Decoding the On-Neck Candlestick Pattern: Understanding its Signal and Practical Ambiguity

Welcome to our deep dive into the fascinating world of technical analysis and, more specifically, the intricate language of candlestick charts. These visual tools offer us a unique window into market sentiment, showing the ongoing battle between buyers and sellers over specific periods. Among the vast array of patterns, some are powerful signals, while others, like the On-Neck candlestick pattern, require a more nuanced understanding and cautious approach. If you’re new to technical analysis or looking to refine your trading strategy, mastering these patterns is crucial.

You might have encountered charts showing sudden price movements, and wondered what caused them. Often, the answer lies partly in the patterns forming on the chart. Today, we’ll focus on the On-Neck pattern, also known as the Bearish On Neck Line. Traditionally, it’s presented as a signal of bearish continuation, suggesting a downtrend is likely to persist. However, as we’ll explore, its real-world performance often tells a different story, frequently preceding short-term upward reversals. This inherent ambiguity makes the On-Neck pattern a prime example of why relying on a single indicator without confirmation can be risky.

Our goal is to equip you with the knowledge to confidently identify the On-Neck pattern, understand the market psychology behind its formation, interpret its signals (both traditional and practical), and most importantly, learn how to trade it effectively by incorporating crucial confirmation techniques and robust risk management. Let’s unlock the secrets of this intriguing two-candle formation together.

Understanding the On-Neck Pattern: Structure and Identification

So, what exactly is the On-Neck pattern, and how do you spot it on a chart? At its core, the On-Neck is a two-candlestick pattern that typically appears within an existing downtrend or occasionally during a pullback within a broader uptrend. Recognizing its specific structure is the first step.

The pattern is defined by two consecutive candles:

-

The First Candle: This is a long bearish candle (often depicted as black or red). It indicates that sellers were firmly in control during this period, pushing the price significantly lower from open to close. This candle establishes the prevailing bearish sentiment.

-

The Second Candle: This is a smaller bullish candle (white or green). Crucially, the second candle opens lower than the closing price of the first bearish candle, creating a price gap. However, buyers manage to push the price up during this period, but they lack the strength for a significant rally. The defining characteristic is that this second candle closes at or very near the low price of the first bearish candle.

Think of it this way: the market is falling (long bearish candle). The next period opens even lower (the gap), suggesting bears are still strong. But then, buyers step in and manage to push the price up slightly (the small bullish body). Yet, their strength is limited, and they can only manage to bring the price back up to the *low* of the previous bearish day. This specific closing level, at or near the prior candle’s low, is sometimes referred to as the “neckline” in this context, hence the pattern’s name, “On-Neck Line”.

Identifying this precise closing relationship is vital. If the second candle closes significantly above the prior low, you might be looking at a different pattern. The close *at or near* the low is the signature of the On-Neck.

The location of the pattern also matters. While it can appear elsewhere, its significance is highest when it emerges during a clear downtrend, as it’s traditionally interpreted as a signal that this downtrend is likely to continue after a brief pause.

Market Psychology Behind the On-Neck Formation

Technical analysis isn’t just about recognizing shapes on a chart; it’s also about understanding the human emotions and market forces driving those shapes. The On-Neck pattern tells a story about the ongoing tug-of-war between buyers (bulls) and sellers (bears).

Let’s break down the psychology:

-

Day 1 (Long Bearish Candle): This day shows clear dominance by sellers. They opened the price and pushed it down aggressively, closing significantly lower. Market sentiment is distinctly bearish. Sellers are in control, perhaps fueled by negative news, overall market weakness, or selling pressure on a specific asset.

-

Day 2 (Small Bullish Candle): This day starts with a bearish follow-through – the price opens even lower, often creating a gap down from the previous day’s close. This initial move reinforces the bearish sentiment from Day 1. However, as the day progresses, buyers (the bulls) decide this lower open presents an opportunity. They step in and start buying, pushing the price back up. This is the bullish body of the second candle. But here’s the critical part: despite their effort, the buyers cannot muster enough strength to push the price significantly higher. The price rally stalls precisely at or very near the low of the previous day. The close at this level signals that sellers, while temporarily less aggressive than their peak on Day 1, are still present and ready to resume control at this price level. Buyers attempted a rebound from a discounted open but were effectively capped by the prior day’s low.

