“`html

Navigating the Market’s Whispers: An Introduction to Chart Patterns

In the dynamic world of financial markets, understanding price movements is paramount to successful trading. We, as aspiring or seasoned traders, constantly seek tools and frameworks to decode the market’s intentions. Among the most venerable and insightful tools at our disposal is technical analysis, a discipline dedicated to studying past price and volume data to predict future price action. Within this extensive realm, chart patterns emerge as visual representations of market psychology, offering crucial clues about potential trend continuations or reversals. Think of them as the market’s subtle whispers, often signaling significant shifts before they become obvious to everyone.

Why do these patterns hold such significance? Because human behavior, especially when driven by fear and greed, tends to repeat itself. These repetitive behaviors manifest as recognizable shapes on a price chart, shapes that we can learn to identify, interpret, and, most importantly, profit from. While the market can be unpredictable, these patterns provide a probabilistic edge, helping us identify high-potential trading opportunities. You might wonder, how can simple lines on a chart tell us so much? It’s precisely because they distill the complex interplay of buying and selling pressure into actionable insights. They are not magic, but rather a reflection of the collective sentiment of millions of participants. Are you ready to dive deeper into these visual cues that can transform your trading approach?

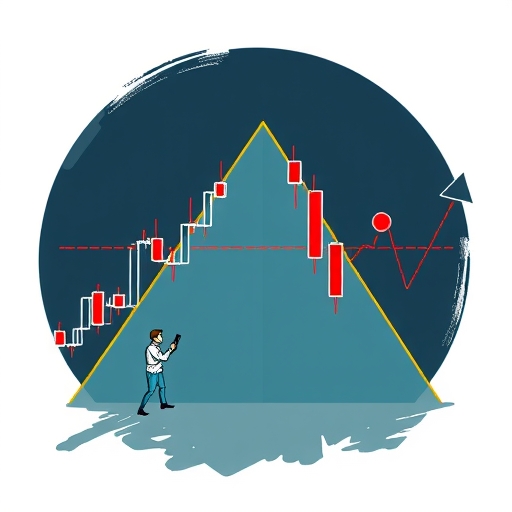

Today, our focus zeroes in on one of the most versatile and, at times, deceptively simple patterns: the triangle chart pattern. While often associated with trend continuation, we will explore its less common, yet profoundly powerful, role as a reversal pattern, particularly when it emerges within a prevailing downtrend. This specific scenario, often overlooked by less experienced traders, can unlock significant long opportunities in a seemingly bearish market. Our mission is to equip you with the knowledge to not just identify these patterns, but to understand the underlying market dynamics that create them, empowering you to make informed, strategic trading decisions.

The Core Mechanics: What Are Triangle Chart Patterns?

Before we delve into the nuances of specific triangle formations, let’s establish a foundational understanding of what a triangle chart pattern truly represents. At its heart, a triangle pattern is a period of price consolidation, where the market pauses, and both buyers and sellers appear to be losing conviction, causing price swings to become narrower over time. This consolidation phase is characterized by the convergence of two trendlines drawn along the peaks and troughs of the price action. Imagine a coiled spring: the energy is building up, but it’s not yet released. That’s what a triangle often signifies – a build-up of pressure preceding a significant price move, or a “breakout.”

Typically, these patterns form over several weeks or months, indicating a period of indecision or equilibrium between supply and demand. The diminishing price volatility within the triangle suggests that the market is awaiting a catalyst, a new piece of information, or simply a shift in collective sentiment to break out of its current range. When this breakout occurs, it often happens with a burst of volume, signifying that the period of indecision has ended and a new, decisive trend has begun. But how do we categorize these triangles, and what does each type usually signal?

There are three primary types of triangle patterns, each with distinct characteristics and implications:

- Symmetrical Triangle: This pattern forms when the price makes progressively lower highs and higher lows, creating two converging trendlines, one sloping downwards and the other sloping upwards. It signifies a period of genuine indecision, where neither buyers nor sellers are dominant. The breakout can occur in either direction, typically continuing the prior trend.

- Descending Triangle: A bearish pattern characterized by a flat, horizontal support level and a downward-sloping resistance trendline formed by lower highs. It indicates that sellers are consistently pushing prices lower against a fixed support level. A breakdown below the horizontal support usually signals a bearish continuation.

