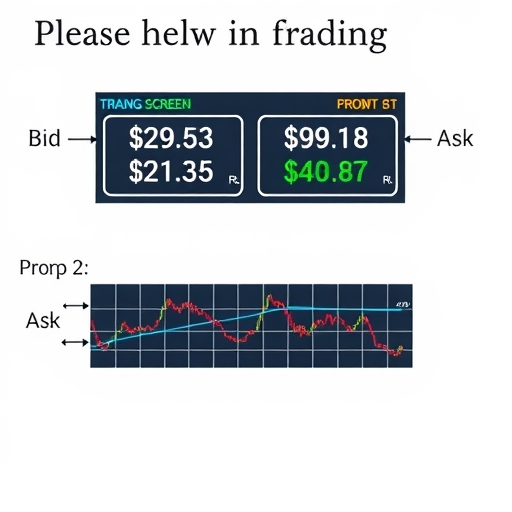

Volatility: When markets become volatile, prices are moving rapidly and unpredictably. This increases the risk for market makers. To compensate for this heightened risk, they will often widen their bid-ask spreads and reduce the size for which their quotes are firm. This protects them from significant losses if the market moves sharply against their position between the time they quote a price and the time the trade is executed.

-

Trading Volume: Similar to liquidity, higher trading volume generally corresponds to narrower spreads and larger firm sizes. High volume indicates active participation, making it easier and less risky for market makers to operate.

-

Time of Day: Spreads can widen during less active trading hours (e.g., overnight sessions for equity markets, or periods between major market opens). During peak hours, when multiple markets are open and trading activity is high, spreads tend to be tighter.

-

News and Events: Leading up to major economic announcements, earnings reports, or significant political events, markets often experience increased volatility and uncertainty. Market makers may widen spreads and reduce firm sizes in anticipation of potential large price swings.

-

Specific Asset Characteristics: Different asset classes inherently have different liquidity profiles. For example, major currency pairs in the forex market or highly-traded large-cap stocks typically have very tight spreads and substantial firm sizes compared to micro-cap stocks or illiquid corporate bonds.

-

Order Size: While firm quotes exist for specified sizes, attempting to trade quantities significantly exceeding the firm size will require sourcing liquidity beyond the best bid/ask, leading to potential slippage and a higher average execution price. Market makers may also adjust their quotes dynamically if they see very large orders entering the market.

Being aware of these factors helps you understand why the quotes you see are changing and how it might impact your trading costs. Trading during periods of high liquidity and low volatility generally results in better execution prices due to tighter spreads and larger firm sizes.

Quotes in Different Markets: Stocks, Bonds, Options, and Forex

The concept of quotes, including the bid, ask, spread, and firmness, applies across various financial markets, though the specifics can differ. Let’s explore how quotes function in some key markets:

-

Stock Markets: In major stock exchanges (like the NYSE or Nasdaq), quotes for listed stocks are generally firm up to specified sizes, often referred to as “round lots” (typically 100 shares) and possibly larger “block sizes” for institutional trades. The quotes you see on your trading platform for active stocks represent the National Best Bid and Offer (NBBO), which is the best available bid price and the best available ask price across all competing markets. For less liquid stocks, spreads can be wider, and the firm size might be smaller, or quotes might even be nominal in certain off-exchange contexts.

-

Bond Markets: The bond market is largely an Over-The-Counter (OTC) market, meaning trades occur directly between dealers rather than on a central exchange. Quotes for bonds, especially corporate and municipal bonds, are often nominal, particularly for less frequently traded issues or larger sizes. Dealers provide quotes based on their inventory and market conditions, but they may not be firm until you engage with the dealer to confirm the price and size. Highly liquid government bonds, like US Treasuries, trade in a more centralized electronic market with tighter spreads and greater firmness for standard sizes.

-

Options Markets: Quotes for options contracts also have bids and asks. The spread on options can be influenced by the liquidity of the underlying asset, the option’s strike price and expiration date (out-of-the-money and short-dated options often have wider spreads), and overall market volatility. While exchange-traded options have market makers providing firm quotes, the complexity of options pricing means the “firmness” might apply to a smaller size relative to the potential volume of trades, and rapid price changes in the underlying asset can cause option quotes to move quickly.