The pattern, therefore, shows a brief attempt by buyers to reverse or pause the downtrend, but their failure to close the price significantly higher than the previous day’s low indicates that the underlying bearish pressure remains strong. It suggests that the selling interest at or above that low price is still substantial enough to prevent a meaningful recovery. It’s like a brief test of the buying power at a lower level, a test that ultimately fails to overcome the sellers’ grip on the market.

Understanding this dynamic – the initial bearish strength, the attempted bullish counter-attack, and the ultimate failure of the bulls to make significant ground above the prior low – is key to interpreting the pattern’s implications, even its sometimes counter-intuitive outcomes.

The On-Neck Signal: Traditional Interpretation vs. Practical Outcome

This is where the On-Neck pattern gets particularly interesting and, frankly, a bit tricky. Traditionally, the On-Neck is taught as a bearish continuation pattern. The logic aligns with the market psychology we just discussed: the bulls attempted a rally but failed at the previous day’s low, implying the path of least resistance is still downwards, and the downtrend is set to resume.

However, statistical analysis of candlestick patterns, notably research compiled by experts like Thomas Bulkowski (published in resources like the “Encyclopedia of Candlestick Charts”), reveals a more complex picture. According to historical data, the On-Neck pattern acts as a bearish continuation pattern only about 50-56% of the time. What does this tell us?

It tells us that the On-Neck pattern is, statistically speaking, *not* a highly reliable continuation signal on its own. A 50-56% success rate means it’s only slightly better than a coin flip. This finding is crucial because it contradicts the conventional wisdom often presented about the pattern.

So, what happens the rest of the time? The data suggests that the pattern frequently precedes a short-term upward reversal. This is the practical ambiguity we mentioned. Why might this happen? Perhaps the brief struggle and the failure of the sellers to immediately push price lower *after* the buyers stepped in is enough for some traders to interpret it as a temporary floor, triggering short covering or new buying interest. Or maybe the pattern’s structure is simply too weak to consistently signal continuation in diverse market conditions.

The key takeaway here is that while the traditional textbook definition labels it as bearish continuation, its real-world statistical performance makes it, at best, an ambiguous signal, and often a precursor to a minor reversal.

This doesn’t mean the pattern is useless. Far from it. It means we must approach it with caution and, most importantly, not trade it in isolation. It should serve as an alert that *something* is happening at the prior day’s low, potentially a pause or struggle, but not a definitive signal to enter a trade based on continuation alone.

Trading Strategies and the Crucial Role of Confirmation

Given the On-Neck pattern’s tendency for false signals and its modest reliability as a continuation pattern, trading it effectively requires discipline, caution, and, most importantly, confirmation from subsequent price action or other indicators.

Simply spotting an On-Neck pattern and immediately entering a short position based purely on its traditional definition would be a low-probability strategy. Instead, we should view the pattern as an alert that tells us to pay close attention to what happens next at this critical price level (the prior low).

Here’s how traders typically approach the On-Neck pattern, keeping its ambiguity in mind:

1. Wait for Confirmation: This is paramount. Do not trade the pattern until confirmed. The most common form of confirmation is the price action *immediately following* the On-Neck pattern.

- For a bearish continuation signal to be validated, you would ideally want to see the price on the *next* candle (the third candle in the sequence) trade and close below the low of the On-Neck pattern (the low price where the second candle closed). A strong bearish close below this ‘neckline’ confirms that sellers have regained control and the downtrend is likely resuming.

- If the third candle instead trades above the high of the pattern (especially the high of the first, long bearish candle), it would suggest the failed attempt by buyers on the second day was actually a setup for a stronger rally, indicating a potential reversal, not continuation.

2. Potential Short Entry: If confirmation for bearish continuation is received (e.g., the third candle closes below the On-Neck low), a trader might consider initiating a short position. The entry point would typically be on the close of the confirming candle or on a subsequent pullback to the confirmation level.

3. Stop-Loss Placement: Proper risk management is non-negotiable. For a short trade entered based on a confirmed On-Neck, the stop-loss order should typically be placed just above the high of the On-Neck pattern. Often, placing it above the high of the first, long bearish candle is a safer bet, as it represents a more significant resistance level. If the price moves above this level, your bearish view is likely incorrect, and exiting the trade is prudent.

