Introduction to Elliott Wave Rules: Decoding Market Structure

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, offers a powerful lens through which traders can interpret the rhythm of financial markets. By identifying recurring fractal patterns in price movements, this methodology reveals how collective investor psychology—driven by alternating waves of fear and greed—shapes market trends. At its heart, the theory suggests that market behavior is not random but follows a structured, predictable cycle composed of impulse and corrective phases. Mastering the rules of Elliott Wave analysis is essential for any serious trader or technical analyst, as it enables accurate pattern recognition, improves forecasting accuracy, and enhances risk management. This in-depth guide will walk you through the foundational principles, break down the three non-negotiable rules, and provide practical insights for applying Elliott Wave theory with precision across various markets.

The Foundation: Understanding Elliott Wave Principles

Before applying Elliott Wave rules to real-world charts, it’s crucial to understand the conceptual framework that underpins the entire system. This context helps clarify why certain structural rules exist and how they reflect the deeper dynamics of market movement.

What is Elliott Wave Theory?

Elliott Wave Theory is a form of technical analysis that identifies repetitive wave patterns in financial markets, which are believed to stem from mass investor psychology. Ralph Nelson Elliott discovered that these patterns are fractal in nature—meaning they repeat across timeframes, whether on a one-minute chart or a multi-year trend. Each wave reflects a phase of market sentiment, oscillating between optimism and pessimism. These movements aren’t chaotic; instead, they unfold in structured sequences that can be categorized, labeled, and projected. Because the theory links price action to human behavior, it provides more than just chart patterns—it offers a narrative of market evolution. For those seeking a deeper understanding of its origins, Investopedia provides a comprehensive overview of the theory’s development and core tenets.

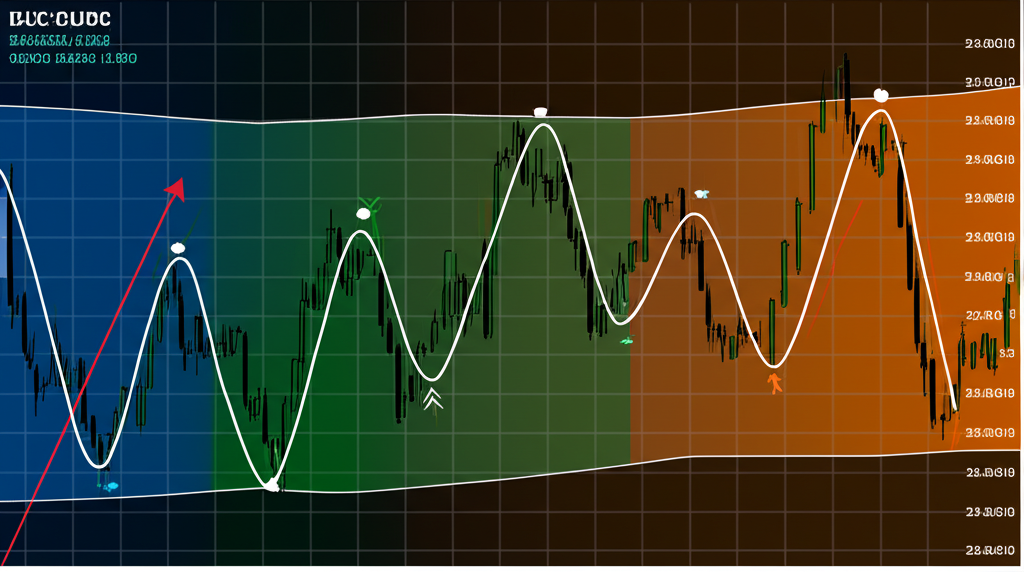

Impulse vs. Corrective Waves: The Core Cycle

The entire structure of Elliott Wave analysis revolves around two primary wave types: impulse waves and corrective waves. These form the backbone of market progression.

- Impulse Waves: These are motive waves that move in the direction of the dominant trend. They represent strong, directional price movement and are always composed of five sub-waves (labeled 1-2-3-4-5).

- Corrective Waves: These move against the main trend and typically reflect periods of consolidation or retracement. They are generally more complex and consist of three sub-waves (labeled A-B-C).

Markets evolve through a rhythmic alternation: a 5-wave impulse is followed by a 3-wave correction. This corrected impulse then becomes part of a larger-degree impulse wave, creating a self-similar, fractal progression that repeats across all timeframes.

