Introduction: Decoding “Cable” in the Forex Market

In the fast-moving realm of foreign exchange, traders rely on shorthand—compact terms that carry deep meaning. One such term, steeped in history and still widely used today, is “Cable.” Far more than just a nickname, it refers specifically to the GBP/USD currency pair—the British Pound versus the US Dollar. This pairing isn’t arbitrary; it reflects a long-standing financial relationship between two economic powerhouses, connected not just by markets but by a legacy of technological advancement. The term itself harks back to a time when communication across the Atlantic was revolutionized, forever changing how exchange rates were shared. Today, understanding Cable means understanding both historical context and modern market dynamics. This article explores the origins of the term, its economic significance, and how traders can approach this volatile yet highly liquid instrument with strategy and insight.

What Exactly is Cable Forex? The Definitive Definition

At its most basic level, “Cable” is the trader’s shorthand for the GBP/USD exchange rate—the number of US Dollars needed to buy one British Pound. When you see a quote like 1.2650, it means one Pound buys $1.2650. As one of the most traded currency pairs in the world, Cable sits at the heart of the forex market. Its liquidity ensures tight bid-ask spreads and swift execution, making it accessible to everyone from large financial institutions to individual traders. The dominance of this pair stems from the global influence of both currencies: the Pound, a legacy reserve currency, and the Dollar, the world’s primary reserve. Together, they represent two of the oldest and most developed economies, whose monetary policies, inflation trends, and political climates are watched closely around the clock. Because of this, movements in Cable often reflect broader shifts in global risk sentiment and macroeconomic outlook.

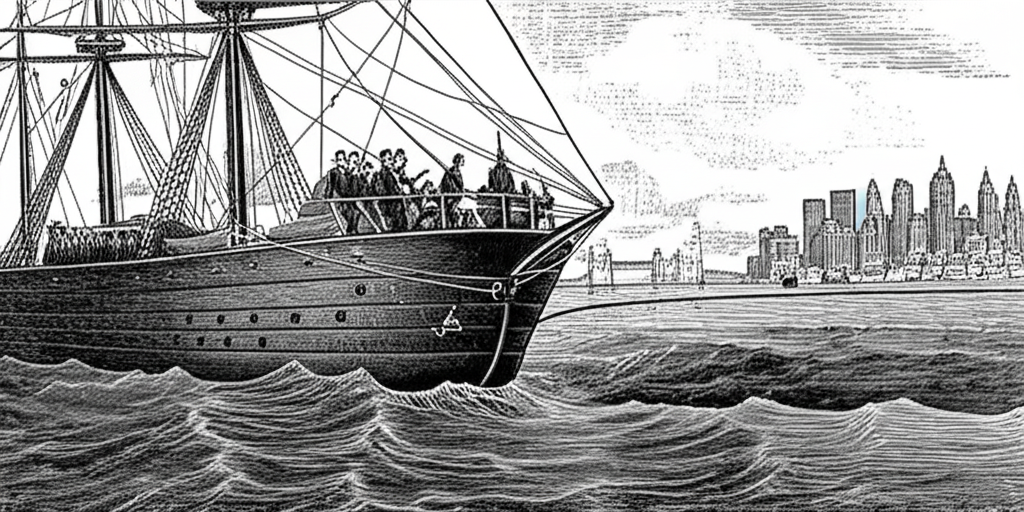

The Historic Origin of “Cable”: A Journey Across the Atlantic

The story behind the name “Cable” is one of innovation and necessity. Before the mid-1800s, financial information between London and New York moved at the speed of ships—often taking weeks to cross the Atlantic. By the time exchange rates arrived, they were already outdated, creating inefficiencies in trade and finance. That changed in 1866 with the successful deployment of the first permanent transatlantic telegraph cable. Stretching over 2,500 miles beneath the ocean, this engineering marvel allowed near-instantaneous transmission of data between the two financial hubs. Among the most critical information sent? The exchange rate between the British Pound and the US Dollar. Traders began referring to this transmitted rate as “the cable,” a nod to the physical conduit that made real-time pricing possible. The term stuck, surviving the transition from telegraph to electronic trading, and now serves as a living reminder of how technology has continuously reshaped financial markets. For a detailed look at this pivotal moment in communication history, the Atlantic Cable website offers a wealth of archival material.

