Navigating the Storm: Understanding the Forces Shaping G20 Currencies Amidst Global Turbulence

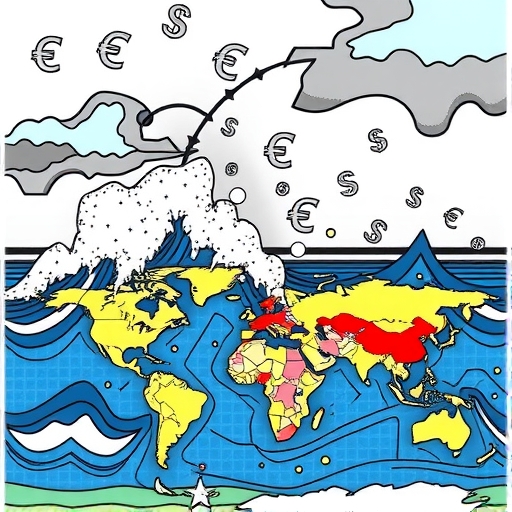

The global economic landscape is perpetually in flux, a complex tapestry woven with threads of policy, trade, and geopolitics. For anyone embarking on the journey of investment, particularly in the dynamic realm of foreign exchange, comprehending these overarching forces is not merely beneficial—it is essential. The recent G20 Finance Ministers and Central Bank Governors meeting in Durban, South Africa, served as a poignant reminder of the profound uncertainties that currently define our interconnected world. Against a palpable atmosphere of escalating geopolitical tensions and the specter of renewed trade protectionism, this forum, historically a crucible for cooperative leadership, finds itself grappling with unprecedented challenges in charting a collective course forward. This critical juncture bears significant implications for the stability and outlook of G20 currencies, as the economic health of individual nations becomes increasingly intertwined with the fragile state of global policy coordination.

You, as an aspiring or experienced trader, must recognize that currency valuations are not isolated phenomena. They are, in essence, barometers of a nation’s economic health, its political stability, and its standing within the global financial architecture. When the major economies of the G20—representing roughly 80% of global GDP—experience seismic shifts, the ripples inevitably reach every corner of the market, profoundly influencing the dynamics of G20 currencies. Let us delve deeper into the specific elements that are currently exerting the most significant pressure on these vital exchange rates, guiding you through the complexities with clarity and practical insight.

Key Factors Influencing G20 Currencies:

- Trade Wars and Tariffs: Increasing protectionism impacts currency valuations.

- Geopolitical Stability: Conflicts can lead to currency instability.

- Economic Indicators: Growth rates, inflation, and central bank policy guide currency movement.

The Looming Threat of Trade Wars: A Tariff Tsunami for G20 Currencies

Imagine the global trading system as a meticulously constructed network of highways, designed for the free and efficient flow of goods and services. Now, picture an unforeseen force erecting sudden, arbitrary toll booths, demanding an ever-increasing fee for passage. This is the essence of trade protectionism, and its most recent manifestation, the aggressive tariff policies advocated by figures like President Donald Trump, threatens to dismantle the very foundations of this global economic infrastructure. His proposed measures—a baseline 10% tariff on all US imports, a 10% levy on goods from BRICS nations, and even more punitive rates soaring up to 50% on specific items like steel, aluminum, and automobiles—are not merely economic nuisances; they are potential catalysts for profound economic upheaval.

What does this mean for G20 currencies? The impact is multifaceted and often immediate. When a country imposes tariffs, it effectively increases the cost of imported goods, making them less competitive. This can lead to a reduction in trade volumes, as businesses and consumers seek cheaper domestic alternatives or simply reduce their purchases. For export-oriented economies within the G20, such as Germany, heavily reliant on its automotive sector, these tariff threats are particularly ominous. Forecasts indicating a potential recession in Germany if auto tariffs materialize underscore the direct link between protectionist policies and national economic contraction. As economic growth slows or reverses, investor confidence wanes, leading to capital flight and, consequently, depreciation of the affected nation’s currency. A weaker currency can make exports cheaper, but it also makes imports more expensive, potentially fueling domestic inflation—a delicate balancing act for any central bank.