-

Forex (Foreign Exchange) Market: The forex market is the largest and most liquid financial market globally, also operating primarily OTC. Quotes for major currency pairs (like EUR/USD, GBP/USD, USD/JPY) typically have incredibly tight spreads, often just 1 or 2 “pips” (points in percentage). Because of the immense liquidity provided by major banks and financial institutions, quotes for standard sizes are effectively firm. Retail forex traders typically trade through brokers who aggregate quotes from multiple liquidity providers. While technically OTC, the competitive nature and high volume mean retail traders experience execution based on prices that are functionally very close to firm quotes for typical retail trade sizes.

If you’re exploring the possibility of trading currencies, understanding these quote dynamics in the forex market is essential. The tight spreads are a major attraction, but it’s still important to understand how your broker sources liquidity and what their execution practices are, especially during volatile news events where spreads can temporarily widen.

If you’re considering starting out in forex trading or looking for a platform with access to a wide range of instruments, understanding the quote mechanisms is your first step. You need a platform that provides reliable pricing and efficient execution. If you’re considering trying out forex or exploring other CFD products, then Moneta Markets is a platform worth considering. It originates from Australia and offers over 1000 financial instruments, suitable for both beginners and professional traders.

How Traders Use Quote Information: Strategy and Slippage Control

Experienced traders don’t just glance at the bid and ask; they use the quote information strategically to inform their trading decisions and manage execution risk. Here’s how quote dynamics play into trading strategies:

-

Assessing Transaction Costs: The bid-ask spread is an immediate cost for market orders. Traders look at the spread relative to the asset’s price (the percentage spread) to understand how expensive it is to enter or exit a position quickly. Narrower spreads mean lower costs.

-

Choosing Order Types: The spread and firm size influence the choice between market orders and limit orders.

- Use Market Orders when speed of execution is paramount, and you are willing to pay the spread, especially if the quoted size is sufficient for your needs and the spread is narrow.

- Use Limit Orders when price certainty is more important than immediate execution. By placing a buy limit order at the bid or lower, or a sell limit order at the ask or higher, you aim to “cross the spread” and potentially achieve a better price, but your order may not be filled if the market moves away from your limit price.

-

Managing Slippage Risk: By comparing your intended order size to the quoted firm size, you can anticipate potential slippage. If your order exceeds the firm size, you know you’ll likely execute at multiple price levels, potentially worsening your average price. This might lead you to split your order, use algorithms, or seek alternative execution methods for large blocks.

-

Gauging Market Depth: While the best bid and ask show the prices for the first layer of liquidity, the depth of the market (represented by other bids and asks away from the best price) indicates how much volume is available at progressively worse prices. Trading platforms often display Level 2 data, showing multiple bid and ask levels and their associated sizes. Analyzing market depth alongside the best bid/ask helps large traders understand the potential market impact of their orders.

-

Identifying Price Manipulation or Thin Markets: Unusually wide spreads or very small quoted sizes can sometimes signal thin trading conditions where a single large order could significantly move the price, or in rare cases, potential attempts at price manipulation. Traders are cautious when quotes exhibit these characteristics.

Mastering the use of quote information moves you beyond being a passive price taker to becoming an active participant who understands the mechanics of execution. It’s a critical skill for minimizing costs and improving trading performance.

The Role of Market Makers and Specialists

We’ve mentioned market makers frequently. But who are they, and what is their role in providing firm quotes and liquidity? Market makers are typically financial institutions or professional trading firms that stand ready to buy and sell a particular asset. They provide liquidity by continuously quoting both a bid and an ask price, committing to trade at those prices up to a specified size.

On traditional exchanges (like the NYSE), historically, specialists performed a similar function, though their role has evolved significantly with electronic trading. Specialists were assigned specific stocks and were responsible for maintaining a fair and orderly market, which included quoting bids and asks.

In modern electronic markets, market making is often performed by competing firms using sophisticated algorithms and high-frequency trading (HFT) strategies. They earn their profits from the bid-ask spread by buying at the bid and selling at the ask repeatedly throughout the day.

Their role is crucial for the efficient functioning of markets. Without market makers:

- It would be much harder and slower for buyers and sellers to find each other.

- The bid-ask spreads would be significantly wider.

- Liquidity would be lower, making it difficult to trade large sizes without causing significant price movements (high market impact).