- Ascending Triangle: Our primary focus, this is a generally bullish pattern. It features a horizontal resistance trendline at the top, representing a ceiling that buyers are repeatedly trying to breach, and an upward-sloping support trendline at the bottom, formed by successive higher lows. This indicates that buyers are becoming more aggressive, pushing the price up with each pullback. A breakout above the horizontal resistance typically signals a bullish continuation.

While their typical interpretations are valuable, it’s crucial to remember that patterns are not always textbook perfect, nor are they foolproof. The context in which they appear, particularly the preceding trend, plays a vital role in their interpretation. Are you ready to see how an ascending triangle can tell a very different story depending on its market backdrop?

Decoding the Ascending Triangle: A Foundation for Bullish Momentum

Let’s take a closer look at the ascending triangle pattern, an inherently bullish formation that every trader should understand. As we’ve briefly touched upon, this pattern is characterized by two distinct trendlines: a relatively flat or horizontal upper trendline acting as a strong resistance level, and a rising lower trendline, connecting a series of progressively higher lows. Visualize it as a ramp leading up to a ceiling. Each time the price pulls back, it doesn’t fall as low as the previous time, indicating that buyers are stepping in at higher and higher prices, signaling increased demand and underlying buying pressure. They are relentlessly pushing the price towards that fixed resistance level.

The psychology behind the ascending triangle is fascinating. The horizontal resistance represents a price point where sellers have consistently entered the market, preventing further upside movement. However, the rising lower trendline tells a different story. It shows that despite hitting resistance, buyers are not giving up. Each time the price pulls back, sellers are becoming weaker, or buyers are becoming stronger, unwilling to let the price drop to previous low levels. This persistent accumulation of buying power beneath the resistance level creates an environment ripe for an eventual breakout. It’s like a spring being compressed more and more tightly against a solid barrier, building up immense potential energy.

Typically, when an ascending triangle forms in an existing uptrend, it is interpreted as a continuation pattern. This means that after a period of consolidation, the price is expected to break above the horizontal resistance and continue its upward trajectory, resuming the primary trend. The breakout is often accompanied by a significant surge in volume, which acts as a powerful confirmation signal, validating the strength of the bullish move. Without this volume confirmation, a breakout might be considered a “head fake” or a false signal. Do you see how the subtle shift in buying behavior, even during consolidation, can paint a clear picture of future potential?

The strength of this pattern lies in its predictability, given the right context and confirmation. Traders often anticipate the breakout and position themselves to capitalize on the ensuing move. But what happens when this typically bullish pattern appears in a market that has been firmly moving downwards? This is where the ascending triangle truly reveals its versatile and potent nature as a reversal signal, a scenario that holds immense value for astute traders.

The Counter-Intuitive Twist: Ascending Triangle as a Reversal in a Downtrend

While the ascending triangle is predominantly known as a bullish continuation pattern during an uptrend, its appearance within a prolonged downtrend can be a profoundly powerful signal for a market reversal. This is where many novice traders might misinterpret the pattern or overlook its significance entirely. When price action has been consistently moving lower, characterized by lower highs and lower lows, and an ascending triangle begins to form, it suggests a crucial shift in market dynamics. Imagine a company’s stock that has been steadily declining due to negative news or broader market sentiment. Then, suddenly, buyers start to show increasing interest, preventing the price from falling to new lows, even as it struggles to overcome a specific resistance level. This is the essence of an ascending triangle in a downtrend.

In this unique context, the horizontal resistance level no longer acts as a mere pause in an uptrend; instead, it represents a battleground where persistent buying pressure is starting to overwhelm the previously dominant selling pressure. The series of higher lows forming the rising support trendline indicates that sellers are losing conviction and are no longer able to push the price down to prior extreme lows. Buyers are stepping in earlier and at increasingly higher price points, absorbing the selling interest that previously drove the downtrend. This gradual but persistent strengthening of buying power suggests a fundamental shift in market sentiment from bearish to bullish. It’s like the tide turning: the ebb of the downtrend is weakening, and the flow of an uptrend is beginning to assert itself.