| Tariffs Impact on G20 Economies | Economy | Effect |

|---|---|---|

| Auto Tariff | Germany | Potential Recession |

| Steel/Aluminum Tariff | USA | Higher Costs, Lower Exports |

| BRICS Tariffs | Brazil | Reduced Trade |

Furthermore, these trade wars erode the existing rules-based global trading system, fostering an environment of fragmentation rather than cooperation. Businesses face increased uncertainty regarding future supply chains and market access, deterring investment and innovation. This pervasive policy uncertainty directly translates into currency volatility, as markets struggle to price in unpredictable political actions. For you, the trader, this means that fundamental analysis must extend beyond traditional economic indicators to include a keen awareness of political rhetoric and trade policy developments, as these non-economic factors can, and often do, trigger significant shifts in G20 currencies.

Geopolitical Fault Lines: How Global Conflicts Fragment G20 Cooperation

The G20 was forged in the crucible of the 2008 global financial crisis, born out of a collective recognition that multilateral cooperation was indispensable for addressing systemic risks. Its mission was clear: to foster robust global leadership and coordinate policies that promote economic stability and sustainable growth. Yet, today, the very fabric of this cooperative spirit is being severely tested by deep-seated geopolitical fault lines. The most prominent among these is Russia’s ongoing war in Ukraine, coupled with the resultant Western sanctions on Moscow. This conflict has not only reshaped international alliances but has also introduced an unprecedented level of acrimony and division within the G20 itself.

The Durban meeting vividly illustrated this fracture. For the first time in a year, the G20 was unable to issue a collective communiqué, a clear statement of shared understanding and agreed-upon actions. This failure to reach consensus on even basic joint statements signifies a profound paralysis, reflecting the deep ideological and political chasms that now separate key members. Moreover, the notable absence of high-profile officials, such as US Treasury Secretary Scott Bessent, from crucial meetings in South Africa, casts a long shadow over the future effectiveness of the forum. While logistical reasons might be cited, such absences invariably raise questions about the commitment of major players to the G20’s cooperative mandate, especially as the US prepares to assume its rotating presidency.

What are the implications for G20 currencies when multilateralism falters? In essence, a lack of coordinated policy responses means that individual nations are left to navigate complex global challenges in isolation. When crises emerge—be it a financial shock, a supply chain disruption, or a renewed pandemic—the absence of a unified global front amplifies their potential impact. This elevated geopolitical risk contributes directly to increased policy uncertainty, leading investors to seek safer havens, often outside the more volatile G20 emerging markets. For these currencies, the inability of their respective governments to collectively address shared economic threats translates into greater susceptibility to external shocks, driving higher volatility and potentially prolonged periods of depreciation. Your understanding of these underlying political currents is crucial, as they often dictate the broader risk appetite that governs capital flows.

| Geopolitical Events | Effect on G20 Currencies |

|---|---|

| Russia-Ukraine Conflict | Increased volatility; higher geopolitical risk |

| US Sanctions on Russia | Currency devaluation in affected economies |

| BRICS Relations | Shifting trade dynamics and currency impacts |

Decoding the IMF’s Economic Compass: Growth, Inflation, and Persistent Policy Uncertainty

To truly grasp the trajectory of G20 currencies, we must first attune ourselves to the broader macroeconomic currents, meticulously charted by institutions like the International Monetary Fund (IMF). Their World Economic Outlook (WEO) provides a critical compass for global economic health, and the April 2025 projections painted a picture of resilience tempered by undeniable precariousness. The IMF forecasts global growth at a modest 2.8% in 2025 and 3.0% in 2026. While positive, these figures remain stubbornly below the historical average, suggesting an economy that is expanding, but without the robust momentum seen in previous cycles.

Accompanying this subdued growth trajectory are persistent, albeit gradually declining, inflation rates, projected at 4.3% in 2025 and 3.6% in 2026. This slower-than-desired disinflation implies that the fight against rising prices is far from over, compelling central banks across the G20 to maintain a cautious stance on monetary policy. The IMF explicitly highlighted the dominance of downside risks to this outlook, with significant downgrades for major G20 economies like the United States and China. These revisions are primarily attributed to the pervasive policy uncertainty that hangs over the global economy, stifling demand momentum and investment.

