The Unseen Engine of Blockchain: Understanding Block Time and Its Pivotal Role

Welcome to a deep dive into one of the most fundamental yet often overlooked parameters in the blockchain universe: block time. Imagine the blockchain as a pulsating digital heart, and block time is its steady, rhythmic beat. It dictates how quickly new transactions are processed, how fast your digital assets move, and ultimately, how responsive and efficient the entire decentralized ecosystem feels. For new investors stepping into the vibrant world of cryptocurrencies and for seasoned traders refining their technical analysis, understanding this core concept is not just an academic exercise; it’s a strategic imperative.

- Block time influences transaction speed and overall efficiency in the blockchain ecosystem.

- It impacts the user experience (UX) of decentralized applications (DApps) and financial protocols.

- Understanding block time is crucial for both new investors and seasoned traders.

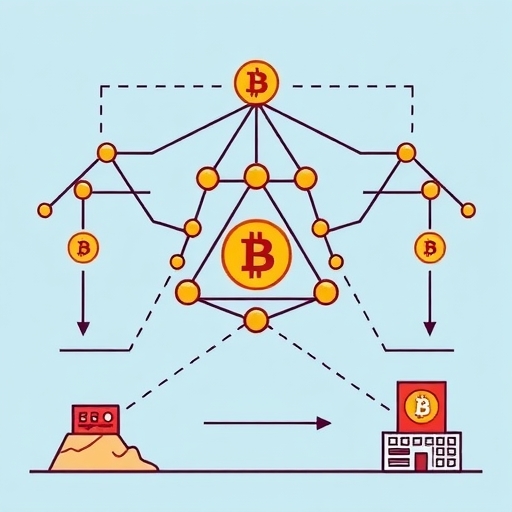

At its core, block time refers to the average time it takes for a new block to be generated and added to the blockchain. Each block contains a bundle of verified transactions, and once it’s added, those transactions are considered confirmed. In essence, it’s the interval between the discovery of one block and the next. Why is this so crucial, you might ask? Because it directly impacts transaction finality, network scalability, and the overall user experience (UX) across decentralized applications (DApps) and financial protocols.

| Parameter | Impact |

|---|---|

| Block Time | Determines transaction speed and network responsiveness |

| Transaction Finality | Affects how quickly transactions are confirmed |

| User Experience | Impacts interactions with DApps and financial protocols |

Historically, blockchains like Bitcoin set a fixed block time of roughly 10 minutes, a design choice balancing security and decentralization. Ethereum, in its proof-of-work (PoW) era, aimed for around 15 seconds. However, as the digital frontier expands, the demand for speed and efficiency has intensified. This pursuit has led to a fascinating race towards block time optimization, a critical frontier in blockchain development that promises to unlock unprecedented levels of performance and utility. We are witnessing a paradigm shift, as networks like Ethereum, Base, and Neo are pushing the boundaries, fundamentally redefining what’s possible in the world of decentralized technology.

Ethereum, the powerhouse of decentralized finance (DeFi) and DApps, is constantly evolving. Following its monumental shift to Proof-of-Stake (PoS) with The Merge, its focus has increasingly turned to enhancing throughput and user experience. Enter EIP-7782, a groundbreaking proposal put forth by core developer Barnabé Monnot, aiming to radically transform Ethereum’s fundamental rhythm. This proposal seeks to halve the current slot time from 12 seconds to a mere 6 seconds, a change targeted for inclusion in the “Glamsterdam” update, currently slated for late 2026.

But what does halving the slot time truly entail from a technical perspective? It’s not simply a matter of pressing a “faster” button. This ambitious goal requires meticulous adjustments to the underlying subslot timings, which are critical phases within each slot that ensure the network’s consensus mechanism functions smoothly. Specifically, EIP-7782 proposes the following:

- Block Proposal Time: Reduced from 4 seconds to 3 seconds. This is the window for validators to propose a new block.

- Attestation Time: Halved from 4 seconds to 1.5 seconds. This is when validators confirm the validity of a proposed block.

- Aggregation Time: Also halved from 4 seconds to 1.5 seconds. This is the period for aggregating attestations from multiple validators.

| Timing Parameter | Original Time | New Time |

|---|---|---|

| Block Proposal Time | 4 seconds | 3 seconds |

| Attestation Time | 4 seconds | 1.5 seconds |

| Aggregation Time | 4 seconds | 1.5 seconds |

These granular adjustments are designed to ensure that even with a significantly shorter slot time, the network retains its robustness and security, allowing for rapid block finality. It’s a testament to the continuous innovation within the Ethereum ecosystem, always striving for greater efficiency without compromising its foundational principles.