The Three Cardinal Rules of Elliott Wave (Non-Negotiable)

These three rules are the foundation of valid Elliott Wave analysis. If any one of them is violated, the proposed wave count is invalid for a standard impulse wave. No exceptions exist—these are absolute requirements.

| Rule # | Description | Significance |

|---|---|---|

| 1 | Wave 2 cannot retrace more than 100% of Wave 1. | Ensures the impulse retains its overall direction; a retracement beyond 100% negates the initial impulse. |

| 2 | Wave 3 can never be the shortest impulse wave. | Highlights the typical strength and momentum of the third wave, often the most powerful segment. |

| 3 | Wave 4 cannot overlap Wave 1. | Maintains the distinct separation and progression of impulse waves, preventing complex, non-trending behavior. |

Rule #1: Wave 2 Cannot Retrace More Than 100% of Wave 1

This rule is fundamental to defining the integrity of an impulse sequence. Wave 2 is a pullback within an ongoing trend and must remain within the price boundaries established by Wave 1. If it drops below the starting point of Wave 1 in an uptrend (or rises above it in a downtrend), the initial move loses its status as a true impulse. Such a deep correction suggests the market is not trending but is instead forming part of a larger corrective structure. In practical terms, if the low of Wave 2 breaches the origin of Wave 1, the count must be discarded and reevaluated. This rule ensures that the market maintains directional continuity.

Rule #2: Wave 3 Can Never Be the Shortest Impulse Wave

Among the three impulse waves in a 5-wave sequence—Waves 1, 3, and 5—Wave 3 must exceed at least one of the others in length. It is often the longest and most dynamic, fueled by growing consensus and strong momentum. While Wave 1 may begin with uncertainty and Wave 5 sometimes fades due to exhaustion, Wave 3 typically reflects the strongest phase of the trend. If your analysis shows Wave 3 as shorter than both Wave 1 and Wave 5, the labeling is incorrect. This rule serves as a reality check, ensuring that the core momentum phase of the trend is properly accounted for.

Rule #3: Wave 4 Cannot Overlap Wave 1

In a standard impulse wave, the price range of Wave 4 must not enter the price territory of Wave 1. Specifically, in an uptrend, the low of Wave 4 must remain above the high of Wave 1. In a downtrend, the high of Wave 4 must stay below the low of Wave 1. This separation preserves the clean, progressive structure of an impulse. Overlap introduces ambiguity and is characteristic of corrective patterns rather than trending moves. The only exception occurs in diagonal triangles, where overlap is allowed due to their unique contracting or expanding structure. Otherwise, violating this rule invalidates the impulse count.

Detailed Rules for Impulse Wave Structures (5-Wave Movement)

Impulse waves are the engines of market trends, driving price in the direction of the larger-degree movement. Each impulse breaks down into five sub-waves, with specific characteristics and constraints that define their validity.

Wave 1 Rules: The Initial Move

Wave 1 marks the beginning of a new trend, often emerging from a prolonged consolidation or correction. In real-time analysis, it can be difficult to identify because sentiment is still largely bearish (in an uptrend) or bullish (in a downtrend). It typically unfolds as a five-wave structure, though occasionally it may take the form of a leading diagonal. Wave 1 is rarely the longest wave and tends to be relatively modest in size compared to Wave 3. Its completion sets the stage for the first correction, Wave 2, which tests the strength of the nascent trend.

Wave 3 Rules: The Strongest Drive

Wave 3 is frequently the most powerful segment of an impulse, often characterized by strong momentum and broad participation. It must comply with Rule #2—never being the shortest of the impulse waves.

- Extensions: Wave 3 is the most likely to extend, meaning its internal sub-waves also form full five-wave patterns. When extended, it can travel several multiples of Wave 1, creating significant price movement.

- Momentum Confirmation: Rising volume and bullish momentum indicators (like MACD and RSI) often accompany Wave 3, reinforcing its strength.

- Fibonacci Projections: Wave 3 commonly reaches 1.618, 2.618, or even 4.236 times the length of Wave 1, making Fibonacci extensions a valuable tool for target estimation.

Wave 5 Rules: The Final Push

Wave 5 represents the concluding phase of the impulse sequence. While it moves in the direction of the trend, it often does so with weakening momentum.

- Length: Wave 5 is frequently similar in length to Wave 1, especially if Wave 3 was extended. In some cases, particularly in commodities, Wave 5 itself may extend.

- Divergence: A telltale sign of Wave 5 is divergence on momentum oscillators. Price may make a new high (in an uptrend), but the indicator fails to confirm it, signaling loss of strength.

- Truncation: Occasionally, Wave 5 fails to exceed the peak of Wave 3. Known as a truncated fifth wave, this signals extreme weakness and often precedes a sharp reversal. Despite the failure to make a new high, it must still consist of five sub-waves.