For G20 currencies, these macroeconomic projections translate into tangible market dynamics. Lower-than-average global growth indicates a less vibrant environment for trade and investment, potentially dampening the attractiveness of growth-sensitive currencies. Persistent inflation means that central banks may need to keep interest rates higher for longer to bring price stability back into equilibrium. Higher interest rates, while potentially supporting a currency in the short term by attracting yield-seeking capital, can also stifle domestic economic activity by increasing borrowing costs for businesses and consumers. Conversely, if a country’s inflation remains stubbornly high compared to its peers, its currency could face depreciation pressures as its purchasing power erodes. As a trader, you must constantly evaluate how each G20 nation’s specific growth and inflation profile aligns with, or diverges from, the global averages, as these discrepancies often create profitable trading opportunities in G20 currencies.

Important Economic Indicators to Monitor:

- GDP Growth Rates: Essential for assessing economic health.

- Inflation Trends: Affects monetary policy decisions.

- Interest Rates: Directly influence currency strength.

Navigating Downside Risks: Why the Global Economic Outlook Demands Vigilance

Beyond the headline growth and inflation figures, the IMF’s assessment underscores a pervasive sense of caution, highlighting a landscape where downside risks are not merely present but are actively dominating the global outlook. Think of it like a ship sailing through calm waters, but with storm clouds gathering menacingly on the horizon. These risks are manifold and interconnected, encompassing everything from the potential for further geopolitical shocks to the risk of financial market instability and the stubborn persistence of inflation.

One primary concern is the potential for the aforementioned trade tensions to escalate further, triggering a full-blown trade war that severely disrupts global supply chains and significantly dampens business confidence. Another risk lies in the possibility of an unexpected resurgence of inflationary pressures, perhaps due to commodity price shocks or wage-price spirals, which could force central banks to adopt even tighter monetary policies, potentially tipping economies into recession. Furthermore, the global financial system, despite its resilience, remains vulnerable to shocks, especially given stretched asset valuations in certain sectors and high levels of private and public debt.

For you, as a participant in the currency markets, understanding these downside risks is paramount. They create an environment where sudden and sharp movements in G20 currencies are always a possibility. When global risk sentiment deteriorates, investors tend to flock to traditional safe-haven currencies like the US Dollar, the Japanese Yen, or the Swiss Franc, leading to capital outflows from more risk-sensitive G20 emerging market currencies. This flight to safety can cause rapid depreciation for currencies perceived as having higher risk profiles. Policymakers across the G20 are thus urged to implement careful macroeconomic policies, ensuring they possess sufficient fiscal space to respond to unforeseen events and calibrated monetary policies that strike a delicate balance between containing inflation and supporting growth. Your vigilance in monitoring these global risk indicators will be a key determinant of your success in navigating the often-turbulent waters of G20 currency trading.

As we navigate these turbulent waters, understanding the intricacies of global economics becomes paramount for traders. If you’re considering entering the forex market or exploring more CFD products, then Moneta Markets is a platform worth considering. Hailing from Australia, it offers over 1000 financial instruments, suitable for both novice and professional traders.

The Sovereign Debt Burden: A Looming Challenge for G20 Emerging Markets

The issue of debt sustainability stands as a formidable challenge, particularly for the Emerging Market and Developing Economies (EMDEs) within the G20. Picture a tightrope walker trying to maintain balance: the higher the debt, the more precarious their position, especially when the cost of borrowing increases. Global interest rates have been on an upward trajectory, significantly increasing the cost of servicing existing debt and making it more expensive for countries to raise new capital. This high cost of capital is a critical impediment to growth for many EMDEs, diverting resources that could otherwise be invested in infrastructure, education, or healthcare into debt repayments.

