Mastering the Rectangle Chart Pattern: A Comprehensive Guide for Traders

Have you ever looked at a price chart and noticed the market seems to be stuck, bouncing back and forth between two levels like a ball in a box? This seemingly simple observation is often the first step to identifying a powerful technical analysis formation known as the rectangle chart pattern. It’s a concept that has been a staple of chart analysis for generations, dating back to the foundational work of pioneers like Richard Schabaker, and later popularized by Edwards and Magee.

Understanding the rectangle pattern isn’t just about spotting lines on a chart; it’s about interpreting the underlying market psychology. What does this period of price consolidation tell us about the balance of power between buyers and sellers? How can we use this insight to potentially identify future trading opportunities? In this guide, we’ll delve deep into the anatomy of the rectangle, exploring its different forms, what it signifies, and how experienced traders approach trading it. Whether you’re new to technical analysis or looking to refine your understanding, mastering the rectangle is a valuable step in your trading journey.

Defining the Rectangle: Boundaries of Support and Resistance

At its core, the rectangle chart pattern is one of the most easily recognizable formations in technical analysis. It’s characterized by a price action that trades between two roughly parallel, horizontal lines. The upper line represents resistance, a level where buying pressure tends to meet selling pressure, causing the price to reverse downwards. The lower line signifies support, a level where selling pressure typically meets buying pressure, leading to a price rebound upwards.

Imagine the price is trapped in a corridor. It hits the ceiling (resistance) and bounces off. It then falls to the floor (support) and bounces back up. This action repeats multiple times, creating the distinct rectangular shape. The key here is the approximate horizontality and parallelism of these support and resistance levels. While they may not be perfectly straight or precisely parallel in the real market, the defining characteristic is the price repeatedly testing these levels and failing to break significantly above or below them for a period.

This back-and-forth movement within defined boundaries is often referred to as a period of consolidation or range-bound trading. It highlights a state of indecision in the market. Neither the buyers nor the sellers have enough conviction or strength to push the price decisively in one direction. Supply and demand are in a state of temporary equilibrium, creating this horizontal trading channel.

| Term | Description |

|---|---|

| Support | The lower boundary where buying interest generally exceeds selling interest. |

| Resistance | The upper boundary where selling interest generally exceeds buying interest. |

| Consolidation | A period where price movements are limited within set boundaries. |

The Psychology Behind the Pattern: Consolidation and Indecision

Why does the market enter into these periods of consolidation, forming a rectangle pattern? It boils down to market psychology and the fundamental forces of supply and demand. Following a prior trend move (either up or down), traders often pause. Those who profited from the preceding move may start taking profits, while new buyers (in an uptrend consolidation) or sellers (in a downtrend consolidation) hesitate to enter the market at current levels.

Within the rectangle, buyers step in when the price approaches the support level, viewing it as a favorable entry point. Conversely, sellers emerge when the price nears resistance, seeing it as an opportunity to sell or short. This creates the rhythmic oscillation between the boundaries. Each test of support or resistance is a battle between these opposing forces. If support holds, it confirms the presence of buyers at that level. If resistance holds, it indicates selling pressure is dominant there.

This period of indecision and consolidation builds potential energy. The longer the price stays contained within the rectangle, and the more times the support and resistance levels are tested, the more significant the eventual resolution is likely to be. Think of it like a spring being compressed; the more it’s compressed, the more powerful the release. The market is gathering strength, waiting for a catalyst or a shift in sentiment that will finally tip the balance in favor of either buyers or sellers, leading to a decisive breakout from the range.

Identifying Bullish and Bearish Rectangles: Context is Key

One of the crucial aspects of analyzing a rectangle pattern is understanding the context in which it forms. Rectangles are primarily identified by the trend that precedes them. This leads us to distinguish between two main types:

- Bullish Rectangle: This pattern forms during an existing uptrend. After a significant upward move, the price enters a period of consolidation within the rectangular boundaries. The expectation, based on classic technical analysis theory, is that this consolidation is merely a pause before the prior uptrend resumes. Buyers are seen as reloading or consolidating their gains before pushing the price higher.

- Bearish Rectangle: Conversely, this pattern appears within a downtrend. Following a notable downward move, the price stabilizes and trades within a horizontal range. This is often interpreted as a temporary halt in selling pressure before the downtrend continues. Sellers are consolidating their positions or waiting for new selling opportunities at slightly higher levels within the range before driving the price lower.