4. Managing Existing Positions: If you hold a long position and an On-Neck pattern appears in your chart, it could be interpreted as a warning sign of potential weakness or a coming pause/reversal in your favor. While not a definitive exit signal on its own, it might prompt you to tighten your stop-loss, take partial profits, or wait for the *next* candle to confirm whether the price is likely to continue down or reverse up.

Remember, trading the On-Neck relies heavily on what happens *after* you spot it. The pattern itself is more of an alert to watch for a potential turning point or continuation signal than a signal in itself.

Enhancing Analysis with Supporting Indicators and Context

Because the On-Neck pattern has a high rate of false signals and low statistical reliability in predicting continuation on its own, it is imperative to use it in conjunction with other technical analysis tools and consider the broader market context. Combining signals from multiple sources significantly increases the probability of a successful trade.

Think of the On-Neck pattern as one piece of a larger puzzle. What other pieces can help you confirm the picture?

-

Volume: Does the trading volume on the second day of the pattern offer any clues? Some analysts look for increased volume on the second day as potential confirmation of bearish pressure being capped at the prior low. However, the significance of volume with the On-Neck specifically can be debated, so it’s best used alongside other tools.

-

Moving Averages: Where does the On-Neck pattern appear relative to key Moving Averages (e.g., the 50-day, 200-day)? If the pattern forms while the price is clearly trading below significant bearishly sloped moving averages, it reinforces the idea of a prevailing downtrend where continuation is more probable, even if the pattern’s individual signal is weak. If it forms *above* a bullish moving average, the bullish reversal potential might be higher.

-

Momentum Oscillators: What are indicators like the Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), or Stochastic Oscillator telling you? If an On-Neck pattern appears in a downtrend, and these oscillators are showing bearish momentum or are oversold but not yet showing bullish divergence, it might slightly increase the probability of continuation upon confirmation. Conversely, if these indicators are showing strong bullish divergence (price making lower lows, but indicator making higher lows), the likelihood of an upward reversal following the On-Neck pattern increases significantly.

-

Support and Resistance Levels: Does the ‘neckline’ (the low of the first candle) correspond with a previously established support level? If the price is struggling at a known support level where the On-Neck forms, the potential for a bounce or reversal becomes higher, reinforcing the pattern’s observed tendency for reversals rather than continuation at such points.

Using these complementary tools helps you build a stronger case for either continuation or reversal following the On-Neck. If multiple indicators align with a bearish continuation signal (after confirmation), you might have a higher confidence trade setup. If they conflict or point towards a potential reversal, you should either avoid the trade or prepare for the higher probability of a reversal.

Always consider the bigger picture. Is the market in a strong trend, range-bound, or volatile? The same pattern can have different implications depending on the overall market environment.

On-Neck vs. In-Neck: Subtle Differences, Different Implications?

Technical analysis often involves recognizing patterns that look very similar but have subtle differences with potentially distinct implications. The On-Neck pattern is frequently compared to, and sometimes confused with, the In-Neck pattern.

Both are two-candle bearish patterns that typically appear in a downtrend, featuring a long bearish first candle followed by a smaller bullish second candle that opens lower (creates a gap). The crucial difference lies in the closing price of the second candle relative to the low of the first candle:

-

On-Neck Pattern: The second candle closes at or very near the low of the first candle.

-

In-Neck Pattern: The second candle closes slightly above the low of the first candle.

While this might seem like a minor distinction, in theory, it reflects a subtle difference in market sentiment. In the In-Neck pattern, the buyers in the second candle managed to push the price *just above* the previous day’s low. This slightly higher close is sometimes interpreted as indicating a *slightly* stronger bullish attempt than in the On-Neck pattern, which stalls precisely at the prior low.

Conventionally, the In-Neck pattern is also considered a bearish continuation pattern, but some interpretations suggest its slightly higher close might hint marginally more towards the possibility of a reversal compared to the On-Neck. However, it’s important to note that statistical analysis often shows that both patterns have similar, relatively low, reliability rates for continuation and frequently result in reversals.

Practically, the distinction emphasizes the importance of precise identification. Pay close attention to where that second candle closes relative to the first candle’s low. While the difference in trading implications between On-Neck and In-Neck might be marginal in reality due to their shared ambiguity, understanding the structural difference is key to accurate pattern recognition.

