What is an Indicative Quote? Unpacking the Core Definition

An indicative quote is essentially a starting point in the world of finance—a preliminary estimate offered by brokers, market makers, or institutions to suggest where a financial asset or service might be priced. It’s not a promise, nor does it lock in any terms; rather, it serves as a snapshot of current market sentiment or valuation expectations. Unlike firm pricing, which binds both parties upon acceptance, an indicative quote carries no obligation. Its role is strictly informational, helping traders, investors, or clients get a sense of potential costs, values, or market levels before diving deeper into negotiations or execution. This type of pricing is especially valuable in markets where real-time, liquid data is scarce—such as over-the-counter (OTC) trading, private placements, or large institutional transactions—where transparency depends on early signals rather than instant executions.

Key Characteristics That Define an Indicative Quote

To fully grasp how indicative quotes function, it’s essential to understand their defining traits:

- Informational Only: These quotes aren’t offers—they’re estimates. They reflect a general sense of value based on available market data, models, or recent activity, but they don’t guarantee anything.

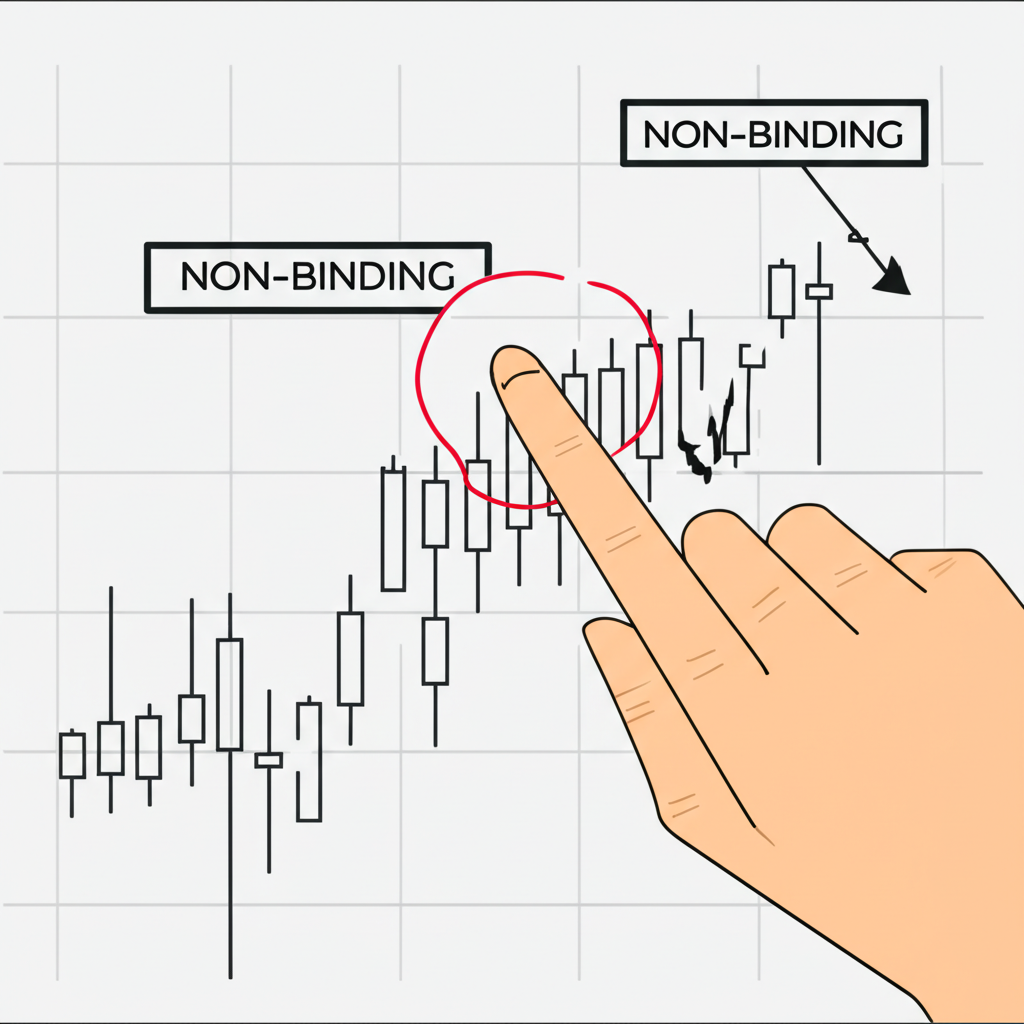

- Non-Binding: Neither the provider nor the recipient is committed to act on the number shared. This lack of obligation is what separates an indicative quote from a formal bid or offer.