In both cases, the rectangle acts as a temporary equilibrium point. Identifying whether the pattern is a Bullish Rectangle or a Bearish Rectangle simply requires looking at the dominant trend that led into the consolidation phase. This initial assessment provides a bias towards the likely direction of the eventual breakout, although, as we will see, breakouts in the opposite direction are also possible and require careful attention.

Is It Continuation or Reversal? Understanding the Potential Outcomes

While rectangles are most commonly known as continuation patterns – meaning they suggest the prior trend will resume – it is vital to understand that they can occasionally act as reversal patterns. This is a point often overlooked by novice traders and highlights the importance of waiting for confirmation rather than assuming the outcome.

A continuation pattern scenario is when a Bullish Rectangle in an uptrend resolves with a breakout above resistance, continuing the upward move, or when a Bearish Rectangle in a downtrend resolves with a breakdown below support, continuing the downward move. This is the textbook expectation.

However, sometimes the period of consolidation within the rectangle signifies a fundamental shift in the supply/demand balance. For example, a Bullish Rectangle might see sellers gain strength during the consolidation, eventually leading to a breakdown below the support level. This would signal a potential reversal of the prior uptrend. Similarly, a Bearish Rectangle could resolve with a bullish breakout above resistance, potentially reversing the preceding downtrend.

This potential for either continuation or reversal underscores why the breakout is the critical event for trading the rectangle pattern. The pattern itself represents indecision; the breakout represents the resolution of that indecision and the likely start of a new directional move. Experienced traders don’t trade *within* the rectangle based purely on the expected continuation; they wait for the market to declare its intentions by moving decisively out of the defined range.

| Outcomes | Description |

|---|---|

| Continuation | The previous trend resumes after the breakout above resistance or below support. |

| Reversal | The price breaks out in the opposite direction of the previous trend, indicating a change. |

Trading Strategies: Range Trading Within the Box

Although waiting for a breakout is the most common approach to trading rectangle patterns, some skilled traders choose to engage in range trading *within* the boundaries of the pattern itself. This strategy involves buying near the support level and selling or shorting near the resistance level, essentially trying to capture the oscillations within the “box.”

This approach requires precision and vigilance. Traders using this strategy are looking for confirmation that the support and resistance levels are holding. They might buy when the price touches support and shows signs of bouncing (like bullish candlestick patterns) and place a stop-loss order just below the support level. Conversely, they might sell or short when the price reaches resistance and shows signs of reversing (like bearish candlestick patterns), placing a stop-loss just above the resistance level.

The appeal of range trading is the opportunity for multiple trades within the consolidation period, potentially generating profits before the eventual breakout. However, this strategy is generally considered higher risk than breakout trading. Why? Because the rectangle pattern *will* eventually break out. If you are in a long position near the support and a bearish breakdown occurs, your stop-loss needs to be tight to limit losses. Similarly, if you are short near resistance and a bullish breakout happens, a tight stop-loss above resistance is essential.

This strategy is best suited for traders who are comfortable with active management, have a good understanding of intraday price action and confirmation signals, and can effectively manage risk in a potentially volatile environment. It requires a different mindset than simply waiting for the pattern’s resolution.

Trading Strategies: Capitalizing on the Breakout

The most widely taught and commonly used strategy for trading the rectangle chart pattern is waiting for and trading the breakout. This approach aims to capitalize on the potential directional move that typically follows the resolution of the consolidation phase. The idea is to join the market just as it is deciding on its next significant move.

A bullish breakout occurs when the price moves decisively and closes significantly above the upper resistance boundary of the rectangle. This signals that buyers have finally overpowered sellers, and the prior upward momentum (or a new upward trend) is likely beginning. A bearish breakdown happens when the price moves decisively and closes significantly below the lower support boundary. This indicates that sellers have taken control, and the prior downward momentum (or a new downward trend) is likely starting.

To trade a bullish breakout, a trader might enter a long position as the price breaks above resistance or on a confirmed close above resistance. For a bearish breakdown, they would enter a short position as the price breaks below support or on a confirmed close below support. The key is to avoid entering on a “false breakout,” where the price briefly moves outside the range but quickly reverses back inside. Waiting for a convincing close beyond the boundary or a retest of the breakout level can help mitigate this risk.

| Trade Type | Entry Method |

|---|---|

| Bullish Breakout | Enter long after breaking above resistance with confirmation. |

| Bearish Breakdown | Enter short after breaking below support with confirmation. |

For traders interested in global markets, including forex and a wide range of CFD products, choosing a platform with robust tools for identifying and trading these patterns is essential. If you’re exploring such options, Moneta Markets is a platform worth considering. Hailing from Australia, they offer over 1000 financial instruments and support major platforms like MT4, MT5, and Pro Trader, catering to both beginners and seasoned traders.