Other similar patterns you might encounter include the Thrusting Pattern, where the second bullish candle closes even higher, significantly into the body of the first bearish candle, suggesting a stronger potential for reversal.

Statistical Insights and Practical Reliability

Let’s revisit the statistical evidence, as it grounds our theoretical understanding in practical market outcomes. As mentioned, research by Thomas Bulkowski indicates that the On-Neck pattern acts as a bearish continuation approximately 50-56% of the time. This figure underscores the pattern’s unreliable nature when considered in isolation.

What does a ~50% continuation rate mean for you as a trader? It means if you were to trade *every* On-Neck pattern purely based on its traditional definition without any confirmation, you’d essentially be flipping a coin on whether the downtrend would continue or reverse. This is not a profitable trading strategy over the long run, as transaction costs alone would likely erode any potential gains.

The fact that it often precedes a short-term upward reversal highlights a common pitfall in pattern trading: assuming the traditional definition always holds true in dynamic markets. Markets are influenced by countless factors, and a single two-candle pattern, no matter how theoretically significant, is just a snapshot in time.

This is precisely why we cannot overstate the importance of confirmation. The statistical unreliability of the On-Neck pattern makes confirmation not just a recommendation, but a necessity. Waiting for the price to break the ‘neckline’ level on the third candle, or waiting for other indicators to align, transforms the pattern from a mere observation into a potential trading signal with a much higher probability of success.

Furthermore, the performance of any pattern can vary depending on the asset being traded (stocks, Forex, commodities), the timeframe being used (daily, hourly, 15-minute), and the overall market conditions (bullish, bearish, range-bound). Backtesting the On-Neck pattern on the specific markets and timeframes you trade is the only way to truly understand its statistical performance in your context. Tools like TrendSpider, Amibroker, or even custom scripts in Python can help you perform such analysis on historical data.

If you are trading Forex, understanding the nuances of how these patterns perform in that specific market, often characterized by high volatility and sensitivity to global news, is particularly important. In this context, combining candlestick analysis with fundamental analysis and understanding economic data releases becomes even more critical.

Implementing the On-Neck into Your Trading Plan: Risk Management and Strategy

Integrating the On-Neck pattern into your trading plan requires acknowledging its limitations and building strategies around confirmation and risk control. Remember, the pattern is primarily an alert, prompting you to look closer and await further information.

Here’s a structured approach:

-

Identify the Pattern: Spot the two-candle formation: long bearish candle followed by a smaller bullish candle opening lower and closing at or near the first candle’s low. Ensure it appears within a relevant context (usually a downtrend).

-

Assess the Context: What is the overall trend? Where is the price relative to key support/resistance or moving averages? What are momentum indicators (like RSI, MACD) suggesting? This step helps you gauge the likelihood of continuation versus reversal *before* confirmation.

-

Wait for Confirmation: This is the crucial step. Do not enter a trade based on the On-Neck pattern alone. Wait for the third candle.

- For potential bearish continuation: Look for the third candle to trade and close decisively below the low of the On-Neck pattern (the ‘neckline’).

- For potential bullish reversal: Watch if the third candle closes strongly above the high of the first bearish candle.

-

Plan Your Trade (if confirmed bearish): If bearish confirmation occurs, decide your entry point (e.g., on the close of the confirming candle, or a subsequent pullback). Determine your stop-loss placement (typically just above the high of the On-Neck pattern, preferably the high of the first candle). Calculate your position size based on your stop-loss and risk tolerance.

-

Manage Your Trade: Once in the trade, monitor price action. Consider setting a target price based on previous support levels or using a trailing stop to lock in profits if the downtrend resumes. Be prepared for the possibility that the downtrend might not extend far before another pause or reversal.

Risk management is your safety net. Always define your stop-loss before entering a trade. The statistical tendency of the On-Neck pattern to reverse upward means your stop-loss above the pattern’s high could be triggered more often than with highly reliable continuation patterns. Accept this as part of trading this specific pattern.

Position sizing is also critical. Never risk too much of your capital on any single trade, especially one initiated from a pattern with known statistical ambiguity like the On-Neck.

Consider practicing identifying and trading the On-Neck pattern on a demo account first to gain experience without risking real capital. This allows you to test your confirmation techniques and risk management strategies in a simulated environment.