Market makers take on inventory risk – the risk that the asset’s price will move against them before they can offset the position they took by trading with you. The size of the spread and the firmness of their quotes reflect this risk, among other factors like competition from other market makers.

Understanding the role and incentives of market makers helps explain why quotes behave the way they do. They are not simply passive observers; they are active participants providing a vital service for which they are compensated by the spread. They are the engine room facilitating the continuous interaction between buyers and sellers.

Regulatory Perspectives on Quotes: Ensuring Fair Markets

Given the importance of quotes in price discovery and execution, regulators play a significant role in establishing rules and oversight around how quotes are generated and displayed. The goal is to ensure fair and orderly markets and protect investors.

In the United States, for example, the Securities and Exchange Commission (SEC) oversees rules governing market quotes, particularly for stocks. The concept of the National Best Bid and Offer (NBBO), which we touched upon earlier, is a regulatory requirement under the SEC’s National Market System (NMS) rules. These rules mandate that brokers must route customer orders to the market that offers the best available price (either the highest bid or the lowest ask) among all competing exchanges and trading venues.

This ensures that investors get the best price currently available in the market, regardless of where their broker sends the order. The NBBO is derived from the firm quotes provided by market participants on various exchanges.

Regulations also often address issues like:

- Quote Accuracy: Rules require market makers and exchanges to ensure their quotes are accurate and reflect prices at which they are genuinely willing to trade.

- Quote Firmness Obligations: Regulations specify the minimum sizes for which quotes must be firm, especially on exchanges. This prevents participants from displaying misleading prices they are not willing to honor.

- Display Rules: Rules dictate how quotes must be displayed and disseminated to ensure transparency and equal access to pricing information for all market participants.

- Prevention of Manipulative Quoting: Regulators monitor quoting activity to detect patterns that might indicate attempts to manipulate prices, such as “spoofing” (placing bids or offers with no intention of executing, solely to influence prices) or “layering.”

For professional traders and institutions, understanding these regulatory frameworks is crucial. They dictate the playing field and define the obligations of market participants. For retail traders, while you might not need to know every specific rule, understanding that regulators are actively ensuring the integrity of the quoting process provides confidence in the fairness of the prices you see displayed on your platform.

Regulatory oversight is a complex but vital part of maintaining efficient and trustworthy financial markets. It provides the structure within which firm quotes can exist and be relied upon by traders.

Technological Advancements and the Evolution of Quoting

The landscape of market quoting has been dramatically transformed by technology, particularly with the rise of electronic trading platforms and high-frequency trading (HFT).

In the past, quotes were often delivered manually, verbally, or via simple electronic systems. Market makers might post their quotes on screens, and brokers would call or use early electronic systems to execute trades based on those quotes. This process was relatively slow, and quotes might become stale quickly, leading to greater price uncertainty and wider spreads.

Today, quotes are generated and updated in real-time by sophisticated computer systems and algorithms. Electronic exchanges aggregate orders from countless buyers and sellers and display the best bids and asks instantly. High-frequency trading firms employ algorithms that can process market data and update quotes in fractions of a second, reacting almost instantaneously to changes in supply and demand.

This technological evolution has had several profound impacts on quoting:

-

Increased Speed: Quotes are updated at lightning speed, ensuring that the displayed prices are almost always current reflections of the market’s willingness to buy and sell.

-

Tighter Spreads: Algorithmic market makers compete intensely to offer the best bid and ask, driving spreads down to fractions of a penny for highly liquid assets. This reduces transaction costs for traders.

-

Greater Transparency: Electronic systems make the best quotes (like the NBBO) easily accessible to all market participants, increasing price transparency.

-

Larger Quoted Sizes (in aggregate): While individual market makers might quote specific sizes, the aggregation of liquidity from multiple participants in electronic order books often means there’s significant depth available at or near the best bid/ask, providing more opportunity for larger orders to be filled near the best price.

-

New Challenges: The speed and complexity of HFT can also present challenges, such as the potential for “quote stuffing” (sending massive numbers of orders and cancellations to clog up data feeds) or the risk of “flash crashes” triggered by algorithmic feedback loops. Regulators and exchanges continuously work to address these issues.