The motivation behind this significant undertaking is multifaceted. Faster transaction confirmation is paramount for mass adoption. Imagine waiting minutes for a transaction to settle in traditional finance; in the fast-paced crypto world, even seconds can feel like an eternity. By accelerating block times, Ethereum aims to deliver a more responsive, intuitive, and ultimately, a more valuable experience for every participant.

The implications of Ethereum’s proposed 6-second slot time extend far beyond mere speed. They promise a profound revolution in how we interact with decentralized applications and, crucially, how Decentralized Finance (DeFi) operates. For you, the investor and trader, these changes translate into tangible advantages that can directly impact your strategies and profitability.

Firstly, consider the immediate impact on user experience (UX). With blocks being confirmed twice as fast, your transactions—whether it’s sending tokens, interacting with a DApp, or minting an NFT—will achieve finality in half the time. This means fresher data for your wallets and DApps, leading to a smoother, more seamless experience that mirrors the instantaneousness of traditional digital services. No more staring at pending transaction screens for extended periods; your digital interactions will feel truly real-time.

| Benefit | Description |

|---|---|

| Quicker Price Updates | Prices on DEXs will reflect market movements almost instantaneously. |

| Reduced Arbitrage Opportunities | Faster blocks make it harder for bots to exploit price differences. |

| Increased Liquidity in AMMs | Rapid price discovery leads to more dynamic liquidity pools and lower trading fees. |

This direct economic benefit for traders cannot be overstated. When fees are lower and market data is fresher, your trading strategies become more precise and cost-effective.

Furthermore, an often-overlooked benefit is enhanced censorship resistance. With more frequent block proposals, there are more opportunities for transaction inclusion. This makes it significantly harder for any single entity or group to censor transactions, as a block producer would need to consistently ignore a transaction across multiple, rapid block intervals. This strengthens Ethereum’s fundamental promise of a decentralized, permissionless network, offering greater peace of mind to its users.

While Ethereum works on its core block time, Layer 2 (L2) solutions are already demonstrating what truly accelerated block times can achieve. Coinbase’s Base Network, an Optimistic Rollup built on Ethereum, has unveiled a game-changing technology called “Flashblocks” on its Sepolia testnet. This innovation dramatically slashes effective block times from an already impressive 2 seconds down to an astonishing 200 milliseconds – a tenfold improvement that brings us to the precipice of near-instant transaction finality.

How do Flashblocks achieve such remarkable speed? The magic lies in their mechanism of using preconfirmation blocks. Unlike traditional block finalization that waits for inclusion on the underlying blockchain, Flashblocks provide early, “soft” confirmations by streaming preconfirmation blocks every 200 milliseconds. These aren’t fully finalized blocks in the traditional sense, but they offer strong probabilistic guarantees that a transaction will be included and not reverted. This means developers and users receive almost immediate feedback on their transactions, significantly boosting the perception of speed and responsiveness.

This approach provides crucial early confirmations and offers revert protection, making the Base network incredibly responsive and user-friendly. For developers, this translates to the ability to build more interactive and real-time applications, free from the latency constraints often associated with blockchain interactions. For users, it means a seamless experience that feels akin to traditional web applications, but with the added benefits of decentralization and self-custody.

The collaboration with Flashbots, a leading research and development organization focused on MEV solutions, underscores the sophistication behind this innovation. Flashbots’ expertise in transaction ordering and block building has been instrumental in optimizing the preconfirmation process. This technology is not isolated to Base; its impact is already spreading. For instance, Uniswap, a pioneer in decentralized exchange, has leveraged similar technology to achieve remarkable 0.25-second block times on its Layer 2 “Unichain,” further demonstrating the industry’s drive towards hyper-speed blockchain operations.

Flashblocks are also part of Base’s broader strategic vision for scalability, alongside new tools like Base Appchains (Layer 3, application-specific blockchains that offer customizable, dedicated block space for high-traffic applications) and Smart Wallet Sub Accounts. This comprehensive suite of tools positions Base as a frontrunner in delivering truly performant and user-centric blockchain infrastructure, propelling the entire ecosystem towards mass adoption.