The significance of this formation in a downtrend cannot be overstated. When the price ultimately breaks above the horizontal resistance of an ascending triangle in this scenario, it is often a definitive signal that the prior downtrend has ended and a new uptrend is commencing. This bullish reversal can present some of the most lucrative long trading opportunities, as the initial move from a long-established downtrend can be quite explosive. You are, in essence, identifying the very bottom or near-bottom of a price cycle, positioning yourself for a significant upward move. But how can we distinguish this potent reversal pattern from other formations, and what specific characteristics should we look for to confirm its validity?

The Anatomy of a Reversal: Identifying Key Features of the Downtrend Ascending Triangle

To accurately identify and trade the ascending triangle as a reversal pattern within a downtrend, we must pay meticulous attention to its structural anatomy and the accompanying market behavior. This isn’t merely about spotting the two converging trendlines; it’s about understanding the specific nuances that validate its potential as a trend-changing force. Let’s break down the critical elements you need to observe.

First and foremost, the **preceding trend** is non-negotiable. For an **ascending triangle** to be considered a **reversal pattern**, it *must* appear after a clear and established downtrend. This downtrend should be characterized by a series of lower highs and lower lows over a significant period. If the pattern forms within a choppy, sideways market or an existing uptrend, its interpretation shifts dramatically. Without a prior downtrend, it cannot signal a reversal of that downtrend.

Next, let’s examine the **trendlines** themselves:

- The Horizontal Resistance Line: This upper trendline should be relatively flat, connecting at least two, preferably three or more, distinct high points that occur at approximately the same price level. This line signifies a persistent supply zone, a price ceiling that the market has struggled to overcome. The more touches this line has, the more significant its psychological barrier.

- The Rising Support Line: This lower trendline is drawn by connecting at least two, but ideally three or more, progressively **higher lows**. This upward slope is critical. It indicates increasing buying pressure as market participants are willing to bid higher for the asset during pullbacks, unwilling to let the price decline to previous low levels. This is the clearest sign of shifting sentiment away from bearish dominance.

Volume analysis is an indispensable component of pattern identification, especially for triangles. During the formation of the **ascending triangle**, you should typically observe **decreasing volume**. This decline in volume reflects the period of consolidation and indecision, as fewer participants are actively trading within the narrowing range. It’s the calm before the storm. However, when the eventual **breakout** above the horizontal resistance occurs, it must be accompanied by a **significant surge in volume**. This explosion in volume confirms that institutional money and a broad base of traders are entering the market, validating the breakout and indicating strong conviction behind the new upward move. A breakout on low volume is often a **false breakout** or a “head fake,” which we’ll discuss later.

Finally, consider the **timeframe**. Ascending triangles, especially those signaling reversals, are more reliable on longer timeframes (e.g., daily or weekly charts) because they represent a more significant shift in market psychology. While they can appear on intraday charts, their predictive power tends to be weaker due to increased market noise. Are you seeing how each piece of the puzzle, from the preceding trend to the volume behavior, contributes to a robust pattern interpretation?

Crafting Your Strategy: Entry Points and Profit Targets for Bullish Reversals

Once you’ve diligently identified an ascending triangle forming within a downtrend, signaling a potential bullish reversal, the next critical step is to formulate a clear, actionable trading strategy. This involves pinpointing optimal **entry points**, setting realistic **profit targets**, and, crucially, managing your risk. Remember, the goal isn’t just to spot a pattern; it’s to translate that observation into profitable trades while safeguarding your capital.

For **entry**, the most common and robust signal is a definitive **breakout** above the horizontal resistance level. This is the moment the coiled spring finally releases its energy. There are typically two main approaches to entering a trade:

- Aggressive Entry (Immediate Breakout): Some traders opt to enter immediately upon the price decisively closing above the resistance line, ideally on a strong candle (like a Marubozu candlestick) and accompanied by a significant **volume** spike. This approach aims to capture the initial explosive move and potentially higher profits, but it also carries higher risk if the breakout turns out to be false.

- Conservative Entry (Retest Confirmation): A more prudent approach involves waiting for the price to break out, then pull back to **retest** the newly broken resistance level, which often transforms into a **support level**. If the price holds above this retested level and shows signs of renewed buying interest (e.g., a bullish candlestick pattern like a hammer or engulfing pattern), it offers a higher-probability entry. This method might mean missing some of the initial move, but it significantly reduces the risk of a false breakout.