For the modern trader, whether retail or institutional, interacting with markets means interacting with electronically generated quotes. While the underlying principles of bid, ask, and spread remain, the speed and density of quote data require reliable technology and trading platforms to process effectively. This is why platform choice is increasingly important for successful trading in any market, including forex.

In choosing a trading platform, the technology powering its quotes and execution is paramount. Speed and reliability matter. When choosing a trading platform, Moneta Markets‘ flexibility and technological advantages are worth mentioning. It supports popular platforms like MT4, MT5, and Pro Trader, combining high-speed execution with low spread settings to provide a good trading experience.

Mastering Quote Dynamics: Practice and Further Learning

Understanding market quotes, from the basic bid-ask spread to the nuanced concept of firm quotes and their role in market microstructure, is not just academic knowledge; it’s a practical necessity for any serious trader.

Here are some steps you can take to deepen your understanding and apply this knowledge:

-

Observe Quotes in Real-Time: Spend time watching live quotes on a trading platform or market data feed. Pay attention to how the bid and ask prices change, how the spread fluctuates, and how the quoted sizes vary, especially around news events or during different times of the trading session.

-

Study Level 2 Data: If your platform provides Level 2 market depth data, explore it. This shows you the orders sitting *behind* the best bid and ask, giving you a much richer picture of where liquidity is concentrated and the potential price impact of larger orders.

-

Practice with Different Order Types: Use a demo account to place market orders and limit orders for various assets. Observe the execution prices you receive, compare them to the quotes you saw when placing the order, and see how slippage affects your results in different market conditions (high vs. low volatility, liquid vs. illiquid assets).

-

Read Market Microstructure Literature: For a deeper academic understanding, explore resources specifically on market microstructure. This field of finance studies the details of how trades are executed, how prices are formed at the micro-level, and the roles of various market participants.

-

Understand Broker Execution Practices: Different brokers may have different methods for executing your orders, especially in OTC markets like forex. Some might internalize orders, while others route them to external liquidity providers. Understanding your broker’s practices can impact your effective execution price, even when quotes appear similar.

Mastering quote dynamics is an ongoing process. The markets are constantly evolving, influenced by technology, regulation, and participant behavior. By continuously observing, learning, and practicing, you build the intuition needed to navigate the complexities of order execution and manage your trading costs effectively.

Think of quote analysis as developing your market vision. It’s not enough to see the landscape (the price chart); you need to understand the ground you’re standing on (the bid, ask, and depth) and how you can move across it (execution through firm quotes). This knowledge is a cornerstone of informed and strategic trading, equipping you to make better decisions whether you are a beginner or seeking to refine your skills.

Risks and Limitations of Quote Information

While quotes, particularly firm quotes, provide valuable information and certainty, it’s important to be aware of their risks and limitations. No single piece of information is a magic bullet in trading.

-

Dynamic Nature: Quotes are constantly changing. A firm quote available one second might be gone the next, especially in fast markets. Your ability to act quickly is crucial.

-

Limited Depth Displayed: While Level 2 data shows more depth, you typically only see a few levels beyond the best bid and ask. The full liquidity profile of the market is not always transparent, especially for very large orders.

-

High-Frequency Trading Impact: HFT strategies can sometimes make it difficult for slower participants to execute at the best displayed prices. Quotes can disappear or change before a manual or slower algorithmic order can reach the market and be filled within the quoted size.

-

Fragmentation: Markets can be fragmented, with trading occurring across multiple exchanges and venues. While the NBBO aims to show the best prices, accessing that best price might depend on your broker’s routing capabilities.

-

Latency: The time it takes for quote information to reach your platform and for your order to reach the market can introduce latency risk, meaning the price might change during transmission.

-

“Iceberg” Orders: Not all liquidity is visible in the displayed quotes. Large traders might use “iceberg” orders, which only show a small portion of the total order size at a given price level, hiding the true depth of interest.

Understanding these limitations helps set realistic expectations for trade execution. Even with firm quotes, executing large orders or trading in volatile conditions can involve slippage. Risk management strategies should account for potential deviations from the best quoted price.

Despite these challenges, firm quotes and transparent market data remain indispensable tools. They provide the most reliable indication of immediate trading possibilities and form the basis for more complex execution strategies designed to minimize impact costs. Your success in trading will, in part, depend on how well you integrate quote analysis into your overall approach, acknowledging both the information they provide and the realities of market dynamics.