- Dynamic and Time-Sensitive: Since these figures are often derived from live or modeled market conditions, they can shift rapidly. A quote valid one minute might be irrelevant the next due to news, volatility, or changes in supply and demand.

- Guidance-Oriented: Their main purpose isn’t to close deals, but to guide decisions. Traders use them to assess interest, refine strategies, or prepare for larger transactions without revealing their full hand.

In fast-moving environments, especially those involving complex or illiquid instruments, this flexibility allows participants to explore possibilities without triggering unintended market reactions.

The Purpose and Importance of Indicative Quotes in Financial Markets

While not enforceable, indicative quotes serve a critical function across financial ecosystems. They act as early signals that help maintain market efficiency, even when actual trades aren’t imminent. By offering a glimpse into potential pricing, they support several key processes:

- Enabling Price Discovery: In markets with limited visibility—like certain bond or OTC derivative segments—indicative quotes help establish a baseline for value. Without them, participants would struggle to determine fair pricing, especially for assets that don’t trade frequently. These preliminary figures allow buyers and sellers to align expectations before formal negotiations begin.

- Supporting Pre-Trade Analysis: Institutional traders often rely on indicative pricing to evaluate market depth and direction. Before placing a large order, they may request multiple indicative quotes to assess average levels and potential execution challenges. This helps them avoid sudden price swings caused by poorly timed entries.

- Facilitating Market Sounding: For major transactions—such as block sales of equities or large commodity contracts—firms may quietly “test the waters” using indicative quotes. This approach lets them gauge investor appetite and pricing sensitivity without broadcasting their intent, which could otherwise distort the market.

- Informing Risk and Budget Planning: Corporations, portfolio managers, and individual investors use these estimates to forecast costs, evaluate returns, or model scenarios. Even if the final execution price differs, the initial quote provides a useful reference point for internal planning and capital allocation.

This behind-the-scenes utility makes indicative quotes a foundational element of modern financial infrastructure, particularly in opaque or bespoke markets.

Indicative vs. Executable Quotes: Understanding the Crucial Difference

One of the most important distinctions in trading and finance lies between an indicative quote and an executable quote. Confusing the two can lead to costly misunderstandings, especially in time-sensitive or high-stakes environments like foreign exchange, equities, or fixed income markets.

An **executable quote**, also known as a firm or binding quote, represents a concrete willingness to transact. When a dealer provides an executable price for a specific volume and time window, they are signaling readiness to buy or sell at that exact level. If the counterparty accepts within the stated timeframe, a legally binding trade is formed. These quotes are standard on electronic trading platforms, where speed and certainty are paramount.

In contrast, an indicative quote is exploratory. It may suggest a likely price range, but it comes with no guarantee of execution. Think of it as a conversation starter rather than a contract.

Here’s a clearer breakdown:

| Feature | Indicative Quote | Executable Quote (Firm/Binding Quote) |

|---|---|---|

| Binding Nature | Non-binding; purely informational | Binding; constitutes a firm offer |

| Actionability | Not actionable; cannot be accepted to execute | Immediately actionable upon acceptance |

| Purpose | Market research, strategy development, preliminary assessment | Immediate trade execution |

| Price Certainty | Approximate; subject to change without notice | Firm; locked in for the specified quantity and duration |

| Risk Exposure | Low direct risk, but risk of misinterpretation | Direct execution risk, including slippage if delayed |

| Common Context | Illiquid assets, large orders, pre-trade inquiries | Liquid markets, standardized instruments, live trading systems |

The workflow typically follows a progression: start with an indicative quote to explore options, then request an executable quote when ready to act.

Factors Influencing the Shift from Indicative to Executable Prices

The gap between an indicative price and the final executable quote can vary widely, influenced by several market dynamics:

- Market Volatility: During periods of heightened uncertainty—such as central bank announcements or geopolitical shocks—prices can fluctuate dramatically within seconds. An indicative quote provided moments earlier may no longer reflect current conditions.