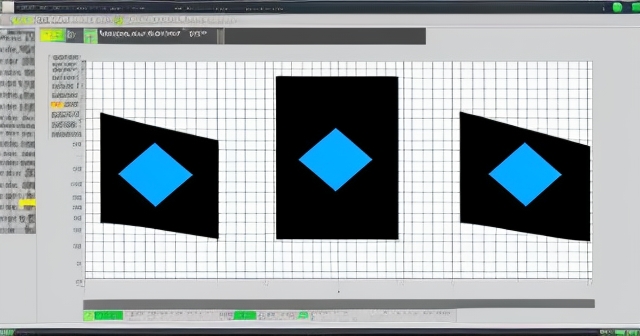

Setting Price Targets: The Measuring Principle

Once a confirmed breakout from a rectangle pattern occurs, a common question is: how far is the price likely to move? Technical analysis provides a useful guideline known as the Measuring Principle (sometimes called the “height rule”) to project a potential minimum price target.

The principle is straightforward: measure the vertical distance between the support and resistance levels of the rectangle (the “height” of the box). This measured distance is then projected from the breakout level. For a bullish breakout, add the height of the rectangle to the resistance level where the breakout occurred. For a bearish breakdown, subtract the height of the rectangle from the support level where the breakdown occurred.

For example, if a rectangle forms between $50 support and $60 resistance (a height of $10), and the price breaks out bullishly above $60, the minimum price target would be $60 + $10 = $70. If it breaks down bearishly below $50, the minimum target would be $50 – $10 = $40.

This is considered a minimum target, and price can, and often does, move further, especially if the breakout is powerful and supported by strong momentum and volume. However, the Measuring Principle provides a logical first target based on the energy built during the consolidation phase. Traders can use this target to plan their profit-taking strategies, although monitoring subsequent price action and other technical indicators is always recommended.

Volume and Confirmation: Validating the Rectangle Breakout

Volume is a critical ally in confirming the validity of a rectangle pattern breakout. Think of volume as the fuel for the move. A breakout that occurs on significantly above-average volume is generally considered more reliable than one on low volume.

When the price breaks decisively above resistance in a bullish scenario, we want to see a surge in buying volume. This indicates strong conviction from buyers, suggesting that the move has broad participation and isn’t just a tentative push. Similarly, a bearish breakdown below support should ideally be accompanied by an increase in selling volume, confirming aggressive distribution.

A breakout on low volume, conversely, can be a warning sign of a potential false breakout. It suggests that there isn’t strong conviction behind the move, and the price might easily reverse back into the range. This is why experienced traders pay close attention to volume profiles around the boundaries of the rectangle.

Analyzing volume isn’t just about looking at the total volume bars; it’s also about understanding where the volume is occurring relative to the price action. Are buyers or sellers being more aggressive at the support and resistance levels? Tools like on-balance volume or volume profile indicators can provide additional insights into the volume dynamics leading up to and during a potential breakout.

Advanced Analysis: Leveraging Cluster and Footprint Charts

For traders employing more sophisticated tools, especially in futures, forex, or other electronically traded markets, analyzing the internal structure of volume using tools like Cluster Charts or Footprint Charts can provide exceptional clarity around potential rectangle breakouts.

Traditional volume bars show total volume for a period (e.g., a minute, an hour, a day). Cluster Charts and Footprint Charts (which are essentially detailed cluster charts) break down the volume within each price bar by specific price levels and often differentiate between aggressive buying volume (“volume delta”) and aggressive selling volume.

How is this useful for the rectangle pattern? As the price oscillates within the range, these charts can show you where the most volume is being traded. High volume at the support level with aggressive buying delta might suggest that large players are accumulating positions, reinforcing the support. Conversely, high volume at resistance with aggressive selling delta could indicate distribution.

When the price approaches a boundary and attempts a breakout, these charts can reveal the conviction. A bullish breakout attempt at resistance accompanied by large clusters of aggressive buying volume just above the resistance level is a powerful confirmation. A bearish breakdown attempt at support with aggressive selling volume pushing through the level is equally significant. Conversely, a potential false breakout might show price pushing slightly through a boundary on minimal volume or even negative delta (more selling than buying) on a supposed bullish move, signaling a lack of conviction.