Potential Pitfalls and How to Avoid Them

Trading candlestick patterns, including the On-Neck, comes with potential pitfalls. Being aware of them is the first step to avoiding costly mistakes.

-

Trading Without Confirmation: This is the most significant risk with the On-Neck pattern due to its low reliability as a standalone continuation signal. Assuming the traditional definition is sufficient will likely lead to numerous losing trades.

How to avoid: Always wait for the price action following the pattern to confirm the direction. Use other indicators to support the signal.

-

Ignoring the Broader Trend: A pattern’s significance is often amplified or negated by the larger market trend. An On-Neck pattern appearing against a strong bullish trend is less likely to signal a bearish continuation than one appearing within an established downtrend.

How to avoid: Always analyze the pattern within the context of the dominant trend and key support/resistance levels on higher timeframes.

-

Setting Stop-Loss Orders Too Tightly: While a stop-loss is essential, placing it immediately at the exact high of the pattern might lead to being stopped out prematurely by minor price fluctuations or whipsaws, especially given the pattern’s tendency for temporary reversals.

How to avoid: Place your stop-loss slightly above the pattern’s high, perhaps using average true range (ATR) or previous swing highs/lows to determine a suitable buffer. Consider placing it above the high of the *first* bearish candle for greater safety.

-

Over-Reliance on a Single Pattern: No single pattern, including the On-Neck, is foolproof. Markets are complex systems, and relying solely on one type of signal blinds you to other crucial information.

How to avoid: Always combine candlestick patterns with other forms of technical analysis, such as chart patterns, trend lines, moving averages, and oscillators. Consider fundamental analysis where applicable.

-

Trading Illiquid Assets: Candlestick patterns are most reliable on liquid assets with high trading volume, where price action is less prone to manipulation or erratic movements. Trying to apply these patterns to thinly traded stocks or obscure instruments can lead to false signals.

How to avoid: Focus on trading highly liquid markets and popular currency pairs in Forex, where patterns tend to behave more predictably (though still require confirmation).

By being mindful of these potential pitfalls and adhering strictly to principles of confirmation and risk management, you can mitigate the risks associated with trading the On-Neck pattern and potentially turn this often-ambiguous signal into a more reliable trading alert.

Backtesting and Customizing Your Approach

Given the statistical insights into the On-Neck pattern’s reliability, simply reading about it isn’t enough. To truly understand how it performs on the specific instruments and timeframes you trade, you must engage in backtesting.

Backtesting involves applying a specific trading strategy or pattern identification rule to historical price data and analyzing the results. For the On-Neck pattern, this means identifying every occurrence of the pattern in your chosen market history and then observing what happened immediately afterward. Did the price continue to fall? Did it reverse upwards? By how much? How often was a specific confirmation condition met? What would the hypothetical profit or loss have been with a defined entry, stop-loss, and target?

Backtesting allows you to move beyond general statistics and determine the pattern’s specific performance characteristics relevant to *your* trading. You might find that the On-Neck performs differently on EUR/USD daily charts compared to NASDAQ 1-hour charts, or that a specific confirmation method (e.g., a break of the low on high volume) significantly improves the pattern’s success rate for you.

Tools for backtesting range from manual chart review (labor-intensive but provides a deep understanding) to automated software and coding environments. Many modern trading platforms and charting services offer built-in backtesting capabilities or the ability to create custom scanners and strategies.

Through backtesting, you can:

- Quantify the pattern’s actual win rate and average profit/loss per trade in your specific context.

- Test different confirmation methods to see which is most effective.

- Evaluate different stop-loss and take-profit strategies.

- Understand the pattern’s behavior under different market conditions.

Customizing your approach means using the general knowledge about the On-Neck pattern as a starting point, and then refining your strategy based on your own research and backtesting results. It’s about adapting textbook knowledge to the realities of the markets you trade. Perhaps for a specific Forex pair, you find that an On-Neck is *more* often a reversal signal, prompting you to look for bullish opportunities upon confirmation rather than short ones.

Backtesting builds confidence in your strategy and helps you understand its potential profitability and risks before you commit real capital. It’s a critical step in developing mastery over any technical pattern, especially one with known ambiguities like the On-Neck.