Diagonal Triangles: Impulse Exceptions

Diagonal triangles are special impulse patterns that appear in specific positions—typically as Wave 1 (leading diagonal) or Wave 5 (ending diagonal)—and sometimes as Wave C in a zigzag. Unlike standard impulses, diagonals permit Wave 4 to overlap Wave 1, making them exceptions to Rule #3.

- Structure: Diagonals are wedge-shaped, formed by converging trendlines. All five sub-waves are three-wave corrections (3-3-3-3-3), not five-wave impulses.

- Leading Diagonals: Found in Wave 1, they often signal the start of a strong new trend after a prolonged correction.

- Ending Diagonals: Appear in Wave 5 or Wave C and indicate trend exhaustion. Their completion is typically followed by a rapid reversal, often retracing the entire diagonal.

Detailed Rules for Corrective Wave Structures (3-Wave Movement)

Corrective waves are inherently more complex and varied than impulse waves. They move against the main trend and are always structured in three waves (A-B-C) or combinations thereof. Their purpose is to rebalance price before the trend resumes.

Zigzags (5-3-5 Structure) Rules

Zigzags are sharp, fast corrections that often retrace a significant portion of the prior impulse.

- Structure: Composed of A-B-C with internal counts of 5-3-5. Wave A is a five-wave impulse, Wave B is a three-wave correction, and Wave C is another five-wave impulse (or ending diagonal).

- Length: Wave C usually equals Wave A or extends to 1.618 times its length.

- Wave B: Must not retrace more than 100% of Wave A. It typically pulls back between 38.2% and 78.6%, maintaining the corrective nature of the pattern.

- Occurrence: Zigzags frequently appear as Wave 2 or Wave 4 in impulses, or within larger corrective sequences.

Flats (3-3-5 Structure) Rules

Flats are sideways corrections that suggest strong underlying momentum, often seen in strong trends.

- Structure: Three waves (A-B-C) with internal counts of 3-3-5. Wave A and B are corrective, while Wave C is impulsive.

- Types:

- Regular Flat: Wave B ends near the start of Wave A, and Wave C ends slightly beyond Wave A’s low (or high).

- Expanded Flat: The most common. Wave B exceeds the start of Wave A, and Wave C extends well beyond Wave A’s endpoint, indicating strong pressure.

- Running Flat: Rare. Wave B extends beyond Wave A’s start, but Wave C fails to reach Wave A’s end, signaling extreme trend strength.

- Wave C Requirement: Must always be a five-wave structure.

Triangles (3-3-3-3-3 Structure) Rules

Triangles represent periods of consolidation, often occurring in Wave 4 or Wave B, and precede a final thrust in the direction of the main trend.

- Structure: Five sub-waves (A-B-C-D-E), each a three-wave correction (3-3-3-3-3).

- Overlap: All waves overlap significantly, creating a converging or diverging pattern.

- Types:

- Contracting Triangles: Symmetrical, ascending, or descending. Trendlines converge, and Wave E may slightly overshoot or undershoot the lower trendline.

- Expanding Triangles: Less common, with diverging trendlines and increasing volatility.

- Wave Relationships: Wave C must overlap Wave A, and Wave D must overlap Wave B.

- Post-Triangle Move: After completion, price typically breaks out in a swift move, often equal to the width of the triangle’s widest section.

Complex Corrections: Combinations and Double/Triple Threes

When simple corrections (zigzags, flats, triangles) combine, they form complex structures known as double threes (W-X-Y) or triple threes (W-X-Y-X-Z).

- Structure: Two or three corrective patterns linked by an intervening “X” wave, which is always a three-wave correction.

- Alternation: These combinations often follow the guideline of alternation—e.g., a sharp zigzag followed by a sideways flat.

- Purpose: They extend the duration of correction, allowing the market to rebalance over time rather than through deep price retracement.

Elliott Wave Rules and Fibonacci Relationships

While not formal rules, Fibonacci ratios are deeply embedded in Elliott Wave patterns. Their recurring presence helps validate wave counts and project future price levels with greater confidence.

Fibonacci Retracement Rules (Wave 2, Wave 4)

Fibonacci retracement levels are used to estimate how deeply a correction might go.

- Wave 2: Typically retraces 50%, 61.8%, or 78.6% of Wave 1. A retracement beyond 78.6% raises suspicion but doesn’t violate Rule #1 unless it exceeds 100%.

- Wave 4: Usually pulls back 23.6%, 38.2%, or 50% of Wave 3. It tends to be shallower than Wave 2, reflecting the alternation principle.

These levels serve as high-probability zones where corrections may find support or resistance, guiding entry and stop placement.