Many G20 emerging markets entered the recent period of monetary tightening with elevated debt levels, exacerbated by the unprecedented fiscal stimulus deployed during the pandemic. This leaves them with diminished fiscal space—the room a government has to increase spending or cut taxes without jeopardizing its financial stability. The IMF has consistently emphasized the urgent need for these nations to restore this fiscal space, highlighting that a precarious debt position undermines investor confidence and directly impacts a country’s credit rating. A downgrade in a nation’s credit rating typically leads to higher borrowing costs and can trigger capital flight, putting significant downward pressure on its currency.

| Country | Debt Profile | Currency Vulnerability |

|---|---|---|

| South Africa | High debt levels post-COVID | Risk of depreciation |

| Brazil | Growing fiscal debt | Capital flight risk |

| Argentina | Chronic default risk | Severe currency instability |

For you, the trader, this means that understanding the debt profile of G20 nations is a fundamental aspect of currency analysis. Currencies of countries with unsustainable debt trajectories are highly vulnerable to sharp depreciation, especially during periods of global financial stress. South Africa, as the host of the G20 meeting, admirably placed an emphasis on an “African agenda,” bringing issues like the high cost of capital and climate change funding for the continent to the forefront of discussions. This focus underscores the reality that many developing G20 members face unique challenges that require tailored solutions to prevent their currencies from becoming perpetually destabilized by overwhelming debt burdens.

Unlocking Capital Flows: Strategies for Strengthening Public Finances and Debt Restructuring

Given the pressing challenges of sovereign debt, the G20 and international financial institutions like the IMF are actively pursuing strategies to alleviate these burdens and foster a more stable environment for capital flows. The objective is not merely to manage debt but to transform it into a catalyst for renewed investment and sustainable growth, thereby bolstering the resilience of G20 currencies. A cornerstone of this strategy is the strengthening of public finances through two primary avenues: domestic revenue mobilization and efficient public spending. This means helping countries collect taxes more effectively and ensuring that every dollar spent by the government yields maximum impact, particularly for Low-Income Countries (LICs) and African nations that often struggle with these fundamentals.

Beyond internal reforms, progress is also being made on improving global debt restructuring mechanisms. The Global Sovereign Debt Roundtable’s “Restructuring Playbook” is a key initiative, aiming to provide a more predictable and orderly framework for nations facing repayment difficulties. Similarly, the G20 Common Framework, designed to facilitate timely and orderly debt treatments for eligible countries, continues to be a vital tool, though its implementation has faced challenges. These frameworks seek to bring together official and private creditors to ensure fair burden-sharing and provide indebted nations with a pathway back to fiscal health.

From a currency perspective, successful debt restructuring and robust public finance management are incredibly positive signals for investors. When a country demonstrates a credible commitment to managing its finances and has a clear plan for resolving its debt issues, investor confidence rises. This can lead to increased foreign direct investment (FDI) and portfolio capital inflows, as investors are more willing to commit funds to a stable and fiscally responsible environment. Such inflows directly support the local currency, increasing demand for it and helping to stabilize or even appreciate its value. For you, tracking the progress of these debt initiatives and a nation’s commitment to fiscal prudence is a powerful indicator of its currency’s potential performance, offering valuable insights for long-term positions in G20 currencies.

The Bedrock of Stability: Why Central Bank Independence is Non-Negotiable for G20 Currencies

In the complex architecture of a modern economy, the central bank serves as a critical independent umpire, tasked with maintaining price stability and safeguarding the integrity of the financial system. For G20 currencies, the independence of their respective central banks is not merely an academic ideal; it is a foundational pillar of their credibility and stability. Warnings against political interference in central bank independence, echoing past rhetoric from figures like Donald Trump towards the Federal Reserve, are paramount because such interference can unleash a cascade of detrimental consequences.

Why is this independence so vital? Central banks, like the US Federal Reserve, the European Central Bank, or the Bank of England, are responsible for setting monetary policy—controlling interest rates and the money supply—to achieve their mandates, typically low and stable inflation. When political actors exert undue pressure on these institutions to prioritize short-term political gains over long-term economic stability, the central bank’s credibility is severely undermined. If markets perceive that a central bank is no longer making decisions based on sound economic principles but rather on political expediency, trust erodes rapidly. This loss of trust can lead to an unanchoring of inflation expectations, making it significantly harder to control prices. The consequence for the currency is often a sharp depreciation, as investors flee an environment where the stability of money is compromised.

Consider the analogy of a trusted bank account: you trust it because you know your money is safe and its value will be preserved. If you suddenly learn that someone outside the bank can arbitrarily dictate how your money is managed, your trust evaporates. Similarly, the strength and stability of G20 currencies hinge on the market’s unwavering belief in the central bank’s autonomy to execute its mandate without political meddling. Vigilant protection of this independence is therefore a non-negotiable prerequisite for maintaining not just price and financial stability, but also the very confidence that underpins the value of a nation’s currency in the global marketplace. As a trader, always monitor the political discourse surrounding central bank autonomy; any perceived threat can be a significant red flag for the associated currency.