While requiring specialized software and understanding, leveraging volume analysis with tools like Cluster Charts or Footprint Charts adds a significant layer of confidence and precision when trading breakouts from patterns like the rectangle, allowing you to see the actual battle between buyers and sellers at crucial price levels.

If you are exploring platforms that support advanced analysis tools or offer access to diverse financial instruments like futures and forex, understanding what features a broker provides is key. Platforms like MT4, MT5, and Pro Trader often support advanced charting and analysis tools, and finding a broker that provides these alongside competitive conditions is important. In your search for a reliable broker with global reach and strong regulatory backing, Moneta Markets is certainly one to consider, holding multiple regulations including FSCA, ASIC, and FSA, and offering services like segregated client funds and 24/7 multilingual support.

Risk Management: Using Stop-Loss Orders Effectively

No matter how perfect a rectangle pattern appears, or how compelling the breakout looks, trading inherently involves risk. Effective risk management is not optional; it is fundamental to long-term success. For the rectangle pattern, this primarily involves the strategic placement of stop-loss orders.

For a bullish breakout trade, where you enter a long position as the price moves above the resistance, a logical place for a stop-loss is just below the former resistance level (which now ideally acts as support) or, more conservatively, just below the lower boundary of the original rectangle. If the price breaks out but then falls back into the range and declines below the former resistance, it often signals a failed breakout or a false breakout, and exiting the trade to limit losses is prudent.

For a bearish breakdown trade, where you enter a short position as the price moves below the support, a suitable stop-loss placement is just above the former support level (which now ideally acts as resistance) or, more conservatively, just above the upper boundary of the original rectangle. If the price breaks down but then rallies back into the range and moves above the former support, the bearish move is likely invalidated, and closing the short position is advisable.

| Trade Type | Stop-Loss Recommendation |

|---|---|

| Bullish Breakout | Set stop-loss just below former resistance or bottom of rectangle. |

| Bearish Breakdown | Set stop-loss just above former support or top of rectangle. |

The exact placement of the stop-loss can be adjusted based on your trading style, risk tolerance, and the volatility of the instrument you are trading. Some traders use a percentage of the rectangle’s height, others use a fixed number of pips or points, while others rely on technical confirmation signals like a close back inside the pattern. The critical point is to have a plan before you enter the trade and to stick to it. A stop-loss order ensures that if the pattern fails to perform as expected, your losses are contained, protecting your trading capital.

Conclusion: Integrating the Rectangle Pattern into Your Trading Toolkit

The rectangle chart pattern is a powerful yet relatively simple formation that provides invaluable insight into periods of market consolidation and indecision. It represents a temporary truce between buyers and sellers, bottling up energy that is eventually released with a decisive breakout.

By understanding the formation of the rectangle, recognizing the significance of its support and resistance boundaries, and identifying whether it’s a Bullish or Bearish Rectangle based on the preceding trend, you gain a clearer picture of potential market direction. While it commonly acts as a continuation pattern, always remember the possibility of a reversal and the necessity of waiting for confirmation.

We’ve explored different approaches to trading the rectangle, from the more active range trading within the box to the more popular strategy of capitalizing on the breakout. We’ve also discussed how to project potential price targets using the Measuring Principle and, importantly, emphasized the critical role of volume in confirming the validity of a breakout. For those looking for deeper insights, advanced tools like Cluster and Footprint charts offer granular views of volume dynamics at critical price levels.

Ultimately, successful trading of the rectangle pattern, like any technical formation, relies on combining pattern identification with other technical tools and, most crucially, implementing robust risk management using stop-loss orders. The rectangle is not a guarantee of future price movement, but it is a time-tested pattern that, when identified and traded correctly, can be a valuable addition to your technical analysis toolkit. Practice identifying these patterns on historical charts, develop your strategy for trading them, and always prioritize capital preservation.

rectangle chart patternFAQ

Q:What is a rectangle chart pattern?

A:It is a technical analysis formation characterized by price action trading between two horizontal lines representing support and resistance.

Q:How can I trade the rectangle pattern?

A:You can wait for a breakout above resistance for a bullish trade or a breakdown below support for a bearish trade.

Q:What is the Measuring Principle in trading?

A:It is a guideline to project potential price targets by measuring the height of the rectangle and adding it to resistance or subtracting it from support after a breakout.