Fibonacci Extension Rules (Wave 3, Wave 5)

Fibonacci extensions help project the potential length of impulse waves.

- Wave 3: Often extends to 1.618 times the length of Wave 1, especially if Wave 1 was not extended.

- Wave 5: Frequently equals Wave 1 in length (1.0x) or reaches 0.618 times the length of Waves 1–3 combined. If Wave 3 was extended, Wave 5 is often shorter.

| Wave Type | Fibonacci Relationship (Common) | Application |

|---|---|---|

| Wave 2 | 38.2%, 50%, 61.8%, 78.6% retracement of Wave 1 | Identifying potential end of correction for Wave 2 |

| Wave 3 | 1.618, 2.618, 4.236 extension of Wave 1 | Projecting potential targets for the strongest impulse |

| Wave 4 | 23.6%, 38.2%, 50% retracement of Wave 3 | Identifying potential end of correction for Wave 4 |

| Wave 5 | Equal to Wave 1 (1.0), or 0.618 * (Wave 1+3) | Projecting potential targets for the final impulse |

Rules vs. Guidelines: A Critical Distinction for Traders

One of the biggest challenges in mastering Elliott Wave analysis is distinguishing between rigid rules and flexible guidelines. Confusing the two can lead to flawed interpretations.

- Rules: Absolute and unbreakable. Violating any of the three cardinal rules invalidates the wave count. These define what constitutes a valid pattern.

- Guidelines: High-probability tendencies that aid in refining counts but aren’t mandatory. Examples include:

- Alternation: Wave 2 and Wave 4 often differ in form—one sharp, one sideways.

- Equality: Wave 1 and Wave 5 are frequently similar in length.

- Channeling: Impulse waves often fit within parallel trend channels.

- Fibonacci Ratios: Useful for projections, but deviations don’t invalidate a count.

Traders should use guidelines to build probabilistic scenarios but always prioritize adherence to the rules when evaluating a wave structure.

Common Mistakes When Applying Elliott Wave Rules

Even experienced analysts can fall into traps when applying Elliott Wave theory. Common errors include:

- Forcing Counts: Trying to fit price action into a desired pattern, ignoring rule violations.

- Ignoring Cardinal Rules: Overlooking breaches of Wave 2, Wave 3, or Wave 4 rules, leading to invalid analysis.

- Misidentifying Wave Degrees: Confusing minor corrections with major impulses distorts the entire structure.

- Overvaluing Guidelines: Treating Fibonacci levels or alternation as rules can lead to premature rejection of valid counts.

- Bias Interference: Letting personal opinions or open positions influence wave labeling.

- Lack of Practice: Mastery requires consistent application across diverse markets and timeframes.

Practical Application: Integrating Rules into Your Trading Strategy

Understanding Elliott Wave rules is only valuable when applied effectively to live trading decisions.

Identifying Valid Wave Counts with Rules

To build reliable wave counts:

- Start with higher timeframes to establish the dominant trend.

- Look for clear 5-wave impulses and 3-wave corrections.

- Apply the three cardinal rules as a filter—any violation means the count is invalid.

- Use guidelines to refine targets and turning points.

- Seek confirmation from volume, momentum, and price action.

Using Rules for Entry and Exit Points

The rules provide clear decision points:

- Stop-Loss Placement: A breach of Rule #1 (Wave 2 > 100% of Wave 1) is a definitive invalidation signal—exit immediately.

- Entry Zones: Look for completions of Wave 2 or Wave 4 near Fibonacci levels (e.g., 61.8% retracement) for entries into Wave 3 or Wave 5.

- Profit Targets: Use Fibonacci extensions (e.g., 1.618x Wave 1) to set realistic targets for Wave 3 or Wave 5.

- Reversal Signals: Ending diagonals or truncated fifth waves, especially with divergence, signal potential reversals and ideal exit points.

For advanced techniques, traders can explore resources focused on technical analysis strategies offered by institutions like Fidelity.

Conclusion: Mastering the Discipline of Elliott Wave Rules

Elliott Wave Theory, when applied with strict adherence to its core rules, offers a structured and insightful approach to market analysis. The three cardinal rules—Wave 2 not exceeding 100% of Wave 1, Wave 3 never being the shortest impulse wave, and Wave 4 not overlapping Wave 1—serve as non-negotiable filters for valid wave counts. While Fibonacci ratios and behavioral guidelines enhance predictive power, they must never override the foundational rules. Mastery requires discipline, practice, and objectivity. By integrating these principles into a robust trading framework, traders gain a deeper understanding of market structure, enabling more informed, confident, and strategic decision-making across all financial instruments.

What is the 3-5-7 rule in stocks according to Elliott Wave Theory?