For traders looking to capitalize on or hedge against these movements in G20 currencies, having a robust trading platform is essential. When choosing a trading platform, the flexibility and technological advantages of Moneta Markets are worth noting. It supports mainstream platforms like MT4, MT5, and Pro Trader, combining high-speed execution with low spread settings to provide an excellent trading experience.

Guarding Against Shocks: Financial Stability and the Unseen Risks in Non-Bank Financial Institutions

While central bank independence is crucial, it is only one component of the broader framework required for enduring financial stability. The G20’s discussions also highlighted persistent financial stability risks stemming from various sources within the global financial system. Think of the financial system as a vast, interconnected network of pipes and reservoirs; while the main arteries (banks) are closely monitored, there are increasingly large and opaque segments (like NBFIs) that could pose systemic risks if left unchecked. Stretched asset valuations—where asset prices appear inflated relative to their underlying fundamentals—and high leverage in certain sectors of the financial system are particular areas of concern. When asset prices are artificially high, they are vulnerable to sharp corrections, which can trigger widespread losses and instability.

A significant focus of regulatory attention is now directed towards Non-Bank Financial Institutions (NBFIs), often referred to as the “shadow banking” sector. These entities, which include hedge funds, money market funds, and various types of investment vehicles, perform credit intermediation functions traditionally associated with banks but operate with less stringent regulation and oversight. The concern is that while individual NBFIs may not be systemically important, their collective activities, high leverage, and interconnectedness could create systemic risks. A sudden loss of confidence or a liquidity crunch in this sector could propagate rapidly through the broader financial system, potentially triggering a wider crisis.

For G20 currencies, robust financial supervision and vigilant surveillance of both traditional and non-bank financial sectors are absolutely crucial. A systemic financial crisis originating from within any major G20 economy, or spreading across borders, would inevitably lead to widespread market turmoil, flight to safety, and significant depreciation of affected currencies. The lesson from past crises is clear: ensuring that risks are identified and managed proactively, especially in opaque areas of the financial system, is paramount to preventing disruptive market moves that could destabilize currencies and economies alike. Your awareness of these underlying structural risks in the financial system will enhance your ability to anticipate potential market shocks and their subsequent impact on G20 currencies.

The G20’s Quest for Consensus: Bridging the Divide in a Fractured World

At its core, the G20 forum embodies the aspirational ideal of multilateralism—the principle of cooperation among nations on common issues. It emerged from the 2008 global financial crisis with a clear mandate: to provide coordinated leadership and solutions to pressing global challenges. Yet, as evidenced by the Durban meeting, the G20’s quest for consensus in a world increasingly fractured by geopolitical rifts and divergent national interests is proving to be an arduous one. The failure to issue a collective communiqué, a standard output of such high-level gatherings, highlights the profound difficulties in bridging these divides.

The significance of high-level absences, such as that of the US Treasury Secretary, cannot be overstated. While one individual’s absence may seem minor, it can signal a broader wavering commitment to collective action, especially from a nation as economically influential as the United States. As the US prepares to assume its rotating G20 presidency, the challenges of fostering unity and driving coordinated policies will be immense. The deep disagreements over issues like the Russia-Ukraine war and global trade policy undermine the very purpose of the G20: to collectively address shared economic problems. When major powers cannot even agree on a common narrative, let alone a common set of actions, the effectiveness of global governance is severely hampered.

What does this mean for the stability of G20 currencies? In an ideal world, the G20 would serve as a crucial coordinating body, ensuring that the macroeconomic policies of its members are harmonized to promote global stability and growth. When this coordination falters, individual nations are left to pursue their own agendas, sometimes at the expense of global stability. This lack of a cohesive global economic strategy contributes to heightened policy uncertainty and makes the world economy more vulnerable to shocks. For you, the trader, this necessitates a more nuanced approach, one that recognizes the increased likelihood of policy divergence among G20 members, which in turn can lead to greater volatility and less predictable movements in their respective currencies. The absence of a strong, unified G20 voice is, in itself, a significant factor influencing the risk premium attached to certain G20 currencies.