- Order Size: Large trades often face execution challenges. A quote that seems reasonable for a small volume may not hold for a block order, as filling it could move the market. Market makers may adjust their executable pricing to account for this impact.

- Liquidity Constraints: For thinly traded securities or exotic derivatives, finding a counterparty willing to match the indicative level can be difficult. The executable price might reflect a wider spread or require negotiation.

- Transaction Specifics: Factors like settlement timing, delivery terms, or unique asset features can affect pricing. An indicative quote usually assumes standard terms; deviations may necessitate adjustments.

As Investopedia notes, “Indicative quotes are for informational purposes only, and the actual execution price could vary based on market conditions.” Investopedia – Indicative Quote This underscores the need for caution when relying on preliminary data.

Indicative Quote Examples: Real-World Applications Across Markets

Indicative quotes appear in numerous financial contexts, each tailored to the unique needs of the market:

- Forex Trading: Currency pairs often display indicative bid/ask levels on trading platforms, such as EUR/USD at 1.0850/1.0855. These numbers give traders a sense of where the market stands, but the actual executable price upon clicking “buy” or “sell” may differ due to latency or rapid movement. Streaming prices update constantly, reflecting the fluid nature of global currency flows.

- Equity Markets: For low-volume stocks or after-hours trading, brokers may offer indicative quotes based on the last traded price or algorithmic models. A stock showing an indicative price of $50.00 might only have executable liquidity at $49.90 or $50.10. Institutional desks also use these quotes when arranging block trades, helping them line up buyers or sellers discreetly.

- Bond Markets: Before a new corporate bond is officially priced, underwriters circulate indicative yields—say, 5.5% to 5.75%—to gauge investor demand. Similarly, for existing but infrequently traded bonds, dealers provide indicative prices based on comparable issues or pricing models, giving portfolio managers a way to value holdings between trades.

These examples illustrate how indicative quotes serve as practical tools across asset classes, bridging information gaps in less transparent markets.

Beyond Trading: Indicative Quotes in Broader Contexts

The concept of a non-binding, preliminary estimate extends well beyond financial instruments. In many service-based industries, providing an indicative quote is standard practice for setting expectations early in a client relationship.

- Insurance: When applying for auto, home, or life coverage, the initial premium shown online or over the phone is typically an indicative quote. It’s calculated using the information provided—driving history, property location, health status—but isn’t final. After underwriting, which may include inspections or medical exams, the insurer can adjust the rate based on verified risk. The initial number is helpful, but not binding.

- Legal Services: Law firms often give clients an indicative quote for services like property conveyancing, contract drafting, or litigation. These estimates are based on experience and initial case assessments, usually derived from hourly rates and projected effort. However, they’re not contractual commitments. The final cost can change if the matter becomes more complex. Similarly, settlement discussions in disputes often begin with indicative figures—proposals floated to test resolution potential before formal agreements are drafted.

In these fields, indicative quotes manage expectations while allowing professionals to reserve judgment until they have complete information.

Indicative Rate vs. Effective Rate: A Key Financial Distinction

In personal finance and lending, another important distinction exists between the indicative rate and the effective rate—two figures that are often confused but carry very different implications.

The **indicative rate**—also called the nominal or headline rate—is the advertised interest rate on loans, savings accounts, or investments. For example, a bank might promote a personal loan with an indicative rate of 5% per year. It’s simple to understand but doesn’t tell the full story.

The **effective rate**, however, reflects the true cost or return. It accounts for compounding frequency, fees, and other charges. Using the same 5% loan example, if interest is compounded monthly and there’s a 1% origination fee, the effective annual rate (EAR) will be higher—around 5.12% or more, depending on the fee structure. This is the rate that truly impacts your wallet.

Regulatory bodies like the Financial Industry Regulatory Authority (FINRA) stress the importance of looking beyond headline numbers. FINRA – Investing Basics Consumers are encouraged to ask for the effective rate or APR (Annual Percentage Rate) to compare products accurately. Whether you’re evaluating a mortgage, credit card, or investment return, understanding this difference is essential for sound financial decision-making.

Limitations and Potential Risks of Relying on Indicative Quotes

Despite their usefulness, indicative quotes come with caveats. Treating them as guaranteed prices can lead to frustration, missed opportunities, or flawed planning.