While Ethereum and Base are pushing the boundaries of fixed and accelerated block times, the Neo network offers a fascinating alternative: dynamic block timing. This innovative feature, introduced in NeoGo v0.111.0, represents a departure from the traditional fixed-interval block generation seen in many other blockchains. Proposed by Neo core developer Roman Khimov, dynamic block timing allows nodes to vary their block generation intervals, creating blocks as soon as transactions are available, up to a defined maximum interval.

Think of it like this: most blockchains operate on a fixed schedule, like a train that departs every hour, regardless of how many passengers are on board. If there are no passengers, the train still departs empty. Similarly, fixed-interval blockchains might produce empty blocks during periods of low network activity, wasting resources and creating unnecessary latency. Neo’s dynamic approach is more like a taxi service: it departs as soon as a passenger gets in, but if no one comes for a while, it will eventually leave after a certain maximum waiting time to ensure timely delivery.

This adaptability is a key innovation designed to address the inefficiencies inherent in fixed-interval block production, particularly in networks with varying levels of activity. For specialized blockchain environments, such as NeoFS (Neo’s decentralized storage network), where transaction throughput can fluctuate dramatically, dynamic block timing is particularly beneficial. It helps to:

- Avoid Empty Blocks: By generating blocks only when there are transactions ready to be included, the network avoids producing and propagating empty blocks, saving computational and bandwidth resources.

- Reduce Latency for Time-Sensitive Use Cases: For applications that require near-instant confirmation of transactions, dynamic block timing ensures that blocks are generated immediately upon transaction availability, significantly reducing latency compared to waiting for a fixed interval.

However, implementing dynamic block timing is not without its considerations. While highly efficient for resource utilization, it requires careful thought regarding how it impacts core blockchain assumptions that rely on a predictable time-block relationship. For example, mechanisms like GAS generation frequency (Neo’s utility token for network fees) or the timing of hardforks often rely on a consistent block count or time. These challenges need to be meticulously solved and thoroughly tested before dynamic block timing can be fully implemented on the Neo MainNet, ensuring stability and predictability even with variable block intervals.

While the pursuit of faster block times across networks like Ethereum, Base, and Neo promises significant advancements, it’s crucial to acknowledge the inherent technical challenges and tradeoffs. The path to hyper-speed blockchain operations is not without its hurdles, and understanding these complexities is vital for anyone engaging with decentralized technology.

- The validator burden increases as faster block times demand more from validators, including better hardware and connectivity.

- The need for higher bandwidth as more blocks lead to increased message propagation across the network.

- Challenges with smart contract compatibility arise as changes in block time may break assumptions in existing contracts.

Ultimately, the imperative for rigorous testing cannot be overstated. Before such fundamental changes are deployed on mainnets, they require extensive simulation, testnet trials, and community feedback to identify and mitigate potential issues. Developers must ensure that the pursuit of speed does not compromise the network’s stability, security, or decentralization – the very tenets that make blockchain technology so valuable.

Beyond technical performance, block time holds significant sway over a blockchain network’s economic value and long-term sustainability. For sophisticated investors and those performing in-depth technical analysis, understanding this economic calculus is key to assessing a network’s future potential. The push for faster block times, as seen with Ethereum’s EIP-7782, is partly driven by an ambition to elevate Ethereum’s “service price” – its economic value as a global settlement layer.

A network that can confirm transactions faster and more reliably offers a superior “service.” This superior service directly translates into higher demand from users, developers, and enterprises looking to build on or leverage the blockchain. The concept of network effects comes into play here: as the network becomes more responsive and efficient, it attracts more participants, which in turn enhances its utility and value. More DApps choose to deploy, more users engage, and more capital flows into its ecosystem, creating a virtuous cycle.

| Economic Calculus Factors | Implications |

|---|---|

| Faster Transaction Finality | Makes platforms more attractive, increasing user engagement and capital flow. |

| New Business Models | Enables high-frequency trading, real-time gaming, and instant micropayments. |

| Market Efficiency | Attracts institutional players, increasing overall trading volume and liquidity. |

In essence, optimizing block time isn’t just about speed; it’s about enhancing the fundamental economic engine of the blockchain, making it more competitive, more valuable, and more capable of sustaining its growth in the long run.

The conversation around block time often focuses on the Layer-1 (L1) blockchains like Ethereum. However, it’s impossible to discuss scalability without acknowledging the crucial, symbiotic relationship between L1 block times and Layer-2 (L2) scaling solutions. L2s, such as optimistic rollups like Base and zero-knowledge (ZK) rollups, don’t replace the need for efficient L1 block times; instead, they build upon them, pushing the boundaries of what “effective” transaction speed truly means.