The “3-5-7 rule” is not a formal or universally recognized rule within Elliott Wave Theory as articulated by R.N. Elliott himself. It might refer to a specific trading strategy or simplified interpretation by some practitioners, but it’s not part of the core principles. The fundamental building blocks are the 5-wave impulse and 3-wave corrective structures.

Do professional traders widely adopt and use Elliott Waves in their daily analysis?

Yes, many professional traders and institutional analysts incorporate Elliott Wave Theory into their daily analysis. While not all traders use it as their primary tool, it’s widely respected for its ability to provide structural context, identify high-probability turning points, and manage risk. It’s often used in conjunction with other technical and fundamental analysis methods.

Which timeframes are considered most effective for applying Elliott Wave rules?

Elliott Wave Theory is fractal, meaning its patterns repeat across all timeframes. Therefore, it can be applied effectively from very short-term (e.g., 1-minute charts) to very long-term (e.g., monthly or yearly charts). Most practitioners recommend starting analysis on higher timeframes (daily, weekly) to identify the larger trend, then drilling down to lower timeframes (hourly, 15-minute) for trade entry and exit precision.

What are the specific identification rules for various triangle patterns in Elliott Wave?

Triangle patterns (contracting or expanding) are corrective waves, typically labeled A-B-C-D-E, where each sub-wave is a three-wave correction (3-3-3-3-3). The key rules are:

- They consist of five overlapping waves.

- Wave C must overlap Wave A.

- Wave D must overlap Wave B.

- Wave E often slightly undershoots or overshoots the trendline.

- They typically occur in Wave 4 positions of impulses or Wave B positions of larger corrections.

How do the Elliott Wave rules specifically apply to ABC corrective patterns?

ABC corrective patterns follow specific internal rules depending on their type:

- Zigzag (5-3-5): Wave A is 5 waves, Wave B is 3 waves, Wave C is 5 waves. Wave B must not retrace more than 100% of Wave A.

- Flat (3-3-5): Wave A is 3 waves, Wave B is 3 waves, Wave C is 5 waves. Wave B often retraces 90-100%+ of Wave A.

- Triangle (3-3-3-3-3): Each of the A-B-C-D-E sub-waves is a 3-wave correction, with significant overlap.

Where can I download a comprehensive Elliott Wave Theory PDF that details all the rules?

While specific PDFs are often proprietary or copyrighted, many reputable financial education websites and trading platforms offer free guides or e-books that detail Elliott Wave rules. Searching for “Elliott Wave Theory rules PDF” on academic or well-known trading education sites may yield resources. The original works by R.N. Elliott and A.J. Frost & Robert Prechter Jr. are also available, though often in book format.

Are there particular Elliott Wave rules or adaptations for Forex trading?

The fundamental Elliott Wave rules (the three cardinal rules and internal wave structures) apply universally across all financial markets, including Forex. However, in Forex, due to the 24/5 nature of the market and high liquidity, some patterns like expanded flats or complex corrections might be more prevalent. Traders also typically focus on shorter timeframes and integrate currency-specific economic data.

What is the best way to apply and visualize Elliott Wave rules on a live trading chart?

To apply Elliott Wave rules on a live chart:

- Use charting software with robust drawing tools for wave labeling and Fibonacci retracements/extensions.

- Start by identifying the current larger trend and try to label the impulse and corrective waves.

- Rigorously apply the three cardinal rules to validate your count.

- Use Fibonacci tools to project potential targets and retracement levels for subsequent waves.

- Look for confirmation from volume and momentum indicators.

- Always have an alternative wave count in mind and know your invalidation points.

Can Elliott Wave rules ever be violated, and what does such a violation signify?

The three cardinal Elliott Wave rules (Wave 2 < 100% of Wave 1, Wave 3 not shortest, Wave 4 not overlapping Wave 1 in a standard impulse) are considered inviolable for a valid impulse wave. If any of these rules are violated, it signifies that your current wave count is incorrect, and the market is either in a different pattern (e.g., a complex correction instead of an impulse) or you need to adjust your wave labeling. Rule violations are crucial signals for invalidating a trade setup or re-evaluating market structure.

What are the key distinctions between Elliott Wave “rules” and “guidelines”?

The key distinction is necessity vs. probability:

- Rules: These are absolute, non-negotiable conditions. If a rule is violated, the wave count is definitively invalid. Examples include the three cardinal rules.

- Guidelines: These are high-probability tendencies or observations that often occur but are not mandatory. Their violation does not invalidate a count but suggests a less common or atypical pattern. Examples include the guideline of alternation, equality, and specific Fibonacci ratios.