- No Price Guarantee: The most significant limitation is that the quoted level may not be available when you’re ready to trade. Markets evolve quickly, and liquidity can vanish in moments.

- Slippage Risk: This refers to the difference between the expected price and the actual execution price. It’s common in volatile markets or with large orders, where even a few seconds can result in a worse fill.

- Potential for Misinterpretation: Some users, especially those new to financial markets, may assume an indicative quote means a deal is possible at that price. Without clarity, this can lead to false confidence or disputes.

- Sensitivity to Volatility: As Reuters highlights, “Market volatility, fueled by geopolitical events or economic data, can significantly widen bid-ask spreads and make indicative pricing less reliable.” Reuters.com In such environments, even well-informed estimates can become outdated almost instantly.

To mitigate these risks, always confirm with an executable quote before proceeding with any transaction.

Conclusion: Navigating the World of Indicative Quotes with Confidence

Indicative quotes are more than just numbers—they’re strategic tools that support transparency, planning, and informed decision-making in financial and non-financial domains alike. From guiding traders in volatile forex markets to helping consumers estimate insurance premiums, they provide a starting point for conversations about value and cost. Yet, their non-binding nature demands caution. They are not promises, and their fluidity means they should be treated as part of a broader decision-making process rather than the final word.

Understanding the difference between an indicative quote and an executable one is fundamental. The former opens the door to exploration; the latter enables action. By recognizing both the power and the limitations of preliminary pricing, market participants—from individual investors to institutional players—can navigate complex transactions with greater clarity and confidence. Whether you’re trading securities, arranging financing, or securing a service contract, always move from indication to confirmation before committing.

What exactly does “indicative quote” mean in finance?

In finance, an indicative quote is a preliminary, non-binding price provided by a market participant, like a broker or market maker, to give an approximate idea of where a financial instrument or service could be priced. It’s for informational purposes and does not obligate any party to trade at that price.

Can an indicative quote be considered a firm offer to trade?

No, an indicative quote cannot be considered a firm offer to trade. It is explicitly non-binding and informational. A firm offer, known as an executable quote, is required to initiate an actual trade.

How do indicative quotes impact a trader’s decision-making process?

Indicative quotes help traders by providing a preliminary view of market conditions and potential prices. This aids in market research, price discovery, and planning their strategies before requesting a firm quote. However, traders must be aware that the actual execution price might differ.

What are the primary differences between an indicative quote and a firm quote?

The primary difference is their binding nature. An indicative quote is non-binding and informational, while a firm quote (or executable quote) is a binding offer to buy or sell at a specific price, which can be immediately acted upon to execute a trade.

In which financial markets are indicative quotes most commonly used?

Indicative quotes are commonly used in forex trading, the bond market, for less liquid stocks, and in OTC (over-the-counter) markets. They are particularly useful where continuous, firm prices are not readily available or for large institutional transactions.

Are there any risks associated with relying on indicative prices for trading?

Yes, risks include the price not being available when you try to trade (market slippage), the potential for misinterpretation as a firm offer, and the rapid obsolescence of the quote due to market volatility. Always seek an executable quote for actual trading.

How is an indicative quote used in the context of insurance policies?

In insurance, an indicative quote is a preliminary estimate of a premium for a policy (e.g., auto, home, life) based on initial information provided by the client. It is non-binding and subject to change after a full underwriting process where the insurer verifies details and assesses the actual risk.

What role do indicative quotes play in the legal profession or for service estimates?

In legal contexts, professionals might provide indicative quotes for legal fees or potential settlement figures. These are preliminary estimates based on initial assessments and are non-binding until formal agreements (like retainer contracts) are signed, or settlements are legally finalized.

Why would a broker provide an indicative quote instead of a live, executable price?

Brokers provide an indicative quote to offer preliminary trading information without committing to a price, especially in illiquid markets, for large block trades that could impact the market, or when a client is just sounding out prices. It helps with price discovery and market assessment before a firm commitment.

How does the “indicative rate” differ from the “effective rate” for loans or investments?

The indicative rate is the advertised or nominal rate, often a simple interest rate. The effective rate (like APR) is the actual rate paid or received after accounting for compounding periods, fees, and other charges, representing the true cost of borrowing or the true return on an investment. This is a key financial distinction.