When you enter, you should have a clear **take profit** target in mind. The most widely accepted method for calculating a price target from a triangle pattern is to measure the vertical height of the triangle at its widest point (the base) and then project that height upwards from the **breakout point**. For example, if the triangle’s base is $10 wide, and the breakout occurs at $50, your potential profit target would be $60. This projection is based on the idea that the energy compressed within the triangle will be released, propelling the price by at least the magnitude of its consolidation range.

Consider a stock, say Apple (AAPL), that has been in a sustained downtrend. You observe an ascending triangle forming, with its base measuring $20. If AAPL breaks above the horizontal resistance at $170 with surging volume, your projected target would be $190. This gives you a clear objective for your trade. It’s about having a map, not just a compass.

Whether you are trading stocks, cryptocurrencies, or currency pairs, the principles of breakout and target setting remain consistent. If you’re exploring the vast opportunities within the **forex market** or other Contract for Difference (CFD) instruments, choosing a platform that offers robust tools and diverse instruments is crucial. If you’re considering starting **forex trading** or exploring more CFD products, then Moneta Markets is a platform worth considering. It hails from Australia and offers over 1000 financial instruments, catering to both novice and professional traders.

Having a well-defined entry and profit target is only half the battle. The other, equally important half, is managing the downside. How do we protect our capital when the market doesn’t behave as expected?

Mastering Risk: Stop-Loss Placement and Managing Uncertainty in Triangle Trades

No trading strategy, no matter how robust, is without risk. In the volatile world of financial markets, **false breakouts** and unexpected market turns are a constant possibility. This is why disciplined **risk management**, particularly the strategic placement of a **stop-loss order**, is not just advisable, but absolutely critical when trading ascending triangle patterns, especially when seeking a **reversal** in a downtrend. Your stop-loss is your safety net; it limits your potential losses if the trade goes against you, protecting your capital for future opportunities.

Where should you place your stop-loss for an ascending triangle breakout? The most common and logical placement is just below the horizontal **resistance line** that has now been breached. Why? Because if the price falls back below this level after breaking out, it signals that the breakout was likely false, or that the bullish momentum has failed. Alternatively, a slightly more conservative approach, particularly for a reversal play, is to place the stop-loss below the last significant **swing low** within the triangle’s rising support trendline. This provides a bit more breathing room but also entails a larger potential loss per trade.

Let’s revisit our Apple (AAPL) example. If you entered long at $170 after the breakout, placing your stop-loss just below $170 (e.g., $169.50) means you’re protecting yourself if the price dips back into the triangle. If the last significant swing low within the triangle was $160, a more conservative stop-loss might be at $159. The choice depends on your risk tolerance and the volatility of the asset. The key is that once your stop-loss is hit, you exit the trade without hesitation, regardless of what you *think* the market might do next. This is paramount to preserving your capital.

Understanding **false breakouts**, sometimes called “head fakes” or “fake-outs,” is also vital. A false breakout occurs when the price briefly moves beyond the resistance (or support) level, giving the impression of a valid breakout, only to quickly reverse direction and move back into the pattern or in the opposite direction. These can be particularly frustrating as they trap unsuspecting traders. How do we avoid them?

- Confirmation is Key: As previously mentioned, always wait for strong volume confirmation on the breakout candle. A breakout on low volume is a red flag.

- Multiple Closures: Wait for the price to close above the resistance line for at least one, preferably two, consecutive candles on your chosen timeframe (e.g., two daily closes above resistance for a daily chart pattern). This helps ensure the breakout has conviction.

- Retest Confirmation: As discussed for conservative entry, waiting for a retest of the broken resistance as support provides an excellent filter against false breakouts. If the retest fails and the price breaks back below, it’s a strong sign of a failed breakout.

Managing uncertainty also means acknowledging that no pattern is 100% accurate. Markets are influenced by a myriad of factors, including unexpected news events, macroeconomic shifts, and algorithmic trading, all of which can override even the most perfectly formed chart patterns. Your **risk-reward ratio** should always be favorable, ideally at least 1:2 or 1:3, meaning your potential profit is at least twice or thrice your potential loss. This ensures that even if you only win 50% of your trades, you can still be profitable overall. Are you committing to embracing risk management as a cornerstone of your trading philosophy?