Beyond the Basics: Advanced Quote Concepts

For those looking to delve deeper into market microstructure, there are several more advanced quote-related concepts worth exploring:

-

Tick Size: The minimum price increment for an asset. Smaller tick sizes can allow for tighter spreads but can also increase message traffic and HFT activity.

-

Order Types and Quote Interaction: How different order types (market, limit, stop, etc.) interact with the standing bids and asks, and how they might affect the quotes themselves.

-

Maker-Taker vs. Pro-Rata Fee Structures: How exchange fee structures (some pay you to add liquidity, others charge you to take it) influence quoting behavior and spread formation.

-

Implied Quotes: In options or futures markets, quotes for less active contracts might be “implied” or derived from the prices of more active related contracts or the underlying asset using mathematical models.

-

Crossing Networks and Dark Pools: Trading venues that allow institutional investors to trade large blocks of shares anonymously at prices within the NBBO spread, without displaying their quotes publicly. This impacts the liquidity available in the public quote stream.

-

Quote Conventions: Specific conventions used in quoting certain instruments, like basis points for bonds or specific decimal places for currency pairs.

These concepts highlight the complexity of modern financial markets and the intricate mechanisms underlying price formation and trade execution. While not strictly necessary for every beginner trader, exploring these areas provides a more complete picture of the market ecosystem and the forces that shape the quotes you see.

Continuous learning is a hallmark of successful trading. The more you understand the underlying mechanics, the better equipped you are to adapt to changing market conditions and leverage available information. This foundation in market microstructure, starting with understanding firm quotes, is a valuable asset in your trading journey.

Trading across different asset classes, from traditional stocks to the dynamic forex market, often requires familiarity with these varying quote conventions and market structures. If you are broadening your trading horizons and looking for robust platform support across diverse instruments, including forex, consider exploring brokers with versatile offerings.

If you are looking for a regulated broker that offers global trading capabilities, Moneta Markets has multiple regulatory certifications, including FSCA, ASIC, and FSA. They also provide comprehensive support like segregated client funds, free VPS, and 24/7 Chinese customer service, making them a preferred choice for many traders.

Conclusion: Empowering Your Trading with Quote Intelligence

In summary, market quotes are the essential information packets of the financial world. Moving beyond simply knowing the last traded price to understanding the bid, the ask, the spread, and crucially, the concept of a firm quote, fundamentally changes how you view market interaction.

A firm quote represents a commitment – a promise from a market maker to trade a specific amount at a specific price. This commitment is vital for price certainty, particularly when executing market orders or dealing with significant trade sizes. It helps mitigate the risk of slippage, ensuring that for the quoted size, you can expect your order to be filled at the displayed price or better.

We’ve seen how the firmness and tightness of quotes are influenced by market liquidity, volatility, volume, and even the specific asset being traded. We’ve also touched upon how technology has revolutionized quoting, leading to faster updates and tighter spreads, and how regulators work to ensure quote accuracy and fairness.

For both novice investors and experienced traders seeking to deepen their technical analysis, incorporating quote dynamics into your understanding is non-negotiable. It impacts your transaction costs, influences your choice of order types, and provides insights into the underlying health and depth of the market.

By observing quotes closely, understanding the distinction between firm and nominal prices, and recognizing the factors that affect them, you gain a more sophisticated perspective on market mechanics. This knowledge is not just theoretical; it’s eminently practical, equipping you to make more informed decisions about when and how to enter or exit trades, ultimately contributing to better execution quality and potentially improved trading outcomes.

Embrace the study of quotes. It’s a key step in mastering the language of the market and unlocking a deeper understanding of the forces that drive price movements. As you continue your journey in the financial markets, this foundational knowledge will serve you well, helping you navigate opportunities and manage risks with greater confidence.

firm quoteFAQ

Q:What is a firm quote?

A:A firm quote represents a commitment from the market maker to trade at a certain price for a specified size, ensuring execution certainty.

Q:How does a nominal quote differ from a firm quote?

A:A nominal quote is merely indicative and does not carry an obligation to trade at the stated price, while a firm quote is a binding offer.

Q:Why is understanding the bid-ask spread important?

A:Understanding the bid-ask spread helps traders gauge transaction costs, market liquidity, and efficiency, which can impact trading strategies.