- Faster L2 Finality: A faster L1 confirms batches of transactions sent from L2s more rapidly.

- Reduced Withdrawal Times: Faster L1 times improve the efficiency of withdrawal processes for optimistic rollups.

Moreover, L2s themselves are innovating with their own concepts of internal “block times.” Base’s Flashblocks, achieving 200-millisecond effective block times, is a prime example. This demonstrates how L2s are capable of delivering near-instant user experiences even when the underlying L1 has a slower, but still improving, block time. They introduce their own “local” confirmation mechanisms that provide immediate feedback to users, effectively abstracting away the longer L1 finality for most day-to-day interactions.

The emergence of Layer-3 (L3) chains, or Appchains, further extends this symbiotic relationship. These application-specific blockchains, often built on top of L2s (like Base Appchains built on OP Stack), provide dedicated block space and even greater customization for specific DApps. They can tailor their own “block production” schedules to meet the unique demands of their applications, all while inheriting the security and eventual finality from their L2 parent, which in turn relies on the L1. This layered approach creates a highly scalable and adaptable blockchain ecosystem, where faster L1 block times provide a stronger, more efficient foundation upon which the entire structure can flourish.

Now, let’s bring these complex concepts closer to home. You, whether an investment novice eager to learn or a seasoned trader delving into the nuances of technical analysis, are at the forefront of this evolution. How do accelerated block times, from Ethereum’s bold proposals to Base’s immediate speeds, translate into tangible advantages for your trading strategies and daily interactions with decentralized markets?

- Execution Speed and Slippage: Faster transaction inclusion reduces slippage, ensuring orders are filled at intended prices.

- DeFi Opportunities: More efficient yield farming strategies are possible due to quicker execution and lower gas costs.

- Responsive Data: Faster blocks provide more real-time on-chain metrics and data points for technical analysis.

Understanding these underlying network mechanics empowers you not just to observe, but to actively participate and thrive in the ever-accelerating world of decentralized finance. It’s about combining your analytical skills with an appreciation for the technological infrastructure that makes modern trading possible.

We have journeyed through the intricate world of block time optimization, exploring how major networks like Ethereum, Base, and Neo are meticulously redefining the very heartbeat of their blockchains. From Ethereum’s ambitious EIP-7782 aiming for a 6-second slot time by 2026, designed to enhance DeFi efficiency and user experience, to Base Network’s groundbreaking Flashblocks delivering near-instant 200-millisecond confirmations on Layer 2, and Neo’s innovative dynamic block timing adapting to network demand – the industry is clearly in a relentless pursuit of speed, scalability, and efficiency.

These advancements promise immense benefits: faster transaction inclusion, fresher data for DApps, reduced arbitrage, lower trading fees, and ultimately, a more responsive and economically valuable blockchain ecosystem. However, as we’ve discussed, this pursuit is not without its complex technical tradeoffs. The increased demands on validators, higher bandwidth requirements, potential for network congestion, and the critical need for rigorous testing and smart contract compatibility checks are all hurdles that developers must meticulously navigate. It’s a delicate balance, where innovation must always be tempered with stability and security.

The journey of block time optimization is far from over; it is a continuous evolution. We can anticipate further innovations in consensus mechanisms, sharding technologies, and inter-blockchain communication protocols that will continue to push the boundaries of transaction speed and finality. Cross-chain implications will become increasingly significant, as a faster L1 benefits all connected L2s, creating a ripple effect of efficiency across the entire decentralized landscape.

For you, the astute investor and trader, staying informed about these fundamental technological shifts is crucial. They are not merely academic curiosities but direct drivers of market dynamics, user adoption, and investment opportunities. Our mission, as your guide in this complex digital financial world, is to distill these intricate concepts into understandable knowledge, empowering you to make informed decisions and confidently navigate the markets. By understanding the unseen engines driving blockchain technology, you are better equipped to identify opportunities, manage risks, and ultimately, achieve your financial goals. Continue to explore, continue to learn, and embrace the accelerating pace of innovation that defines this exciting frontier.

block timeFAQ

Q:What is block time in blockchain?

A:Block time refers to the average time it takes for a new block to be generated and added to the blockchain.

Q:Why is block time important?

A:Block time impacts transaction speed, user experience, and the overall efficiency of decentralized applications.

Q:How does block time optimization affect DeFi?

A:Optimizing block time increases transaction speed, reduces fees, and enhances user experience in decentralized finance.