Augmenting Your Edge: Confirming Breakouts with Volume and Auxiliary Indicators

While recognizing the pure **price action** of an ascending triangle is fundamental, experienced traders rarely rely on a single indicator or pattern in isolation. To significantly increase the probability of a successful trade and minimize the likelihood of a **false breakout**, it is crucial to **confirm** the pattern’s validity and the breakout’s strength using additional tools. Think of these auxiliary indicators as your supporting cast, providing additional evidence to build a stronger case for your trade. The two most critical confirmation tools are volume and momentum indicators like **RSI (Relative Strength Index)** and **MACD (Moving Average Convergence Divergence)**.

The role of **volume** cannot be overstated. As discussed, during the formation of the ascending triangle, particularly in a downtrend, you’ll often see volume gradually decrease, reflecting the market’s indecision and the tightening price range. However, the true litmus test of a genuine **breakout** is a dramatic **surge in volume** as the price pushes above the horizontal **resistance level**. This explosion of volume signals that significant capital is entering the market, confirming strong conviction behind the bullish move. A breakout without a substantial increase in volume should be treated with extreme caution, as it often leads to a quick reversal and a false signal. It’s like a car trying to accelerate without enough fuel – it won’t go far.

Beyond volume, momentum oscillators like **RSI** and **MACD** can provide valuable insights into the underlying strength of the price action.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. For a bullish breakout from an ascending triangle, you would ideally want to see the RSI moving above the 50-level, and potentially pushing towards 70 or higher, indicating increasing bullish momentum. Divergences between price and RSI (e.g., price making higher lows but RSI making lower lows during the triangle’s formation) can also offer early warning signs of weakening selling pressure before the breakout.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. For a bullish breakout, look for a **bullish crossover** of the MACD line above the signal line, ideally occurring around the time of the price breakout or just before it. A move of the MACD histogram into positive territory (above zero) further confirms strengthening bullish momentum.

Let’s consider an example: You spot an ascending triangle in a major currency pair like EUR/USD, which has been in a persistent downtrend. As the price breaks above the horizontal resistance, you observe a significant spike in trading volume. Simultaneously, you check the RSI, and it has just moved decisively above 50, showing increasing buying momentum. Your MACD also registers a fresh bullish crossover. These multiple layers of confirmation significantly enhance the probability of a successful **bullish reversal** trade. They act as a checklist, ensuring you have enough evidence before committing your capital. By integrating these tools, you are not just seeing the pattern; you are understanding the forces driving it. Are you ready to apply these confirmation techniques in your own analysis?

Beyond the Textbook: Real-World Considerations and Adaptability

While theoretical knowledge of chart patterns is essential, navigating the actual financial markets requires a degree of adaptability and an understanding that textbook examples are often tidier than reality. The **ascending triangle**, particularly in its role as a reversal pattern in a downtrend, is a powerful concept, but applying it successfully in the real world demands more than just rote memorization. We need to consider market noise, the interplay of different patterns, and the varying characteristics across different asset classes. Are you ready to move beyond the perfect diagrams and into the messy, yet profitable, reality of trading?

One key consideration is **market noise**. On smaller timeframes (e.g., 1-hour or 15-minute charts), price action can be highly volatile and subject to random fluctuations. This noise can make identifying clear triangle patterns challenging and increase the likelihood of **false breakouts**. This is why we often emphasize that patterns tend to be more reliable on higher timeframes (daily, weekly), as they filter out much of the short-term noise and reflect more significant shifts in market psychology. For example, a minor ascending triangle on a 5-minute chart of Amazon (AMZN) might be quickly invalidated, whereas one forming on the daily chart could signal a sustained reversal.

Furthermore, patterns rarely appear in isolation. Often, an **ascending triangle** might form as part of a larger, more complex pattern, or it might be preceded or followed by other recognizable formations. For instance, a small ascending triangle might form within a larger falling wedge pattern (another bullish reversal pattern). Recognizing these nested or complementary patterns can provide even stronger confirmation for your trade. It’s like finding multiple clues that all point to the same conclusion, building a stronger case for a potential trade. Experienced traders develop an eye for these intricate relationships over time through practice and observation.

The behavior of **triangle patterns** can also vary slightly across different **financial instruments**. While the core principles remain the same for **stocks**, **commodities**, and **forex pairs**, the typical volatility and underlying market drivers can influence how cleanly patterns form and how quickly breakouts occur. For instance, currency pairs in the **forex market** might exhibit different characteristics due to their 24/5 trading nature and sensitivity to economic news. Similarly, cryptocurrencies, known for their extreme volatility, might see more explosive breakouts but also more frequent false signals. Understanding the specific dynamics of the asset you are trading is paramount.