Why Does Cable Matter? Significance of the GBP/USD Pair

Cable isn’t just popular—it’s essential. As a major currency pair, it plays a central role in the global forex ecosystem. Representing two of the world’s most influential economies, GBP/USD reacts quickly to shifts in monetary policy, economic performance, and geopolitical sentiment. Its deep liquidity means traders can enter and exit positions efficiently, even with large volumes. But it’s the volatility that truly defines Cable. Unlike some pairs that trend steadily, GBP/USD is known for sharp, sometimes unpredictable swings, often triggered by news events or central bank decisions. This volatility can be a double-edged sword: it offers profit potential for those who anticipate moves correctly, but it also demands disciplined risk management. The pair’s responsiveness makes it a favorite among active traders, particularly those who specialize in news-driven strategies or technical breakouts.

Key Economic Indicators Influencing Cable

The direction of the GBP/USD exchange rate hinges on a range of economic data points from both the United Kingdom and the United States. These indicators provide insight into economic health and influence central bank policy, which in turn drives currency valuation.

- Interest Rate Decisions: The stance of the Bank of England (BoE) and the Federal Reserve (Fed) is perhaps the most powerful driver. Rate hikes tend to strengthen a currency by attracting capital seeking higher returns, while cuts can weaken it.

- Inflation (CPI): Consumer Price Index reports signal whether inflation is rising or falling. Persistent inflation may prompt central banks to tighten policy, boosting the currency.

- GDP Growth: Quarterly GDP figures reflect the overall pace of economic expansion. Strong growth often supports a stronger currency, while contraction can weigh on it.

- Employment Data: In the US, the Non-Farm Payrolls report is a market-moving event. In the UK, unemployment rates and wage growth are closely watched as signs of economic resilience.

- Retail Sales: Consumer spending makes up a large portion of both economies. Rising retail sales suggest confidence and can support currency strength.

- PMI Reports: Manufacturing and Services Purchasing Managers’ Indexes offer early signals about economic momentum. Readings above 50 indicate expansion, while those below suggest contraction.

These reports are released on predictable schedules, allowing traders to prepare. The Federal Reserve’s extensive publications provide critical context for US economic trends, directly impacting the Dollar side of the pair. You can access detailed reports and analysis at the Federal Reserve website.

Geopolitical Factors and Their Impact

While economic data forms the foundation, political events often act as catalysts for sudden movements in Cable. The UK’s unique position—outside the EU but deeply tied to global markets—makes it especially sensitive to political shifts.

- Post-Brexit Adjustments: Even years after the UK left the European Union, new developments in trade agreements, regulatory alignment, or political rhetoric can spark volatility in the Pound.

- Elections and Leadership Changes: UK general elections or leadership contests within major parties can introduce uncertainty, often leading to short-term weakness in GBP. Similarly, US elections and shifts in fiscal policy affect Dollar strength.

- Global Risk Sentiment: During times of international tension or financial instability, the US Dollar often acts as a safe-haven asset. This can cause Cable to fall even if UK fundamentals are stable, simply because investors are flocking to the Dollar.

- Trade Relations and Diplomacy: Broader geopolitical developments, such as trade negotiations or sanctions, can indirectly influence the relative strength of the two currencies by altering economic outlooks.

These factors underscore the importance of staying informed beyond just economic calendars. A single speech, policy announcement, or unexpected event can shift market sentiment in minutes.

Trading Cable Forex: Practical Aspects and Strategies

Successfully trading Cable requires more than just monitoring price charts—it demands a blend of technical precision and fundamental awareness. The pair’s tendency to trend strongly makes it suitable for momentum strategies, but its susceptibility to news-driven spikes means traders must remain agile. Risk management is non-negotiable; stop-loss orders, position sizing, and emotional discipline are key to surviving its swings. Whether trading on a short-term or long-term basis, a structured approach increases the odds of consistent performance.

Understanding Cable Charts: Technical Analysis for GBP/USD

Technical analysis plays a central role in navigating the GBP/USD market. Traders use price patterns and indicators to identify potential turning points, confirm trends, and time entries.