Real-World Examples and Visual Recognition

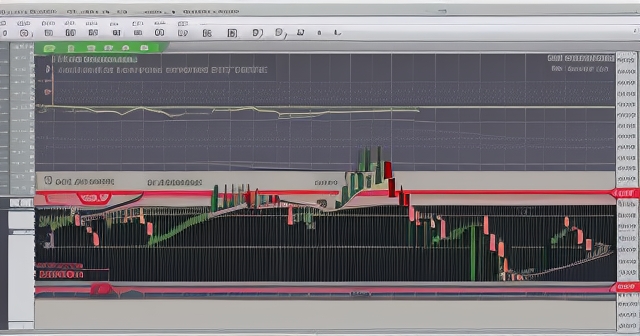

While understanding the definition and psychology is crucial, seeing the On-Neck pattern on real charts helps solidify your recognition skills. The pattern’s appearance can vary slightly depending on the asset and timeframe, but the core structure remains consistent.

Let’s visualize it: You’re looking at a chart, and the price has been trending downwards. You see a prominent red (or black) candle with a large body, showing strong selling pressure for that period. The next candle opens, and you see a gap down – the opening price is below the close of the previous red candle. As this second candle develops, it turns green (or white), indicating that the price is rising from its open. You watch it, and it closes right around the low of the first red candle. It doesn’t push significantly higher into the body of the first candle; it just stops, or ‘rests,’ on the previous low.

Examples might be found in charts of various stocks, commodities, or currency pairs. For instance, hypothetically, you might see this pattern emerge in a downtrending stock like PayPal (PYPL) or a commodity like gold. Or, if you’re trading Forex, you might spot it on the EUR/USD or GBP/JPY chart during a period of decline.

Imagine seeing an On-Neck pattern form near a minor support level during a downtrend. This confluence of factors might increase the likelihood of the pattern acting as a temporary pause or even a reversal point, consistent with its practical tendency, rather than a strong continuation signal. Conversely, if the pattern forms in the middle of a steep, established downtrend with no significant support nearby, and the third candle breaks decisively below the pattern’s low on high volume, the continuation signal becomes more compelling.

Practicing identifying the On-Neck pattern on historical charts is an excellent exercise. Flip through charts of different assets and timeframes and look for occurrences. Trace the pattern with your finger or mouse. Note where the second candle closes relative to the first candle’s low. Then, look at what happened on the *next* candle and in the following periods. Did the price continue down? Did it reverse? Did volume play a role? This visual practice, combined with understanding the statistics and confirmation requirements, is essential for mastering chart patterns.

Comparing Candlestick Patterns: Why Context Matters

The On-Neck pattern is just one among dozens of candlestick formations. Comparing it to other patterns helps highlight its unique characteristics and underscores why context is so important in technical analysis. We briefly touched on the In-Neck pattern, but let’s consider others.

-

Piercing Line vs. On-Neck: A Piercing Line pattern is a two-candle pattern (bearish then bullish) that forms in a downtrend, similar to the On-Neck. However, the bullish second candle in a Piercing Line closes *more than halfway up* the body of the first bearish candle. This shows significantly stronger buying pressure than in the On-Neck, where buyers only manage to push the price back to the prior low. A Piercing Line is considered a strong bullish reversal signal, demonstrating much greater bullish conviction than the On-Neck.

-

Bearish Engulfing vs. On-Neck: A Bearish Engulfing pattern involves a smaller bullish candle followed by a large bearish candle whose body completely “engulfs” the body of the previous bullish candle. This pattern, typically found in an uptrend, is a strong bearish reversal signal. It shows a dramatic shift in power from buyers to sellers. The On-Neck, conversely, starts with bearish power, sees a brief bullish attempt, and that attempt fails to overcome the prior low.

-

Hammer/Inverted Hammer vs. On-Neck: Hammer and Inverted Hammer patterns are single-candle bullish reversal signals often found at the bottom of a downtrend. They show price attempting to move lower but being strongly rejected by buyers, resulting in a long lower or upper wick and a small body near the top or bottom of the candle’s range. These patterns show immediate, strong rejection of lower prices, unlike the On-Neck, which involves a struggle that only manages to bring the price back to the prior low.

These comparisons illustrate that the *specific* relationship between the open, high, low, and close of consecutive candles provides nuanced information about the supply and demand dynamics at that moment. The On-Neck’s defining characteristic – the bullish second candle closing precisely at or near the prior low – is what distinguishes it and gives it its specific, albeit ambiguous, meaning compared to patterns showing stronger bullish rallies (Piercing Line) or complete shifts in power (Engulfing).