For traders navigating the vast opportunities across various asset classes, especially in the **forex market** where real-time execution and low spreads are crucial, the choice of a trading platform becomes a critical component of success. In selecting a trading platform, Moneta Markets‘ flexibility and technological advantages are worth noting. It supports mainstream platforms like MT4, MT5, and Pro Trader, combining high-speed execution with low-spread settings, providing an excellent trading experience.

Ultimately, successful application of these patterns comes down to continuous learning, consistent practice, and developing a deep intuitive feel for the market. No two patterns are identical, and flexibility in your analysis is key. Are you prepared to embrace the complexities of the real market and continually refine your approach?

The Impermanence of Patterns: Recognizing Failed Setups and Adapting Your Approach

A fundamental truth in **technical analysis** is that no pattern, no indicator, and no strategy is foolproof. The market is an inherently probabilistic environment, not a deterministic one. This means that while an **ascending triangle** in a **downtrend** is a powerful **bullish reversal pattern**, it will not always play out as expected. Sometimes, the pattern “fails.” Recognizing a **failed setup** or a **false breakout** is just as crucial, if not more so, than identifying a successful one, as it prevents significant capital loss and allows you to adapt your trading plan. Are you prepared to accept that even the best analysis can sometimes be wrong, and how will you respond?

A **failed ascending triangle** occurs when, after its formation, the price does not break out bullishly above the horizontal **resistance level**. Instead, it might:

- Break Down Below Support: The most significant sign of failure is when the price breaks decisively below the rising **support trendline**. This indicates that the buying pressure, which was previously building through higher lows, has now capitulated. Sellers have regained control, and the original downtrend is likely to continue or even accelerate. This scenario should trigger an immediate exit if you’ve already entered, or a complete abandonment of the long trade idea.

- Revert Within the Pattern: The price might attempt a breakout, move slightly above the resistance, but then quickly reverse and fall back *inside* the triangle. This is the classic **false breakout** or “head fake.” It traps eager buyers who entered on the initial surge, only to see their positions quickly turn negative. We discussed mitigating these with volume confirmation and waiting for multiple closes or a retest.

- Lose Momentum and Drift Sideways: The pattern might lose its characteristic shape and simply drift sideways in a very tight range without a clear breakout in either direction. This suggests extreme indecision and a lack of conviction from both buyers and sellers, rendering the pattern’s predictive power null.

Why do patterns fail? Multiple reasons. Perhaps a sudden, unexpected news event impacts market sentiment. Maybe a larger, overriding trend or pattern is exerting more influence. Or perhaps the buying pressure wasn’t as strong as it appeared, and institutional sellers stepped in at the resistance level with overwhelming force. It’s a reminder that no chart pattern exists in a vacuum. It’s a tool for analysis, not a crystal ball.

Your ability to adapt and manage these failed setups is what truly distinguishes a professional trader. It requires emotional discipline to cut losses quickly and analytical flexibility to reassess the market’s true intentions. If an **ascending triangle** in a **downtrend** fails to produce the expected **bullish reversal**, you must:

- Exit Your Trade: If your stop-loss is hit, honor it without hesitation. This is non-negotiable.

- Re-evaluate: Take a step back. Is the downtrend still intact? Has a new bearish pattern emerged? Your initial analysis of a reversal was incorrect, and the market is telling you something new.

- Avoid Recency Bias: Don’t let a failed trade sour your outlook on the pattern itself. Every trade is independent, and the probabilistic edge still exists over a series of trades.

The journey to mastering **technical analysis** is not about being right every time, but about managing risk effectively and adapting your strategy when you are wrong. Are you ready to embrace this core tenet of trading and fortify your resilience?

Your Journey Forward: Embracing Continuous Learning in Technical Analysis

We’ve embarked on a comprehensive exploration of the **ascending triangle chart pattern**, particularly its potent, often counter-intuitive role as a **bullish reversal signal** when it emerges within a prevailing **downtrend**. We’ve dissected its anatomy, understood the underlying market psychology, crafted strategies for entry and profit taking, and critically, emphasized the non-negotiable importance of **risk management** and recognizing failed setups. You now possess a deeper understanding of how this single pattern can offer distinct, high-probability trading opportunities in varying market contexts. But your journey in mastering **technical analysis** is an ongoing one, an evolution of skill and insight.