- Moving Averages: The 50-day and 200-day moving averages are commonly used to define the trend. When the 50 crosses above the 200, it forms a “golden cross,” often signaling a bullish shift. The reverse—a “death cross”—may indicate bearish momentum.

- Relative Strength Index (RSI): This oscillator helps identify overbought or oversold conditions. An RSI above 70 suggests the pair may be overextended to the upside, while below 30 indicates potential downside exhaustion. However, in strong trends, RSI can remain in extreme territory, so it’s best used in conjunction with other tools.

- MACD (Moving Average Convergence Divergence): The MACD helps confirm trend strength and potential reversals. A bullish crossover occurs when the MACD line rises above the signal line, often used as a buy signal.

- Support and Resistance: Historical price levels where the market has reversed repeatedly act as psychological barriers. A break above resistance may trigger further buying, while a drop below support can lead to accelerated selling.

- Chart Patterns: Classic formations like head and shoulders, double tops, and symmetrical triangles appear regularly on GBP/USD charts. These patterns can signal impending reversals or continuation moves, especially when confirmed by volume or momentum indicators.

Many traders combine these tools into a cohesive system, using multiple confirmations before entering a trade.

Common Cable Forex Trading Strategies

Given its behavior, several strategies have proven effective for trading Cable.

- Trend Following: When GBP/USD enters a clear uptrend or downtrend, traders align their positions accordingly. In an uptrend, they look to buy on pullbacks; in a downtrend, they sell on rallies. This approach works well during periods of strong macroeconomic divergence between the UK and US.

- Breakout Trading: After periods of consolidation, Cable often erupts in one direction. Traders watch key levels and enter when price breaks out with momentum, often using volume or volatility filters to confirm the move.

- News Trading: High-impact events like BoE rate decisions or US Non-Farm Payrolls can trigger rapid price movements. Traders may place orders before the release or react quickly afterward, aiming to capture the initial volatility. This strategy requires fast execution and strict risk controls.

- Long vs. Short Cable:

- Going Long Cable: This means buying GBP/USD in anticipation that the Pound will strengthen against the Dollar. It’s typically favored when UK economic data improves or US data disappoints.

- Going Short Cable: Selling the pair reflects a bearish view on the Pound or a bullish one on the Dollar. This might occur ahead of weak UK data or strong US economic performance.

The key is consistency—sticking to a tested methodology rather than chasing random opportunities.

Cable vs. Fiber: Distinguishing Major Currency Pairs

In trading circles, “Cable” (GBP/USD) is often mentioned alongside “Fiber,” the nickname for EUR/USD. While both are major USD pairs and share some similarities, their behavior and drivers differ significantly.

| Feature | Cable (GBP/USD) | Fiber (EUR/USD) |

|---|---|---|

| Currencies | British Pound vs. US Dollar | Euro vs. US Dollar |

| Origin of Nickname | Transatlantic telegraph cable (1866) | Modern fiber-optic cables linking Europe and the US |

| Economic Drivers | UK-specific data, BoE policy, political events (e.g., Brexit) | Eurozone-wide data, ECB policy, German economic performance |

| Typical Volatility | Higher—prone to sharp moves on domestic UK news | Moderate—moves are often more gradual due to broader consensus-based decision-making |

| Market Correlation | Can move independently, especially during UK political events | Strong internal correlation across Eurozone members |

| Sensitivity | Highly reactive to UK fiscal policy, elections, and central bank surprises | Influenced by ECB guidance, inflation across multiple countries, and geopolitical risks in Europe |

While both pairs react to Fed policy and US data, Cable tends to be more responsive to idiosyncratic risks. Fiber, representing 19 countries, often reflects broader regional sentiment. Traders who understand these nuances can better allocate risk and avoid overexposure to similar market drivers. For those seeking authoritative data on global forex activity, the Bank for International Settlements (BIS) Triennial Central Bank Survey provides comprehensive insights into trading volumes and market structure.