Understanding these relationships helps you appreciate why the On-Neck is not a strong reversal pattern like the Piercing Line or a strong continuation pattern like the Three Black Crows. Its structure reflects a specific type of hesitation and failed recovery attempt by buyers at a key level, which the market may interpret in different ways, leading to its variable outcome.

Final Thoughts: Mastering the On-Neck with Prudence and Practice

As we conclude our exploration of the On-Neck candlestick pattern, what are the key takeaways you should carry with you? Firstly, recognize the pattern accurately: a long bearish candle followed by a smaller bullish candle that opens lower and closes at or very near the first candle’s low. This occurs most meaningfully within a downtrend.

Secondly, understand the market psychology: it represents a temporary bullish attempt during a downtrend that fails to make significant headway above the prior day’s low, suggesting persistent bearish pressure.

Thirdly, and perhaps most importantly, internalize the pattern’s practical reality: while traditionally a bearish continuation signal, statistical analysis shows it has a low reliability rate for continuation (around 50-56%) and frequently precedes short-term upward reversals. This makes it an ambiguous pattern on its own.

This ambiguity is not a reason to discard the pattern, but a reason to treat it with caution. The On-Neck pattern is best used as an alert – a signal to pay close attention to what happens next – rather than a definitive trading signal upon its completion. Confirmation from subsequent price action (the third candle breaking below the pattern’s low) and congruence with other technical indicators (Volume, Moving Averages, Oscillators) are essential for increasing the probability of a successful trade.

Integrating the On-Neck into your trading plan requires robust risk management, including strategic stop-loss placement and appropriate position sizing. Backtesting its performance on your specific markets and timeframes is crucial for understanding its behavior in your trading environment.

Mastering technical analysis is an ongoing journey of learning, observation, and practice. Each pattern, like the On-Neck, offers a piece of the puzzle, but the real skill lies in combining these pieces with other analytical tools and sound risk management principles to form a comprehensive trading strategy. Don’t just look for patterns; understand what they tell you about the market’s participants and verify their signals before committing your capital.

If you’re expanding your trading horizons, perhaps into areas like Forex trading or exploring various CFD instruments, having access to a versatile and reliable platform is invaluable. If you’re looking for a broker with regulatory oversight and global trading capabilities, Moneta Markets holds multi-jurisdictional regulatory certifications from bodies like the FSCA, ASIC, and FSA. They also offer services like segregated client funds, free VPS, and 24/7 multilingual support, making them a preferred choice for many traders globally.

We hope this deep dive into the On-Neck pattern has been illuminating. Continue to practice identifying it, combine it with other tools, and always prioritize risk management. Happy trading!

Would you like to explore another specific candlestick pattern in detail?

| Item | Description |

|---|---|

| The On-Neck Pattern | A bearish continuation pattern consisting of a long bearish candle followed by a smaller bullish candle. |

| Confirmation | Look for the subsequent candle to help affirm the pattern’s signaling accuracy. |

| Stop-Loss Strategy | Place stop-loss orders above the high of the On-Neck pattern to manage risks effectively. |

| Pattern Type | Key Characteristics |

|---|---|

| On-Neck Pattern | Two candles, signifies an imminent bearish continuation. |

| In-Neck Pattern | Similar structure but closes slightly above the first candle’s low, indicating possible reversal. |

| Piercing Line | Strong bullish reversal pattern showing bullish conviction. |

| Considerations | Recommendations |

|---|---|

| Pattern Recognition | Emphasize understanding the relationship between opening, closing, high, and low prices. |

| Contextual Analysis | Consider market trends, key levels, and indicators when analyzing the pattern. |

| Practice | Engage in backtesting and simulated trading to strengthen skills. |

on neck candlestick patternFAQ

Q:What is the On-Neck candlestick pattern?

A:It is a bearish pattern consisting of a long bearish candle followed by a smaller bullish candle that closes near the low of the first candle.

Q:How reliable is the On-Neck pattern?

A:The On-Neck pattern has a reliability rate of about 50-56% for signaling bearish continuation.

Q:What should be done after identifying an On-Neck pattern?

A:Wait for confirmation from subsequent price action before entering a trade and apply proper risk management strategies.