Beyond Communiqués: The Imperative for Coordinated Action and its Impact on G20 Currencies

The inability of the G20 to consistently issue collective communiqués is a symptom, not the root cause, of the challenges facing global economic cooperation. The true imperative lies in the capacity for coordinated action—the collective implementation of policies designed to foster shared prosperity and stability. In an increasingly volatile and interconnected world, no single nation, regardless of its economic might, can effectively address monumental challenges like climate change, global pandemics, or systemic financial risks in isolation. Multilateralism, despite its current struggles, remains the most viable pathway to achieving these shared goals.

For G20 currencies, the implications of successful, coordinated action are profound. When major economies agree on fundamental macroeconomic policies—whether it’s managing inflation, stimulating growth, or addressing debt vulnerabilities—it creates a more predictable and stable global economic environment. This stability reduces policy uncertainty, encourages cross-border investment, and builds investor confidence. For instance, coordinated fiscal stimulus during a global downturn can amplify its positive effects, while coordinated efforts to strengthen financial regulations can prevent future crises. Such collaboration instills a sense of collective resilience, making individual G20 currencies less susceptible to idiosyncratic shocks and fostering a more balanced and efficient global capital allocation.

Conversely, a continued drift towards uncoordinated, nationalistic policies risks exacerbating global imbalances and creating a less favorable environment for G20 currencies. The world needs robust multilateralism to ensure the free flow of trade, capital, and ideas, which are the lifeblood of economic growth. The path forward for G20 economies and the resilience of their currencies hinges critically on the ability of these major powers to transcend their differences, re-establish trust, and implement macroeconomic policies that are not only nationally beneficial but also globally synergistic. As you refine your trading strategies, remember that the degree of cooperation (or lack thereof) among the G20 powers will continue to be a powerful, underlying current shaping the performance and prospects of the currencies you trade.

In an era of heightened global uncertainty, selecting a reliable and secure forex broker is as crucial as mastering market analysis. If you are looking for a regulated and globally tradable forex broker, Moneta Markets holds multi-country regulatory certifications including FSCA, ASIC, and FSA. They also offer segregated client funds, free VPS, and 24/7 Chinese customer service, making them a top choice for many traders.

Conclusion: Charting a Course for G20 Currencies in a Volatile World

The Durban G20 meeting served as a stark, yet crucial, reminder of the profound uncertainty clouding the global economic outlook and, by direct extension, the future trajectory of G20 currencies. We have dissected the formidable pressures at play, from the destabilizing shadow of escalating trade wars and deeply entrenched geopolitical fissures to the persistent macroeconomic challenges of subdued growth, stubborn inflation, and pervasive sovereign debt burdens. The imperative to uphold central bank independence and fortify financial stability, particularly in the opaque realm of Non-Bank Financial Institutions, has never been more critical.

While the calls for bold, cooperative leadership echo loudly across the international stage, the current state of multilateralism remains fragile. The G20, a forum once celebrated for its decisive action, now struggles to forge consensus, a symptom of the deeper rifts that divide its members. For you, the astute trader, this environment is not merely one of risk but also of opportunity, provided you possess a nuanced understanding of these complex interdependencies. The stability and resilience of G20 currencies will not solely depend on the intrinsic strength of individual economies, but equally on the collective capacity of these major powers to transcend their differences, re-establish trust, and implement coordinated macroeconomic policies. Only through such concerted action can we hope to foster an environment of genuine stability, sustainable growth, and collective prosperity in an increasingly volatile and interconnected world. Your journey in currency trading will undoubtedly be enriched by a continuous and rigorous engagement with these powerful global forces.

g20 currenciesFAQ

Q:What factors influence G20 currencies?

A:Key factors include trade wars, geopolitical stability, and economic indicators such as growth rates and inflation.

Q:How do trade conflicts affect currency valuation?

A:Trade conflicts can lead to reduced trade volumes and investor confidence, resulting in depreciation of affected currencies.

Q:Why is central bank independence important for G20 currencies?

A:Central bank independence is crucial for maintaining price stability and investor trust, which are essential for currency strength.