Conclusion: Navigating the Cable Market with Confidence

The term “Cable” is more than a nostalgic reference—it’s a symbol of how deeply history and finance are intertwined. From the laying of the first transatlantic telegraph cable to today’s algorithmic trading systems, the GBP/USD pair has remained a cornerstone of the forex market. Its liquidity, volatility, and responsiveness make it a compelling instrument for traders who are willing to understand its drivers. Success with Cable comes from combining awareness of economic fundamentals with disciplined technical analysis and robust risk management. Whether you’re positioning for a long-term trend or reacting to a surprise economic report, staying informed and structured is essential. By mastering the dynamics of this historic pair, traders gain not just a tool for profit, but a deeper appreciation for the evolution of global finance.

Why is the British Pound called “Cable” in forex trading?

The British Pound is called “Cable” because of the transatlantic telegraph cable laid between London and New York in 1866. This cable was used to transmit exchange rates between the UK and the US, and the term “Cable rate” became synonymous with the GBP/USD exchange rate. The nickname stuck and is still widely used in the forex market today.

What currency pair does “Cable” refer to in the foreign exchange market?

In the foreign exchange market, “Cable” exclusively refers to the currency pair of the British Pound (GBP) against the United States Dollar (USD), expressed as GBP/USD.

What are the main factors that influence the “Cable” exchange rate?

The main factors influencing the Cable exchange rate include:

- Interest rate decisions by the Bank of England (BoE) and the Federal Reserve (Fed).

- Inflation reports (CPI) from both the UK and US.

- Gross Domestic Product (GDP) figures.

- Employment data (e.g., US Non-Farm Payrolls, UK Unemployment Rate).

- Geopolitical events, such as UK elections, Brexit developments, and international trade relations.

- Market sentiment and risk appetite.

How does “Cable” compare to “Fiber” (EUR/USD) in terms of trading characteristics?

Both “Cable” (GBP/USD) and “Fiber” (EUR/USD) are major, highly liquid currency pairs. However, Cable is often considered more volatile and prone to sharper moves, especially in response to UK-specific news and political developments like Brexit. Fiber, while still significant, tends to reflect the broader economic health of the entire Eurozone and policies of the European Central Bank (ECB), and may exhibit relatively lower day-to-day volatility compared to Cable.

What does “long cable meaning finance” imply in forex trading?

In finance, “long cable” means to buy the GBP/USD currency pair. When a trader goes long cable, they are speculating that the value of the British Pound will increase relative to the US Dollar, expecting to profit from an upward movement in the exchange rate.

Are there specific trading strategies that work best for the GBP/USD “Cable” pair?

Due to Cable’s characteristics, several strategies are popular:

- Trend Following: Capitalizing on its tendency to establish strong trends.

- Breakout Trading: Exploiting sharp moves after periods of consolidation.

- News Trading: Taking positions around major economic data releases or central bank announcements due to high volatility.

- Support and Resistance Trading: Identifying key price levels where buying or selling pressure is expected.

Where can I find a real-time “Cable forex chart” for analysis?

You can find real-time Cable forex charts on virtually any reputable forex broker’s trading platform, financial news websites (e.g., Investing.com, TradingView, Reuters), and dedicated charting services. These platforms typically offer various timeframes, technical indicators, and drawing tools for comprehensive analysis.

Is “Cable” considered a volatile currency pair?

Yes, “Cable” (GBP/USD) is generally considered one of the more volatile major currency pairs. Its volatility is influenced by the economic dynamics of two significant global economies, central bank policies, and particularly sensitive to UK-specific political events and economic data, leading to frequent and sometimes sharp price movements.

What is the historical significance of the “Cable rate” in financial markets?

The historical significance of the “Cable rate” lies in its origin with the first successful transatlantic telegraph cable in 1866. This cable revolutionized financial communication by allowing near real-time transmission of the GBP/USD exchange rate between London and New York, fundamentally changing how international finance operated and laying the groundwork for modern forex trading.

How do economic data releases from the UK and US affect “Cable Trade”?

Economic data releases from the UK (e.g., BoE interest rates, CPI, GDP) and the US (e.g., Fed interest rates, NFP, CPI) significantly affect Cable trade. Positive economic data from the UK or negative data from the US typically strengthens the Pound against the Dollar (leading to a higher Cable rate). Conversely, negative UK data or positive US data tends to weaken the Pound against the Dollar (lower Cable rate), driving trading decisions for “long cable” or “short cable” positions.