The financial markets are dynamic, constantly evolving landscapes. What works today might need slight adjustments tomorrow. The patterns themselves remain consistent because human psychology doesn’t fundamentally change, but their manifestation can be influenced by new technologies, global events, and shifting market structures. Therefore, **continuous learning** is not merely a suggestion; it is a prerequisite for sustained success in trading. This means:

- Practice, Practice, Practice: Apply what you’ve learned to live charts. Identify patterns, draw trendlines, and mentally (or physically, on a demo account) execute trades. Backtest your strategies on historical data to build confidence in their efficacy. The more you see these patterns in real-time or historical contexts, the more intuitive their recognition becomes.

- Combine with Other Tools: While we focused on volume, RSI, and MACD, the world of **technical analysis** is vast. Explore other indicators and patterns (e.g., candlestick patterns, moving averages, Fibonacci retracements) that can complement your understanding of triangle patterns and provide even stronger confirmation signals. No single tool tells the whole story.

- Stay Informed, Not Overwhelmed: Keep an eye on significant macroeconomic news and events that can impact market sentiment, as these can sometimes override even the strongest technical setups. However, avoid getting lost in the noise; your primary focus should remain on price action and volume.

- Maintain Discipline and Patience: The market offers endless opportunities, but not all of them are high-probability trades. Wait for your setups, be patient with your entries, and, most importantly, adhere strictly to your **risk management** rules. Discipline is the bridge between knowledge and profitability.

- Learn from Mistakes: Every losing trade is a learning opportunity. Analyze what went wrong, update your trading journal, and adjust your approach accordingly. This iterative process of learning and adapting is key to long-term growth as a trader.

The ability to accurately interpret the **ascending triangle**, particularly its role in signaling a **bullish reversal** from a **downtrend**, sets you apart. It allows you to anticipate significant shifts in market direction and capitalize on them. Our mission is to simplify complex knowledge, transforming abstract concepts into actionable insights that empower you to navigate the markets with confidence and clarity. As you continue to refine your skills, remember that every successful trade is built upon a foundation of solid analysis, stringent risk management, and an unwavering commitment to lifelong learning.

Whether you’re engaging in **forex trading**, delving into stocks, or exploring the burgeoning world of cryptocurrencies, the principles of **technical analysis** remain universally applicable. For those seeking a robust and reliable partner in their trading endeavors, especially within the **forex market**, due diligence in platform selection is key. If you are looking for a globally regulated forex broker with comprehensive protection, Moneta Markets holds multiple international regulatory certifications including FSCA, ASIC, and FSA. They also offer full support services such as segregated client funds, free VPS, and 24/7 Chinese customer service, making them a top choice for many traders.

Embrace the challenge, trust your analysis, and may your trading journey be filled with wisdom and profitability.

| Chart Pattern Type | Description | Market Implications |

|---|---|---|

| Symmetrical Triangle | Characterized by converging trendlines signifying indecision | Breakout can occur in either direction |

| Descending Triangle | Flat support level with a downward-sloping resistance | Indicates bearish sentiment with likely continuation if support breaks |

| Ascending Triangle | Flat resistance with an upward-sloping support | Typically bullish, suggesting a breakout upward is likely |

| Entry Method | Description |

|---|---|

| Aggressive Entry | Enter immediately on breakout above resistance with strong volume |

| Conservative Entry | Enter on pullback retest of broken resistance |

| Considerations | Details |

|---|---|

| Stop-Loss Placement | Below the broken resistance level or below the last swing low |

| Volume Confirmation | Significant increase in volume upon breakout is critical |

| Market Timeframe | Higher timeframes offer more reliable patterns due to reduced noise |

ascending triangle in downtrendFAQ

Q:What is the significance of an ascending triangle in a downtrend?

A:It suggests a potential reversal from bearish to bullish, indicating that buyers are starting to gain strength.

Q:How do I confirm a breakout from an ascending triangle?

A:Look for a strong price move above the resistance line accompanied by high trading volume.

Q:What should I do if the breakout fails?

A:It’s crucial to have a stop-loss in place; exit the position and reassess market conditions.

“`